- within Media, Telecoms, IT and Entertainment topic(s)

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

Understanding how the virtual economy works

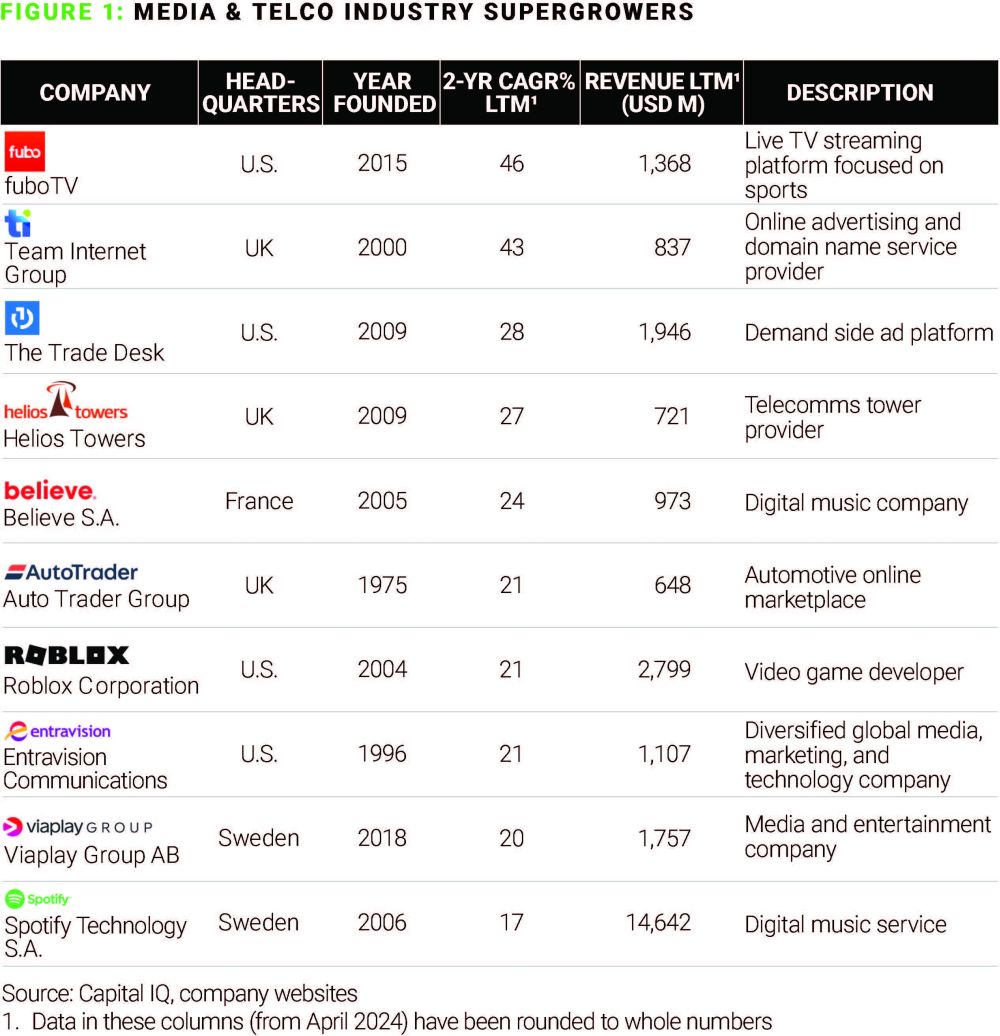

A heavy ledger of digital disruptors dominates the media, entertainment, and telecommunications segment of Fastest Growers, from indie music distributor Believe S.A. to programmatic advertiser The Trade Desk and gaming platform Roblox.

Older assumptions about the markets audiences are interested in, or the best way to mint a new rockstar, have been tossed as these innovators deploy leading technologies to continue to build out their offerings. Believe S.A. is looking to expand from digital distribution into digital publishing, while Auto Trader Group has made investments to not just provide real time data but create a seamless digital vehicle purchasing experience. For all of the fastest growers, digital begins and ends in the "real world," and moves past the feeder model of old broadcasting. Here, we look at key winning strategies and tactics.

