- within Finance and Banking topic(s)

- within Cannabis & Hemp, Law Practice Management and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Retail & Leisure industries

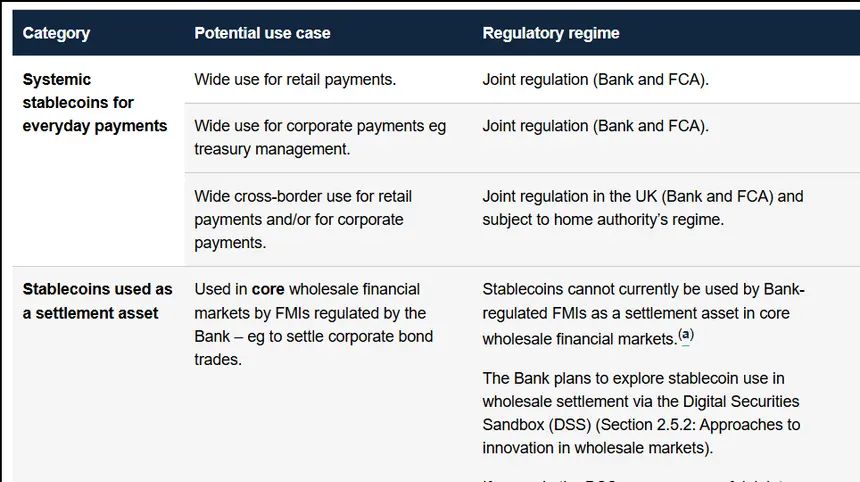

The Financial Services and Markets Act (FSMA) 2023 expanded the Bank of England's regulatory remit to cover digital settlement assets (DSA), including systemic stablecoins. Systemic stablecoins – those that are widely used in payments and therefore may pose risks to UK financial stability – will be regulated by the Bank and the Financial Conduct Authority (FCA), once recognised by HM Treasury (HMT).

The Bank is consulting about how it intends to regulate sterling-denominated systemic stablecoins. Its proposed approach aims to harness the potential benefits that systemic stablecoins could bring to payments in the UK, while ensuring that innovation happens responsibly. Among other things, the consultation covers backing assets and holding limits.

Backing assets

Following feedback, systemic stablecoin issuers will be permitted to hold up to 60% of backing assets in short-term UK government debt. For the remaining 40%, the Bank will provide issuers unremunerated accounts at the Bank of England, ensuring robust redemption and public confidence, even under stress.

Additionally, those issuers considered systemic at launch, or transitioning from the FCA regime, will initially be able to hold up to 95% of backing assets in short-term UK government debt, to support their viability as they grow.

The Bank is also considering central bank liquidity arrangements to support systemic stablecoin issuers in times of stress. These arrangements would reinforce financial stability by providing a backstop should systemic issuers be unable to monetise their backing assets in private markets.

Holding limits

To safeguard continued access to credit as the financial system gradually adapts to new forms of digital money, the Bank is proposing temporary holding limits of £20,000 per coin for individuals and £10 million for businesses (with an exemptions regime to allow the largest businesses to hold more if required). These limits would be removed once the transition no longer poses risks to the provision of finance to the real economy. These limits would not apply to stablecoins used for settling wholesale financial market transactions in the Bank and FCA's Digital Securities Sandbox.

Non systemic stablecoin issuers will be regulated by the FCA. If recognised as systemic by HM Treasury (HMT), they will transition into the Bank's regime and will be jointly regulated, with the Bank overseeing prudential and financial stability risks, and the FCA continuing to supervise conduct and consumer protection.

The Bank and the FCA will publish a joint approach document in 2026 to clarify how rules will apply in practice and support a smooth transition between regimes.

Additionally, the Bank has issued a document about quantifying the risks to the provision of finance to the economy from potentially significant and rapid outflows of bank deposits into new forms of digital money. This analysis has shaped the proposed holding limits, and the consultation also invites feedback on alternative mechanisms for managing these risks.

The consultation ends on 10 February 2026.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.