- within Corporate/Commercial Law topic(s)

- in United States

We discuss executive compensation trends in European listings focusing on the use of legacy, contingent, and 'plug the gap' incentives to align with company goals and ensure effective attraction and retention.

European listings have made a remarkable comeback in 2024, indicating that more companies view the current market condition as an optimal listing window. We anticipate that the European listings market in 2025 will be shaped by several key factors, including stabilizing equity capital markets; continued focus of corporates on divestment of noncore business units and the pent-up demand of maturing private equity (PE) -backed investments.

Executive pay programs are more complex and subject to closer scrutiny than ever before.

Against this backdrop, we look at executive compensation trends from recent European listings (private company and PE-backed initial public offering (IPOs) and corporate spinouts) to consider what factors are relevant when it comes to incentivising the executive team on going public.

We looked at companies that listed on the BME, Euronext, First North Stockholm, Nasdaq (Copenhagen and Stockholm), Oslo Stock Exchange and Six Swiss Exchange between January 2017 and March 2024. We found some interesting observations on legacy and one-off awards for executive directors on listing. Post-listing and ongoing remuneration should be considered against the broader European executive compensation landscape. Please refer to our publications 2024 AGM trends in Europe: Analysis of Executive Director remuneration policies and shareholder feedback and Navigating the European executive compensation landscape for more details on ongoing executive remuneration trends.

Companies in our analysis

For our analysis on European on-listing awards to the executive team, we've reviewed publicly available disclosures in listing prospectuses on admission for the 19 companies in our sample listing in the last seven years. The 19 companies covered a wide range of market capitalisations (€20 million - €42 billion).

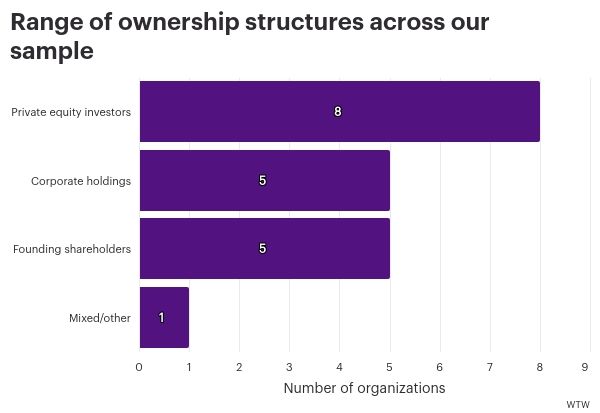

We also observed a range of ownership structures across our sample including those that prior to listing were majority owned by founding shareholders or private equity investors; those that had a mix of ownership with no single majority holding and those that on listing were spun out of majority corporate holdings.

Types of awards

In terms of incentivising executive directors on a listing, we typically observed legacy, contingent awards and "plug the gap" incentive awards. We define:

- Legacy incentives as those which were granted prior to, but vested and paid out after, listing and weren't contingent on listing

- Contingent awards as incentives, which were granted prior to listing but where vesting/payout was contingent on listing

- "Plug the gap" incentives as those that bridge the gap between pre-listing, legacy plans and post-listing, future-state remuneration arrangements

Solution

Executive Compensation and Board Advisory

The right balance of global connectivity and on-the-ground local expertise

Create long term value arrow_right_alt

Why grant on-listing awards?

Granting on-listing awards can provide a benefit to the company, the executive team and the new broader shareholder base. For the company, on-listing awards can be a tool to motivate and retain key talent through a time of transformation. These types of awards are also very important when a company is seeking to attract key talent close to the listing date who are essential to the future success of the newly public company. For executives, they can show how much they helped the company go public. They can also give them a first or better chance to become owners of the company. For shareholders, on-listing awards provide longer-term alignment between the interests of management and shareholders.

What factors determine whether on-listing awards are merited?

On listing, awards to the executive team won't be present in every scenario and in our sample of those companies that disclosed details of one-off awards to executive directors, 53% made awards to CEOs.

Just as the rationale for going public depends on a variety of factors, so is the existence of on-listing awards dependent on a range of different factors, including:

- The number of fully vested shares currently held by the executive team

- The value of outstanding unvested equity awards currently held by the executive team

- The timing of the last equity award prior to listing

- The relative shareholdings and equity awards between members of the executive team

- Potential dilutive impact to existing and newly public shareholders

- The post-listing remuneration packages for the executive team, including new long-term incentive awards

To bring these different factors to life, we have presented below some example scenarios that may or may not give rise to on-listing awards being granted to executives.

A new executive director could have joined the business to take the company on the next stage of growth, and, compared to founding executives, this individual could need top-up awards

PolyPeptide Group AG is a leading pharmaceutical active ingredient manufacturing company, with headquarters in Switzerland, listed on Six Swiss Exchange in 2021. On top of the Company's preexisting incentives, on IPO, two one-off restricted share awards were granted to the CEO as compensation for the forfeited remuneration from their previous employer. The first award had a value of CHF750,000 and the second award had a value of CHF100,000. The first award was subject to three years' service and vested in thirds each year from June 2022. The second award was subject to just one years' service and vested in June 2022.

