- within Consumer Protection, Insolvency/Bankruptcy/Re-Structuring and Insurance topic(s)

The EU and UK prospectus regimes govern disclosure requirements for securities offered to the public and/or admitted to trading on a regulated market. Recent and forthcoming changes to these regimes have implications for issuers and other parties involved in debt capital markets transactions offered, or listed on regulated markets, in the EU or UK.1 In this article, we summarise the main changes and highlight some of the areas of divergence between the EU and the UK regimes.

EU prospectus regime: changes introduced by the Listing Act

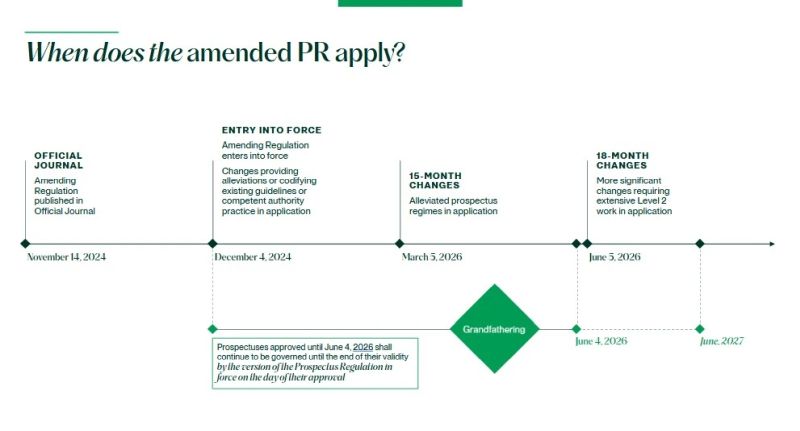

Regulation (EU) 2024/2809 (the Amending Regulation), an element of the EU's Listing Act package, was published in the Official Journal on November 14, 2024, and entered into force on December 4, 2024. The Amending Regulation introduces various changes to the Prospectus Regulation (EU) 2017/1129 (the PR). Some of these changes applied immediately upon entry into force, others apply after a 15-month transitional period (i.e. from March 5, 2026) and a final batch after an 18-month transitional period (i.e. from June 5, 2026, with grandfathering for this final batch of changes), as detailed in the timeline below:

What changes apply from December 4, 2024?

The changes that apply from December 4, 2024, are mainly aimed at providing alleviations or codifying existing guidelines or competent authority practice. These include:

- Incorporation by reference. The requirement for a supplement to update annual or interim financial information in a base prospectus has been removed (although issuers can still voluntarily supplement for such financials), effectively allowing program issuers to incorporate future financial information by reference. The responses provided to date to the European Securities and Markets Authority (ESMA) Q&As on this topic are largely as expected and in line with thinking in the market. There are two questions still pending though, the answers to which may have an impact.

- Small changes have also been made to the documents listed as being suitable for incorporation by reference. These include the addition of "sustainability reporting" as a type of management report that can be incorporated and the removal from the list of documents approved under the Prospectus Directive. However, ESMA noted in a July 2025 Final Report that it expects competent authorities to continue to allow the incorporation by reference of Prospectus Directive documents, including doing so using a supplement.

- Risk factors. The Amending Regulation introduces a provision into the PR that explicitly states that prospectuses shall not contain risk factors that are generic, that serve only as disclaimers, or that do not give a sufficiently clear picture of specific risks. This effectively codifies the existing ESMA guidelines on risk factors published in October 2019. The Amending Regulation also introduces a subtle change to the materiality ordering requirement for risk factors. Risk factor disclosure is already likely to meet this so a general change in approach is not necessary.

- Supplements. The Amending Regulation inserts a new provision stating that supplements cannot be used to introduce new types of security for which the necessary information has not been included in the base prospectus, unless this is necessary to comply with capital requirements under Union law. The aim of this is to foster regulatory convergence and seems to represent the codification of the approach of certain competent authorities. On February 18, 2025, ESMA published a consultation paper setting out draft guidelines on what constitutes a new type of security for these purposes. It will be important for issuers that ESMA strikes the right balance and is not overly restrictive around the use of supplements, although the draft guidelines appear conservative. For example, the explanatory text to one of the draft guidelines includes "green bonds" and "sustainability-linked notes" in a list of securities that should be provided for in a base prospectus for approval. ESMA is aware of the potential impact on the market of this approach and asks a specific question around these types of securities in the consultation as well as broader questions. We await the outcome of the consultation and ESMA's final report containing the final version of the supplement guidelines, expected in the last quarter of 2025.

