- with readers working within the Banking & Credit industries

- within Finance and Banking, Accounting and Audit and Law Department Performance topic(s)

- with Finance and Tax Executives

- in United Kingdom

- with readers working within the Banking & Credit and Law Firm industries

On 1 July 2025, the European Securities and Markets Authority ("ESMA") released its first thematic note (the "Note") in a series clarifying ESMA's expectations for sustainability communications made by financial institutions and asset managers. The Note aims to provide clarity on how sustainability claims should be communicated in financial markets, with a view to creating a standard across the market.

The Note forms part of wider efforts to reduce greenwashing risks in financial services and is influenced by the publication of various progress reports by ESMA, including the "Final Report on Greenwashing" and "Opinion on sustainability claims and greenwashing in the insurance and pensions sectors". It also follow the May 2024 publication of ESMA's new names guidelines for all funds marketed in the EU using environmental, social and governance ("ESG") or sustainability-related terms (see our Briefing "ESMA Guidelines for Funds Marketing with ESG and Sustainability Related Terms" for more information).

KEY PRINCIPLES

The Note is targeted at European banks, including in relation to issuance of green products,

and asset managers. It focuses on ESG credentials, setting out four key principles:

1. Accurate

- Sustainability claims should be fairly and accurately representative.

- There should be no omission and/or cherry-picking of information.

- ESG terminology and imagery or sounds should be consistent with the sustainability profile of the entity/product.

2. Accessible

- Sustainability claims should be based on easily accessible information that is understandable,

- but not oversimplistic.

- Layering and/or linking further information is acceptable.

3. Substantiated

- Sustainability claims should use clear and credible reasoning, facts and processes.

- Fair, proportionate and meaningful methodologies should be the basis of substantiations.

- Comparisons must make clear what is being compared.

4. Up-to-date

- Sustainability claims should be based on up-to-date information, and any material change disclosed in a timely manner.

- Clear indication of analysis' date and permitter may be useful.

DO'S AND DON'TS

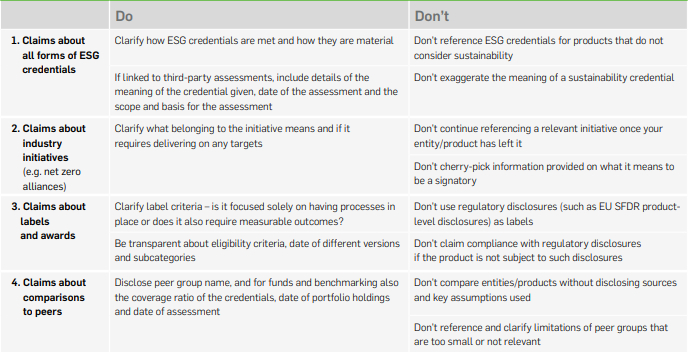

The table below sets out examples of communication-related do's and don'ts provided in the Note. It is not exhaustive:

THE UK POSITION

In May 2024, the Financial Conduct Authority's ("FCA") introduced a new anti-greenwashing rule ("AGR") and supplemental guidance for FCA-authorised entities, including any asset manager marketing in the UK. The AGR is contained in the ESG Sourcebook of the FCA Handbook (ESG 4.3.1R) and contains a set of principles which overlap with those in the Note. Claims must be: accurate and verifiable; clear and understandable; comprehensive; and fair and meaningful in comparisons.

The FCA works with the Competition and Markets Authority ("CMA") and the Advertising Standards Authority ("ASA") to address greenwashing and protect consumers.

WHAT NEXT?

European and UK-based financial market participants should assess their greenwashing risk in the context of the latest guidance and regulatory framework, with a view to adopting appropriate strategies into ESG governance and compliance processes. They should also consider the need for internal training and due diligence materials on point.

More thematic notes are expected from ESMA in the coming months, each addressing different aspects of sustainabilityrelated disclosures.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.