For natural resources companies, it's not unusual to take 10 risks to the insurance market, but if they were considering three alternative insurance structures for each, they would be faced with 59,049 possible combinations of insurance options.

Leaning on sophisticated data and analytics is the gateway to pinpointing the optimal risk retention and insurance strategy for the business.

Key takeaways

- Think ahead. Having a clear understanding of the aspirations for the future of the business is the bedrock of decision-making.

- Work backwards. Using these objectives keeps risk and finance leaders on track when navigating rapid change and transformation.

- Harness data. Sophisticated modelling enables leaders to make optimal decisions on risk spend and deploying capital strategically.

Risk leaders: look ahead to make the right decisions today

While forecasting involves predicting the future based on current trends, backcasting approaches planning from a future perspective. If you set your objectives, you know what steps need to be taken to get there. By backcasting, natural resources companies can stay agile in responding to challenges with the end goal in mind.

The momentum behind the energy transition is growing. And risk leaders are challenged in making the right decisions today, to build a better tomorrow for their business. In achieving long-term ambitions, risk leaders need to optimize their strategies to unlock capital for growth.

Making an optimal decision: Eight steps natural resources companies need to take

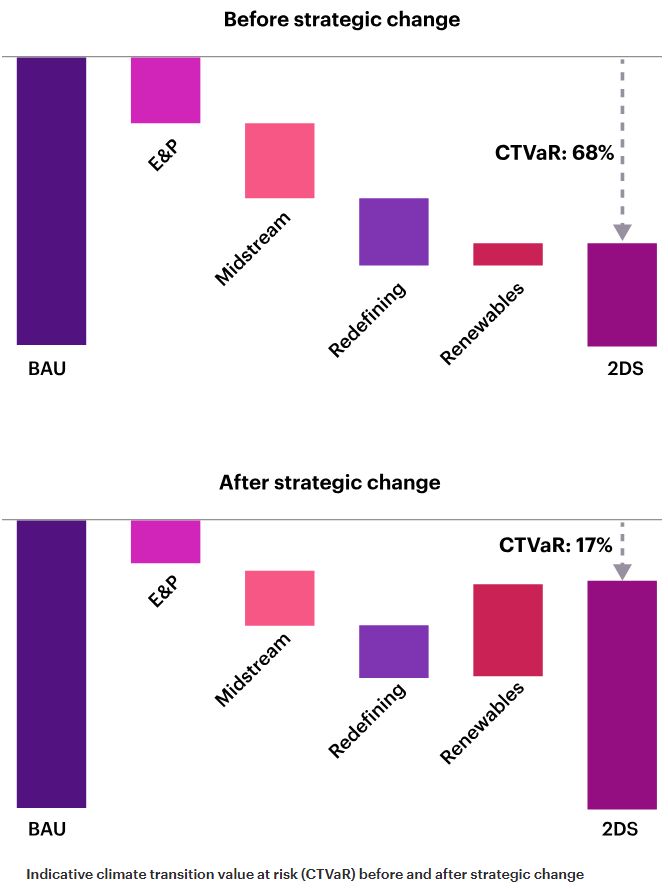

- It starts with understanding your risk tolerance. The decarbonization imperative continues to drive the energy transition forward at pace, and natural resources companies' sector mix can create different exposures in different climate change scenarios. For a +2˚C scenario, traditional oil and gas companies with only a small renewables mix will have a higher percentage of climate transition value at risk over time. In the same climate change scenario, a company with a larger portion of renewable operations is likely to have less climate transition value at risk.

Fig 1: demonstrating the value at risk before and after strategic change:

Indicative climate transition value at risk (CTVaR) before and after strategic change

Understanding where the company is on their energy transition pathway and how operations – both now and into the future – impact value at risk, will help to build a robust risk tolerance.

- Use data to model possible scenarios and understand their operational and financial impacts. Leaders across the industry share a common misconception that data is limited for renewable energy operations and technologies. In fact, there are already close to a thousand loss event data points and this list continues to grow. There are two main ways to model risks associated with the energy transition: the first is a data-driven approach to model loss frequency and loss severity using actuarial analysis; the second is a cross-functional approach where data and sector specialists facilitate a deep-dive conversation with functional leaders to elicit the challenges and likely risk scenarios facing their business. In the second more qualitative approach, data specialists then map out these scenarios and their potential financial impacts.

- Map these insights onto your risk tolerance. Having already agreed on the group risk tolerance, overlaying insurance structures on the simulated loss expectancies casts a spotlight on areas where companies can best retain or transfer risk. Examine the operations of each business unit and consider the cost and likelihood of loss events. Most companies will be able to retain smaller losses on the balance sheet, and leaders are rethinking their approach to insurance – considering insurers as a derisking partner only for unexpected and large loss events.