- Exemptions from the prospectus requirement. The Amending Regulation amends some of the exemptions from the prospectus requirement, particularly for tap issues. For example, it increases the cap in the existing exemption for securities fungible with securities already admitted to trading in the same regulated market from 20% to 30%. It also introduces new exemptions for tap issues that could be used where the issue size exceeds the 30% limit, where the notes being tapped have been admitted to trading for at least the prior 18 months (subject to the preparation of a short-form disclosure document). Certain other modifications have been made to existing exemptions primarily aimed at making these marginally wider, effectively facilitating issues without a prospectus. Bearing in mind that debt issuance is frequently documented under programs, and issuance under those is straightforward using final terms, wider exemptions are unlikely to change practice significantly for program issuers. Certain exemptions might be of some utility for issuers who issue debt using standalone prospectuses, to the extent there are no other considerations driving the need for a prospectus, such as a preference to provide a curated and up-to-date disclosure package.

- Limited changes around retail offers. The Amending Regulation introduces some limited changes to provisions applicable to retail offers. The withdrawal right period for investors (for instance, in connection with the publication of a supplement to a retail prospectus) is being extended from two to three working days. This reflects the (now lapsed) previous temporary changes to the rules introduced as part of the European Commission's Covid recovery package.

There are other changes in application from December 4, 2024, in the areas of use of languages, equivalence and the universal registration document.

Are any of the March 5, 2026, changes relevant to debt securities?

The changes that apply from March 5, 2026, relate to alleviated prospectus regimes. The PR's simplified disclosure regime for secondary issuances is replaced by an EU follow-on prospectus concept, available where an issuer has securities already admitted to trading on a regulated market or SME growth market for 18 months. Further details on content of the follow-on prospectus are expected and will require analysis before it is possible to gauge whether this will be more popular than the simplified prospectus it replaces.

What changes come into play on June 5, 2026?

These changes are more significant and require extensive Level 2 work by ESMA and the European Commission.

Proposals in respect of some of these changes are covered by ESMA's June 2025 final report containing ESMA's technical advice to the European Commission on the Prospectus Regulation (ESMA's June 2025 Final Report), further to the consultation published by ESMA on October 28, 2024. ESMA's June 2025 Final Report includes proposed amendments to the existing delegated regulation (EU) 2019/980 on format, content, scrutiny and approval of the prospectus (the PR Delegated Regulation). These include:

- Standardized format and sequence. Prospectuses will be required to follow a standardized format and sequence, subject to a derogation for securities offered in a third country where an offering document is prepared under the law, rule or practice of that country. The technical advice included in ESMA's June 2025 Final Report envisages a pragmatic approach (with, for example, application of the requirement limited to single-issuer, non-equity, standalone prospectuses for plain-vanilla debt), which is likely to be welcome as far-reaching changes would prove burdensome for issuers. It remains to be seen whether and to what extent ESMA's technical advice is reflected in the Level 2 provisions that will be enacted by the European Commission.

- Contents of a prospectus. Streamlining changes are also being introduced, such that financial information included in a non-equity prospectus will only be required for the last financial year (and not the last two as under the existing regime). Furthermore, some combining the currently separate retail and wholesale non-equity disclosure annexes into a single framework is being proposed. The complete picture on what prospectuses will look like once the new regime is fully in application will not be available for a while as further ESMA and European Commission workstreams are anticipated.

- Sustainability disclosure. The Amending Regulation gives the European Commission the power to introduce a disclosure annex into the PR Delegated Regulation to be followed for debt securities advertised as taking into account environmental, social and governance (ESG) factors or pursuing ESG objectives. ESMA's June 2025 Final Report includes a proposed annex, which would operate as a building block to be followed in addition to the non-equity annexes when drawing up a prospectus. It builds on ESMA's public statement on sustainability disclosures from summer 2023. Other changes serve to acknowledge the EU Green Bond Regulation and the European Green Bond (EuGB) label under it, such as those requiring prospectuses to incorporate by reference relevant information from an issuer's fact sheet under that regulation. ESMA have clearly been thinking about how prospectus disclosure should fit together with EuGB requirements, including in the context of programs.

