- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

As technology estates grow more fragmented and expensive across cloud, SaaS, labor, and on-premise infrastructure, organizations can unlock significant value through targeted optimization and consolidation.

1. What's driving change?

Many enterprises are grappling with structural inefficiencies and outdated practices that undermine cloud & infrastructure value realization and operational agility.

- Fragmented estates: M&A activity and decentralized teams have created duplicated infrastructure, inconsistent tools, and incompatible models that hinder scalability and raise operational overhead.

- Cloud cost opacity: Poor tagging, scattered provisioning, and immature FinOps practices obscure true cloud spend, making accountability and optimization difficult.

- Legacy inertia: On-premise systems and outdated outsourcing contracts remain embedded in critical processes, slowing and raising the cost of modernization.

- Developer-led sprawl: Teams provision environments independently, bypassing governance, inflating costs, and complicating security and compliance.

- Underpowered FinOps: Internal FinOps or optimization teams can lack the technical depth to challenge decisions or drive savings.

2. Where can value be created?

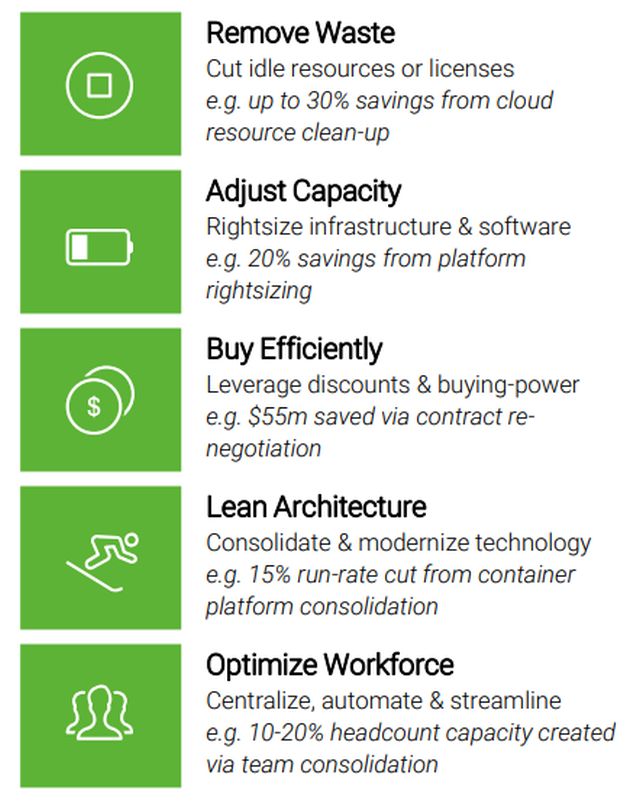

Value is being unlocked by systematically targeting five high-impact levers that reduce cost, streamline operations, and strengthen technology foundations.