- Think laterally about risk. Many natural resources companies are more resilient and able to retain more risk than they realise. While some losses are interconnected, such as in a catastrophic event where property damage, liabilities and directors and officers (D&O) are all exposed, most risks are diversified in an average year. By looking across the portfolio of risks, risk and finance leaders can use mathematical analysis to better understand the risk tolerance for the portfolio as a whole.

- Move away from thinking in insurance tower silos. Considering the portfolio of risks as a whole means risk and finance leaders can think in terms of 'premium spend' across the entire portfolio, rather than for each insurance tower. This shift enables risk leaders to prioritize purchasing insurance for those classes of risk where insurers are offering good value for money, while retaining risk where markets are overcharging, deploying this risk capital elsewhere.

- Go beyond deductibles, limits, retentions and

short-term market trends. Taking a portfolio-based

approach enables risk and finance leaders to build a resilient and

sustainable risk management strategy that is less exposed to

insurance market volatility. "With a more stable finance

strategy, leaders can look to deploy capital in initiatives such as

investments in technology or growth ventures with clarity and

confidence." Inti Gomez, Head of Risk & Analytics LatAm,

WTW

" With a more stable finance strategy, leaders can look to deploy capital in initiatives such as investments in technology or growth ventures with clarity and confidence."

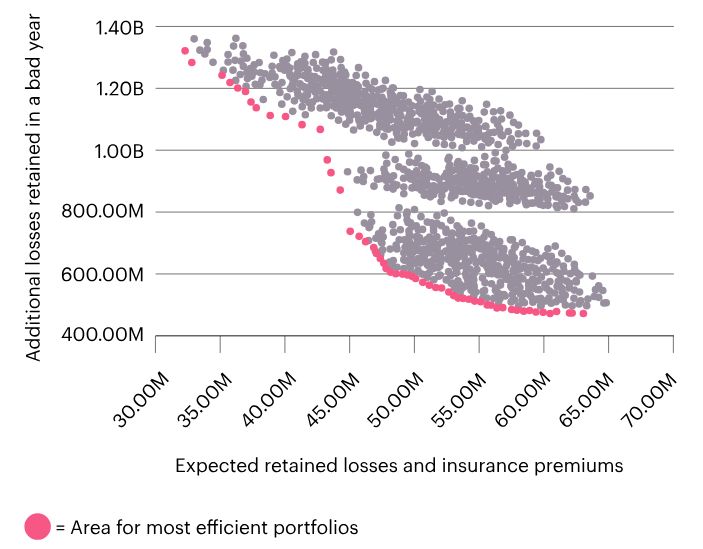

Inti Gomez | Head of Risk & Analytics LatAm, WTW - Pinpoint the best strategy. It's common for companies in the natural resources industry to take ten or more risks to the insurance market. For each of these risks, if they were considering three alternative insurance structures, the insurance strategy decision-makers would be faced with 59,049 possible combinations of insurance options. Sophisticated applications, such as Connected Risk Intelligence, model each individual risk and then generate a selection of portfolio-based optimal options. This band of "efficient frontier" optimized options enables risk leaders to balance their risk and insurance spend with their risk tolerance.

Fig. 2 demonstrating optimized capital efficiency and lowest total cost of risk, compliant with group risk tolerance

Graph indicative of how an efficient frontier can be identified using data modelling of all possible combinations of insurance options

"By choosing a strategy on the efficient frontier, CFOs and treasurers can be confident that they have selected the option with the lowest total cost of risk, compliant with their risk tolerance." Charles Barder, Head of Risk & Analytics International at WTW

By choosing a strategy on the efficient frontier, CFOs and treasurers can be confident that they have selected the option with the lowest total cost of risk, compliant with their risk tolerance."

Charles Barder | Head of Risk & Analytics International at WTW

- Use capital strategically For renewables, emerging risks and uninsurable risks will be of significantly greater financial value than the insurable risks in a risk portfolio. Risk and finance leaders should be collaborating to make decisions that deploy capital in the most beneficial way for their business. For natural resources companies with a lower risk tolerance, this could be spending more on premiums to reduce retentions and derisk the balance sheet. For more resilient companies, using risk finance capital more strategically can leave funds free for investment in growth ventures as part of the energy transition.

Build financial stability for long-term growth

Speak your c-suite's language – make the connection between opportunities, capital, return on investment, risk tolerance and cost on a strategic, multi-year, portfolio basis.

It comes back to backcasting. For natural resources companies to uphold their commitments as part of the energy transition, keeping the future objectives at the core of decision-making will keep companies on track. A short-term siloed risk strategy needs to be challenged.

Looking back on today, five years from now:

Backcasting: looking back on steps taken today

Demand more from your risk finance advisor. Future-ready companies are strategic about how to optimize risk spend to protect critical assets and operations, and build financial stability to move ahead with confidence.

Find out more about building a forward-thinking risk finance strategy

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.