Appropriate preexisting incentives are in place, which wouldn't require additional on-listing awards to be implemented

Among the companies in our sample, 10 companies disclosed legacy awards and, of these, only five granted awards on IPO. It's possible that these companies didn't implement an incentive on listing as the incentives already in operation, or those that would be in place post-IPO, acted as a sufficient retention mechanism.

In the transition from private to public, the executive team receive a go-forward remuneration package reflective of leading an independent public company

Alcon Inc., headquartered in Geneva, Switzerland, is a global leader in eye care. The company became an independent, publicly traded entity in April 2019, following being spun out of Novartis. In the transition from private to public, management and the board had to balance Swiss public company pay practices, continued executive retention and overall reward fairness, all within a newly public company context.

At the time of listing, no additional value was delivered to executives through on-listing incentives, but transitional arrangements were put in place to ensure that executives weren't disadvantaged in respect of legacy incentive awards. These took the form of Keep Whole Awards, to replace the payment of a dividend in kind, and Refill Awards, to replace the forfeited portion of the original Novartis Performance Share Units (PSU) awards.

Following listing, with the transition from being a subsidiary of Novartis to being an independent public company, the executive team received a remuneration package reflective of their increased strategic and operational responsibilities. While a subsidiary of Novartis, the total target LTIP opportunity for executive committee members ranged from 160% to 270% of base salary.

Following the IPO, the LTIP opportunity was materially increased and, in 2019, LTI awards were granted to the CEO with a target opportunity of 280% of base salary. The awards consisted of Performance Share Units (PSU), which convert to shares at vesting, contingent on the achievement of performance measures. As noted by the company, this increase, effective from the spin-off date, reflected the new responsibilities as executives of an independent public company.

Valuable preexisting incentives are in place and there could be retention risk concerns which would merit additional awards to ensure the executive team is in place for a sufficiently stable period post-listing

Syensqo is a Belgian multinational materials company, headquartered in Brussels, Belgium. It was established in December 2023 through a spin-off from Solvay and was listed on Euronext.

Prior to the demerger, Solvay operated a long-term incentive plan for its executive team and implemented an IPO contingent award. This decision was made to enhance the existing compensation structure and align executive interests with the company's strategic goals.

The LTIP in operation was a hybrid plan, consisting of performance-based (70%) and restricted shares (30%). The target opportunity was set at 150% of salary for the CEO and 125% of salary for the CFO and other Executives.

Prior to the demerger, Solvay granted additional awards to 17 members of the Solvay Leadership Team, including the CEO, in the form of share options. These awards were subject to performance conditions and would be forfeited if the partial demerger didn't occur by 2025.

The case of Syensqo illustrates a common trend observed within our sample, the implementation of additional on-listing awards despite the existence of preexisting incentives. Out of 22 companies, 10 disclosed the operation of legacy awards and, of these, six applied on-listing awards in the form of either contingent or one-off awards. This approach highlights the importance of aligning executive compensation with company milestones and strategic objectives, ensuring that key leaders are motivated to drive long-term success.

European listings have made a remarkable comeback in 2024, indicating that more companies view the current market condition as an optimal listing window.

Looking ahead

We will continue to observe the impact of macroeconomic and geopolitical conditions on the European listings market. From an executive compensation perspective, while ongoing pay design practices will remain broadly consistent with market norms, we continue to expect to see varied practice when it comes to valuable legacy, contingent awards and "plug the gap" incentive awards in the hands of executive directors depending on the factors present in each situation.

Final Thoughts

A listing is a significant commercial milestone that offers the opportunity to review and align legacy executive compensation arrangements with the interests of both executives and public company investors. With public ownership comes increased scrutiny from regulators, proxy advisors, the media and other stakeholders. We're well-equipped to support organizations in key areas as they prepare for listing:

01

Remuneration disclosures

Details of both existing and future remuneration arrangements are required as part of the listing prospectus disclosures. These disclosures necessitate careful coordination between external advisors (remuneration advisors, lawyers, investment banks) and internal departments (HR, accounting, legal, treasury, tax) to ensure accurate and comprehensive preparation.

02

Corporate governance

After a company is listed, shareholders can give direct feedback on how executives are paid. They can do this through both binding and advisory votes at the Annual General Meeting. Given the heightened corporate governance standards for public companies, newly listed organizations must consider executive remuneration in the context of investor interests and market expectations.

03

New listed company roles and responsibilities

Listing introduces additional responsibilities in areas such as investor relations, finance and legal. Companies need to recruit or promote individuals with appropriate compensation packages that reflect these enhanced roles and functions.

04

New incentive plans

Most newly listed companies implement new equity incentive plans to grant awards to key employees and directors. These plans should incentivize participants to achieve the business strategy through challenging performance metrics, while also incorporating market practices and investor guidelines.

05

New non-executive directors

Upon listing, the company's board will include independent non-executive directors (NEDs). These NEDs will be compensated differently from executive directors, and the company will need to design appropriate fee structures for these individuals.

Setting, managing and communicating executive pay is increasingly sensitive. Executive pay programs are more complex and subject to closer scrutiny than ever before. WTW provides expert perspectives and consulting to help companies balance talent and governance risks and drive business performance. We collaborate with management and boards to align the interests of key stakeholders and develop pay arrangements that withstand scrutiny from shareholders, regulators and other stakeholders.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.