3. What's the quantifiable impact?

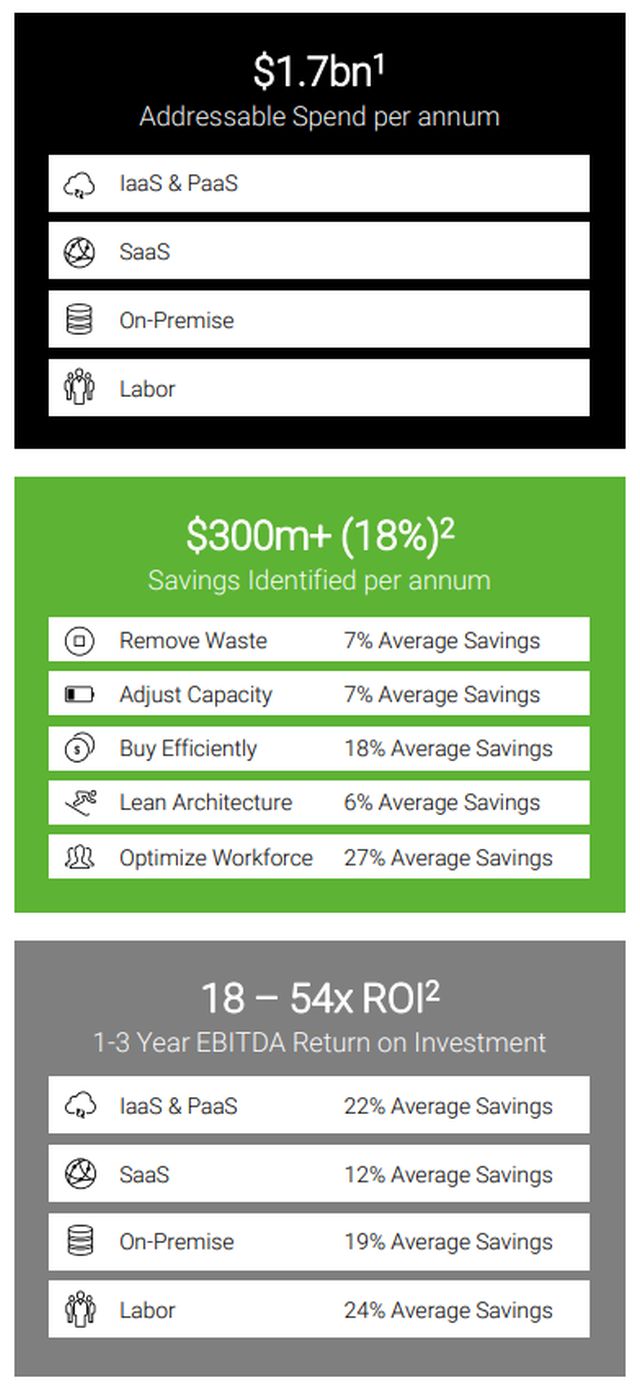

Targeted cloud and SaaS optimizations, platform consolidation, license management, and workforce streamlining delivered 10-40% savings across infrastructure, software, and labor through rightsizing, governance, automation, and strategic procurement.

Addressable Spend:

- A sample of 50 client engagements completed within the last 3 years across a range of industries from Technology, Media & Telecoms to Retail.

- Cumulative annual revenue of over $400 billion per annum across the 50 organisations engaged ranging from businesses with over $30 billion per annum in revenue to under $200 million per annum.

- An addressable spend of over $1.7 billion per

annum

- Infrastructure and Platform-as-a-Service

- Software-as-a-Service

- On-premise Infrastructure

- Cloud & Infrastructure Labor

Savings Identified:

- Total savings of 18% against addressable spend per annum across IaaS, PaaS, SaaS, On-Premise and Labor.

- Multiple levers typically applied to addressable spend (e.g. combining Remove Waste and Buy Efficiently).

- Total savings as high as 56% in some environments

- Over half of the sample client engagements delivered savings of more than 20%.

- Average savings across all 10 industries assessed of between 14 and 32% per annum.

Return on Investment (ROI):

- High Return on Investment (i.e. improvement on Earnings Before Interest, Taxes, Depreciation & Amortization) relative to engagement duration.

- Material savings realized in-year particularly within IaaS, PaaS and SaaS environments utilising pay-as-you-go models.

- Savings possible within days or weeks particularly where the Remove Waste, Adjust Capacity and Buy Efficiently optimization levers are applied.

4. What can erode value creation?

Without strong execution, governance, and accountability, even well-identified savings can quickly erode—turning potential value into missed opportunity.

- Execution failure: Even when savings are identified, lack of ownership, political resistance, and weak delivery accountability often stall progress and prevent realization of value.

- Governance gaps: Without foundational elements like CMDBs, tagging standards, or centralized tooling, organizations struggle to establish cost baselines or track optimization impact.

- Tool sprawl: The use of multiple FinOps tools and inconsistent data sources leads to confusion, fragmented insights, and diluted optimization effectiveness across teams.

- Sustainability risk: Without embedding changes into the operating model—such as new roles, controls, and processes—initial savings quickly erode and optimization becomes a one-off event.

- Decentralized ownership: When infrastructure decisions are distributed across teams without centralized oversight, visibility is reduced and cost accountability becomes fragmented, undermining long-term efficiency.

"Through deep diagnostics and hands-on execution across cloud, SaaS, labor, and infrastructure, we've learned that meaningful savings—often 10-40%—are achievable quickly, but only when backed by strong governance, centralized platforms, and sustained action."

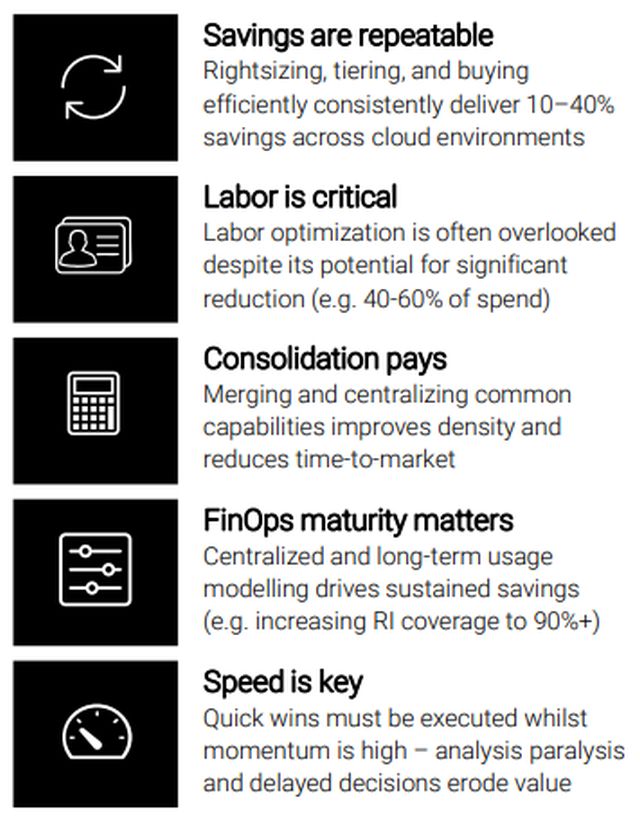

5. What have we learned?

We've seen that even well-established teams frequently face common pitfalls and missed opportunities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]