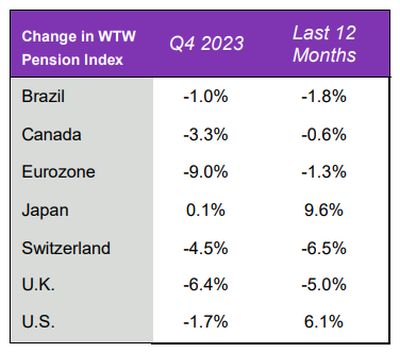

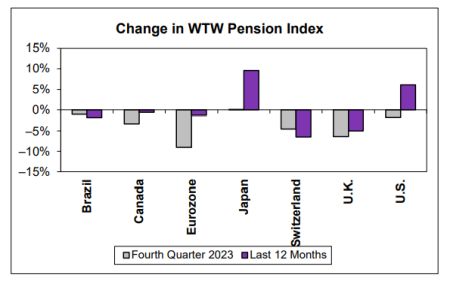

Volatile Fourth Quarter Index Results

More dovish Central Bank policies across key markets in Q4 2023 led to a more volatile quarter than Q3 marked by discount rate decreases across all countries. Asset performance was largely positive, and inflationary pressures remain but show signs of subsiding. Overall, the combined effects drove negative third quarter pension index results for all countries, with the exception of Japan. The pension index decreased in all regions over the full year, with decreases in the single digits, except for in Japan and the United States, where strong equity performance drove single digit increases.

While it is always the case that Global Pension Finance Watch captures results at the end of each quarter, we particularly want to highlight the point in time view of this publication in light of recent volatility. WTW supports the daily monitoring of pension funded status and other key pension financial metrics for those organizations wishing to inform key business decisions.

The WTW Pension Index is the ratio of the market value of assets to the projected benefit obligation (PBO) for a hypothetical benchmark plan.

About this report

Global Pension Finance Watch, published quarterly, reviews how capital market performance affects defined benefit pension plan financing in major retirement markets worldwide, with a focus on linked asset/liability results. We cover defined benefit pension plans in Brazil, Canada, the Eurozone, Japan, Switzerland, the U.K. and the U.S. Specific plan results will vary, often substantially, based on liability characteristics, contribution policy, portfolio composition and management strategy among other factors. The passage of time since quarter end, may also have a significant impact on pension plan financing.

The impact of capital markets on these pension plans is twofold:

- Investment performance on fund assets

- Changes in economic assumptions on plan liabilities (as measured under international accounting standards)

Role of monitoring as part of successful global pension risk management

Those organizations that monitor their global pension plans are prepared to act quickly when market conditions evolve and have been most successful in achieving their cost and risk management objectives. Monitoring for such conditions is most effective when done in realtime, tailored to the specific characteristics of each retirement plan and supporting assets

The Global Pension Finance Watch captures results for benchmark plans at the end of each quarter and can be a useful guide. For those organizations wishing to inform key business decisions for their own plans, WTW supports the daily monitoring of funded status and other key pension financial metrics via the Cost and Risk Management Channel.

Broader risk management perspective

Beyond financial monitoring, we observe multinationals with the greatest success in managing their defined benefit pension risks exhibit a number of consistent characteristics. They:

- Take the time to understand the complex risks inherent in the plans and the levers available to managing that risk

- Establish a clear, central level of tolerable risk and strategy to managing within those metrics

- Employ a systematic, multi-local approach to evaluating and deploying risk management actions

- Monitor financial markets, changing practices, legislation, and trends.

For more insights on the common techniques multinational organizations have deployed to manage pension risk, we encourage you to read our article on Mastering DB Risks Globally.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.