- Summary requirements. The Amending Regulation will amend the summary requirements for retail prospectuses, including allowing the inclusion of charts, graphs and tables, and to allow a small increase in the page limit if there are guarantors. Also, a statement warning that the issuer has identified environmental issues as a material risk factor will need to be included in the introductory section, if applicable.

The Amending Regulation provides grandfathering for prospectuses approved until June 4, 2026. Our understanding is that this means that program issuers will not have to comply with the new rules due to apply from June 5, 2026, for the remainder of their validity, e.g. if a base prospectus is approved on June 4, 2026, the issuer will not need to comply with the new rules until June 2027.

UK prospectus regime: changes from January 2026 and comparison with the existing regime and the EU prospectus regime

The UK's existing prospectus regime is closely aligned with the PR, which was onshored in the UK after Brexit as the UK Prospectus Regulation (the UK PR). The UK PR will be replaced by a new regime that consists of the UK's Public Offers and Admission to Trading Regulations 2024 (the POATRs) and detailed rules relating to admission to trading made by the Financial Conduct Authority (the FCA). On July 15, 2025, the FCA released Policy Statement (PS25/9), containing a final version of those rules, the Prospectus Rules: Admission to Trading on a Regulated Market sourcebook (the PRM).

Although the new regime retains many familiar concepts for debt issuers, it introduces a different legislative framework and some substantive changes from the existing regime. Key points for debt capital markets practitioners are outlined below.

- Legislative framework. Under the existing regime, a prospectus is needed for any offer of securities to the public, subject to certain exemptions. In contrast, the POATRs has a blanket prohibition on offering relevant securities to the public unless the offer falls within an exemption. The list of exemptions broadly tracks the existing list, such as offers below GBP5 million, offers to qualified investors (QIs) only, offers to fewer than 150 persons other than QIs and offers of securities with a denomination of at least GBP50,000. A new exemption is available where the offer is conditional on the admission of the transferable securities to trading on a regulated market or primary MTF, or where the transferable securities being offered are at the time of the offer admitted to trading on a regulated market or primary MTF.

- A single disclosure regime for all debt securities. A significant change from the existing regime is the adoption in the PRM of a single disclosure standard for debt securities, based on the existing regime's wholesale disclosure standards. The FCA's aim was to simplify the regime and remove barriers that have historically discouraged issuers from offering low-denomination corporate bonds, thereby improving access for retail investors and smaller funds. Notably, a summary is no longer required for any debt prospectus. In contrast, in the EU the summary requirement is expected to be retained for retail debt securities.

- Further alleviations for UK listed companies issuing "plain vanilla listed bonds". Senior unsecured, plain vanilla, listed bonds issued by a UK listed company (or a wholly owned subsidiary of such a company benefitting from an unconditional and irrevocable guarantee from it) benefit from further alleviations in the PRM: lighter touch UK product governance rules and an exemption from annual and half-yearly financial reporting requirements that apply to retail debt, similar to the existing treatment of wholesale debt. UK Listing Rules on financial information continue to apply.

- Sustainability disclosure. Unlike the proposal under the EU's Amending Regulation to introduce a disclosure annex for debt securities advertised as taking into account ESG factors or pursuing ESG objectives, the PRM does not introduce mandatory sustainability disclosure requirements for prospectuses, other than a requirement that a prospectus states whether the bonds are marketed as green, social or sustainable and/or issued under an ESG framework. However, the FCA expects issuers to consider including in prospectuses additional disclosure aimed at bridging the gap between prospectuses and bond frameworks. Though the additional disclosure is not mandatory, the FCA expects issuers to consider whether it is relevant for the purposes of meeting the necessary information test.

- Clarified necessary information test. The test is carried over to the PRM largely unchanged but, for the purposes of debt securities, refined to clarify that the "prospects" of the issuer and any guarantor are to be read as creditworthiness. If debt securities represent or are linked to an underlying asset, necessary information that is material to an investor for making an informed assessment of the underlying assets must also be disclosed.

