- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

Following a period marked by uncertainty during the pandemic, recent macroeconomic trends – particularly heightened inflation and interest rates – have placed significant financial pressures on companies, especially those with elevated leverage.

The UK financial landscape remains delicately balanced following the Monetary Policy Committee's decision in September to hold the Bank of England's interest rate at 5%, while a fast-approaching autumn budget from the new UK Government provides potential for further business disruption.

More broadly, default rates in European leveraged loan markets and high-yield bond markets are reported as likely to reach 4% this year – a notable increase from below 3% just 12 months prior. AlixPartners' recent Mid-Market Debt Report also highlighted "a significant ramp-up in debt refinancing activity, to be expected between 2024 and 2026".

Against this backdrop, there are an increasing number of

corporates reporting elevated levels of stress or distress. When

combined, excessive leverage and looming maturities creates the

ingredients for challenging refinancing discussions.

Distress drives difficult decisions

In financial restructuring scenarios, securing support from financial stakeholders can be challenging. Underperformance, irrespective of the underlying reasons, increases stakeholders' appetite and need for detailed information given the complexity of the decision-making process.

As management teams seek to navigate these dynamics, it is essential to engage with lenders with clear communication and a "single version of the truth". A robust turnaround plan supported by independent assessments are essential to building credibility and confidence.

Acting quickly and proactively to anticipated stakeholders'

needs is critical. An absence of this can lead to multiple requests

for financial information leading to increased cost, disruption to

the business, drain on management's time, and ultimately a

greater risk of failure in such a time-sensitive period.

The power of proactivity – "Common Platform Information"

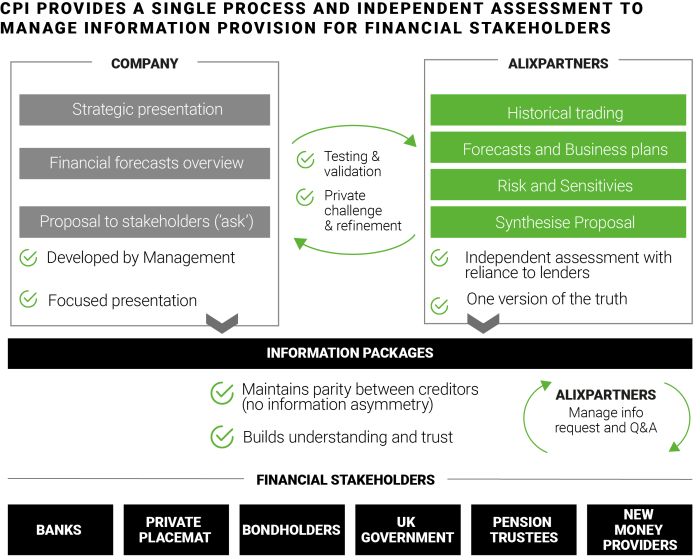

An effective approach for corporates is to proactively utilise Common Platform Information (CPI).

Commissioned by management, CPI is common package of information independently assessed to act as the basis for stakeholders to consider corporate requests and support credit processes. This can include liquidity reviews, business plan / financial forecasts, outcome analysis (EoS, insolvency models etc.), with the scope consensually agreed with all stakeholders.

Importantly, CPI is independently assessed with reliance given to both the corporate and lenders. Through CPI, the provision of information to multiple financial parties in a streamlined manner, information parity amongst creditors, and trust throughout the process can be maintained.

In summary, a CPI process saves time, cost, minimises disruption, and builds confidence to deliver consensual outcomes for all stakeholders at a time when pressured conditions can threaten to derail refinancing processes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.