Insurers are adjusting policy terms and rates in response to geopolitical instability and security risks, though overall capacity remains sufficient.

Key takeaways

The effects of the current Israel/Gaza conflict with possibility of wider escalation continuing to drive rates especially in the Middle East (limited capacity resulting in large premium increases) in conjunction with heightened Strike, Riot and Civil Commotion (SRCC) outlook globally with a number of countries going into an election year.

Crisis Management

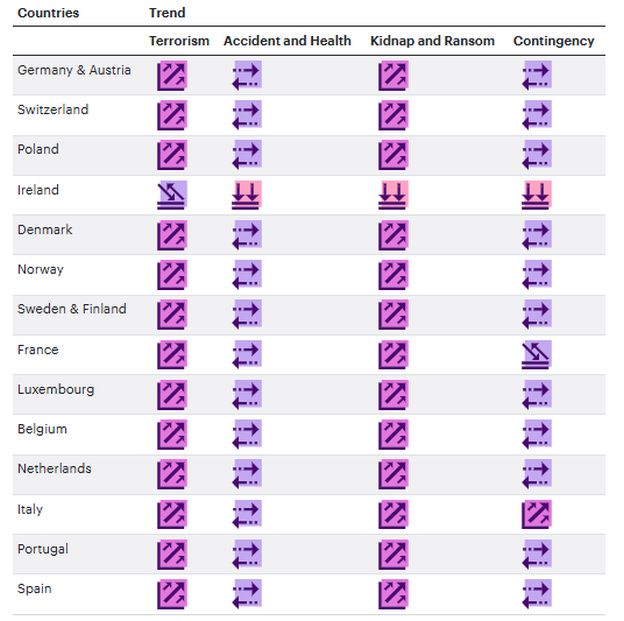

Europe rate trends: Crisis Management

The crisis management insurance market is experiencing:

- Insurers paying and reserving for the continuation of the largest losses in the market's history due to the crisis in Ukraine.

- Clarity is required regarding exclusionary language in property policies offered by certain European carriers, specifically whether terrorism exclusions extend to SRCC coverage.

- Accident and Health market buoyant with new capacity providers entering a saturated market.

- Increasing pressure on (re)insurers due to the conflict in the Middle East and Ukraine.

- No major losses across sub-classes with the exception of Contingency which has experienced significant losses across outdoor festivals for three years running.

- Kidnap and Ransom rates largely stabilizing with some moderate increases of +5-10% in response to greater claims frequency/severity, heightened geo-political tensions/security risks.

- Piracy in the Indian Ocean and Red Sea is an area of particular concern with a significant increase in attacks against commercial shipping.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.