Team Internet Group

Home pages are back and a solid domain name remains a key business asset, as the growth of Team Internet Group shows. The company's online marketing business gross revenue increased by 14% year-over-year to hit $657 million in FY2023 and the online presence business grew at 17% y/y to $180 million. Growth in this area has been helped by improved algorithms to drive ad placements across channels: visitor sessions increased from 2.6 billion to 5.9 billion between FY2021 and FY2023.

We expect continued escalation in domain name purchases driven by the rise of online businesses and macro trends (such as the rise of domains like ".ai"), as well as innovations in AI-based customer journeys and privacy-safe digital marketing technologies.

The Trade Desk

As advertisers have abandoned linear TV, The Trade Desk has been a winner in programmatic advertising. The pitch is simple: AI-led decision making and access for advertisers to premium streamers like Disney, Hulu, Fox, and others to that they can reach customers across the funnel. The Trade Desk is "built for the open internet," and recognizes the non-hierarchical landscape, in which users have shifted away from legacy TV toward digital-first offerings. Revenue for the company grew from $1.2 billion to $1.9 billion between FY2021 and FY2023, growing 31% year-on-year in FY2023 and 23% in FY2023.

Digital advertising is continually evolving and The Trade Desk has positioned itself to perform well as transparency and consumer privacy become more important, with investments in ethical advertising technologies. The company is positioned to take advantage of the continued growth in programmatic advertising with further advancements in AI and machine learning to refine ad targeting without compromising user privacy.

Believe S.A.

For music artists, the old model doesn't work. "Nobody buys records these days," opined Liam Gallagher in a video of himself having to brew his own tea. The obsolescence of traditional labels has opened an opportunity for disruptors like French company Believe S.A., which provides digital music distribution and artist services to independent musicians and labels. As streamers jostle for dominance, Believe has helped artists penetrate digital platforms such as Spotify, Apple Music, and YouTube. The company saw 32% organic growth between FY2021 and FY2022, and 14% between FY2023 and FY2023.

In early 2023, Believe acquired the music publisher Sentric as a first step to rolling out a global publishing service, adding to its core services in digital distribution, marketing and promotional support. We believe the company is well-positioned to benefit from the increasing industry trend of artists choosing independent and alternative routes for music distribution.

Auto Trader Group

At this car yard, consumers can view used and new cars, get a valuation on their own, find Safety information and vehicle history reports, and peruse certified cars. The difference between it and the typical row of dealerships on the outskirts of town is that this one is online and has the benefit of real-time trade information, and provides a more seamless experience for customers than a sweltering walk along the proverbial bitumen. Auto Trade Group nearly doubled its revenue in two years, increasing from $344 million in FY2021 to $603 million in FY2023.

The digital automotive marketplace is continually being improved, with Auto Trader Connect fueled by real-time market data to improve advert quality and pricing decisions, and an end-to-end deal-builder journey in the works. These investments, along with higher car prices and evolving consumer preferences for seamless, digital buying experience puts Auto Trader Group in a strong position to maintain its leadership and driver further growth.

Roblox Corporation

At Roblox, leadership see the gaming company as a virtual economy, and puts the work of creators on the platform at the center of its growth vision. Launched in 2006, Roblox is an online platform that is built on the foundation of user-generated content. The simplicity of its game development environment make it accessible to even young creators and this accessibility has been a key factor in Roblox's widespread appeal. In the company's own words, "Roblox has become one of the biggest virtual economies on Earth."

This dedication to content creators and in-house developers has set the company up to grow rapidly as the gaming experience improves—revenue jumped 31% year-over-year in the second quarter of 2024, hours engaged grew by 24% year-over-year, and daily average users showed similar growth. The company is also focused on development such as revenue-rich technology like immersive ads (as some critics note, there are drawbacks for the user) and AI tools to assist in 3D creation. In 2023, the ten highest-earning creators earned an average of $23 million each, per the company, motivating an ecosystem of game developers to create an experience that would crack the Roblox algorithm and go "viral." CEO David Baszucki has noted how important the accessibility of the platform is—while it is available on VR, most users are on mobile, and accessing the game through their app store.

In recent years, Baszucki has talked about moves that will allow the company to acquire users 17 and older—a huge potential audience—as well as develop genAI tech to enhance the user experience. The company is also expanding the items creators can sell in the marketplace from clothes and accessories to "bodies and heads." Around 80% of users on the platform are "non-paying," and the company believes immersive video advertising (that can be tied to specific developers) and in-game monetization is where the big (Ro)bux are in the future.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.