- Forward incorporation of financial statements. Similar to what has been permitted in the EU by the Amending Regulation, under the PRM issuers may incorporate future annual and interim financial information in base prospectuses, without the need for a supplement (although issuers can still voluntarily supplement for such financials). Publication of information that is forward incorporated by reference into a base prospectus does not, by itself, trigger the preparation of a supplement for a significant new factor, unless it causes a material mistake or material inaccuracy in any other information already appearing in the base prospectus. The FCA will consult on guidance relating to evergreen language to refresh relevant prospectus statements, e.g. the no material adverse change statement.

- Greater flexibility to supplement base prospectuses. Under the PRM, issuers are permitted to use a supplement to change the terms and conditions in a base prospectus in such a way that amounts to the introduction of new products by way of a supplement. There are conditions attached to this (e.g. this is not available for introducing asset-backed securities or securities linked to an underlying asset), but the flexibility may still be helpful for issuers, and goes beyond the EU position discussed above.

- Withdrawal rights do not arise from supplements to wholesale prospectuses. The PRM expressly confirms the market understanding under the existing regime that withdrawal rights do not arise from the publication of a supplement where the relevant offer benefits from one or more of the general exceptions from the prohibition on offers to the public, i.e. an offer to QIs only, an offer addressed to fewer than 150 persons in the UK other than QIs or an offer of securities with a denomination per unit of at least GBP50,000.

- Exemption for tap issues from the prospectus requirement raised to 75%. Like the EU, the FCA has opted to increase the cap applicable to tap exemptions (historically 20%). However, unlike the cap of 30% introduced by the Amending Regulation, the cap in the PRM is 75% of the existing amount of debt securities over a 12-month period. This exemption is expected to be more useful in the context of standalone prospectuses, given the ease of documenting program issuance using final terms.

- Changes to other prospectus exemptions. The FCA has removed the existing exemption for non-profit making bodies. Conversely, the PRM includes exemptions for instruments of Islamic finance backed by a sovereign or central bank in such a way that the economic effect is as though the relevant sovereign or central bank were the issuer of the debt securities or over which a credit support arrangement by a sovereign exists that is equivalent to a sovereign guarantee.

- Protected forward-looking statements (PFLS). The PRM introduces an alleviated liability regime for forward-looking statements that meet prescribed conditions and safeguards. There are limited circumstances in which this regime may be used by debt issuers, and relevance is expected to be greater in the equity capital markets space. In the EU, the Amending Regulation requires the European Commission to look at prospectus liability and ESMA recently published a Call for Evidence in connection with this, with a final report published in June 2025. Questions in ESMA's Call for Evidence addressed different aspects of prospectus liability, including whether safe-harbor provisions for forward looking statements (such as those in the U.S., or those in the UK's PRM) should be introduced at an EU level. In its final report, ESMA does not recommend changes to the existing civil prospectus liability regime at this stage but does provide advice on safe harbor rules for forward-looking statements and on changes to the rules for determining the applicable law should the European Commission still intend to contemplate reform in future.

- Rules on primary MTFs. In a further difference from the UK PR, which applies to regulated market admissions, the FCA has set out requirements for primary MTFs that do not meet the "qualified investor condition". For example, an MTF admission prospectus will be required, although the market operator will set the detailed content for this. Primary MTF requirements are not expected to impact London's International Securities Market (ISM) due to it meeting the qualified investor condition.

The new regime is due to apply to prospectuses approved by the FCA from January 19, 2026. Transitional provisions in the PRM provide that, where a prospectus is approved before that date, the new regime does not apply to offers or requests for admission to trading in reliance on that prospectus during the period of its validity.

For more information and assistance, please contact our global financial markets team. In addition:

- Partner Amanda Thomas (London) and counsel Jennifer Cresswell (London) discuss the UK's new regime on our Market Horizons podcast: On the cusp of UK prospectus regime change - what the FCA's July policy statement means for bonds.

- Partners Amanda Thomas (London), Cristiano Tommasi (Rome), and Paul Péporté (Luxembourg) and counsel Jennifer Cresswell (London) from our global financial markets practice discuss changes to the EU and UK prospectus regimes and the similarities and differences between them on our Market Horizons podcast: All aboard: Changes coming to the EU and UK prospectus regimes—a debt capital markets perspective.

For key points on the UK's new regime relevant to equity capital market transactions, see FCA publishes final rules for public offers and admission to trading regime.

Footnote

1. See the section on the U.K. prospectus regime for a point on the U.K. changes relating to admission to trading on multilateral trading facilities that operate as primary markets (Primary MTFs).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.