- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

Strengthening risk management capabilities, adapting strategies and mitigation measures to evolving political realities have never been more critical for business leaders. Leaders nowadays are facing increasingly complex and uncertain environments where they are expected to respond to emerging risks for long-term success and resilience.

Over the course of the past decade, environmental, social, and governance ("ESG")-related topics have gained significant, almost overwhelming, salience globally in political, business, and public discourse. A growing consensus declared that ESG-related topics require greater focus in order to establish collective action,1 promote long-term value creation,2 and live by the power of principles.3 In line with this general understanding, regulatory requirements and policies have been growing and the increasing complexity has challenged businesses, even to a degree that businesses and their leaders perceive a sort of "compliance fatigue."4

At the same time, significant efforts have led to tangible results. According to the AlixPartners Disruption Index 2025, 76% of executives in this year's survey confirm that ESG considerations drive positive change, and 19% even describe the impact as "significantly positive". Looking ahead, in the next 12 months, 56% of executives expect continued positive revenue impacts, while 61% foresee increased profitability from ESG initiatives.5

However, a growing backlash against certain ESG efforts has led to some priorities and frameworks being questioned, revised, or put on hold. These dynamics have also resulted in mixed reactions by businesses. While some businesses are perceived to have revised or scaled back selected ESG commitments and targets6, others are reiterating their ESG-commitment and targets, often rebranded under "sustainability" or "responsible business".7

The ESG dilemma: what next?

Given the shifting geopolitical and economic landscape, senior managements and boards are challenged with a critical question: Is this the time to double down on ESG initiatives, commitments, and targets? Or is this rather an appropriate moment to scale back? Or do the initiatives need to be reframed, aligning with current realities?

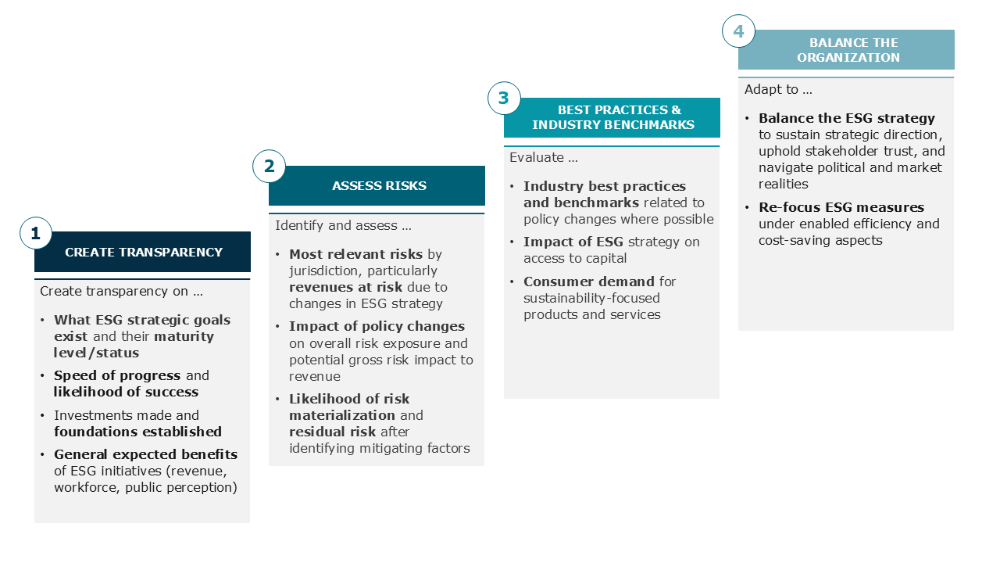

AlixPartners provides a framework, which can support business leaders in considering decisive factors and what information is needed to find suitable answers for the respective organizations:

Figure 1: AlixPartners framework on ESG Strategy Assessment

The path forward

The first step in assessing the need for strategic change should always be a fast and data-driven analyses of the situation, ensuring a transparent and objective evaluation of the status quo. This includes reviewing existing ESG strategic goals, their maturity level, current investments, progress in implementation, and the expected likelihood of success.

This review should be followed by a comprehensive risk assessment. It is essential to identify key risks by jurisdiction, revenues at risk due to ESG changes, and the impact of policy shifts on overall risk exposure. Additionally, the likelihood of risk materialization and residual risks after mitigation efforts should be analyzed. This assessment should not only focus on the immediate impact but also consider the long-term trajectory of ESG initiatives and their implications for the company as a whole.

In a third step, the focus should shift towards external stakeholders and industry benchmarks. A structured evaluation should be conducted to derive key learnings from competitor reactions and industry best practices. This helps to avoid overreactions or, conversely, inaction in an evolving environment. Special attention should also be given to assessing the impact of public perception and media coverage, ensuring proactive management of potential reputational risks.

Lastly, balancing the organization's ESG strategy is critical. Every decision should be weighed carefully, considering both opportunities and threats. Given the increasing number of market risks, companies must strategically assess when it is appropriate to adjust ESG initiatives versus when continuing value creating efforts remains the best course of action.

AlixPartners' Risk practice advises executives to take a balanced, risk-adjusted approach to ESG, ensuring alignment with business goals, stakeholder expectations and market shifts. Companies that proactively assess risks, adapt, and integrate ESG in a commercially viable way will be best positioned to navigate uncertainty and create long-term value.

In addition to the authors listed on this page, Leonard Funke was also a key contributor to this article.

Footnotes

1 World Economic Forum (2024, January). The Global Risks Report 2024 (19th Ed.). https://www3.weforum.org/docs/WEF-_The_Global_Risks_Report_2024.pdfe (access date: March 18, 2025).

2 Eccles R.G., Johnstone-Louis M., Mayer C., & Stroehle J.C. (2020, September/October), The Board's Role in Sustainability. https://hbr.org/2020/09/the-boards-role-in-sustainability (access date: March 18, 2025).

3 United Nations (N.A.). The Ten Principles of the UN Global Compact. https://unglobalcompact.org/what-is-gc/mission/principles https://unglobalcompact.org/what-is-gc/mission/principles (access date: March 18, 2025).

4 Anderson J. (2025, 2 February). Compliance Fatigue May Cause Corner Cutting; Culture Factors In. https://compliancecosmos.org/compliance-fatigue-may-cause-corner-cutting-culture-factors (access date: March 18, 2025).

5 AlixPartners. (2025, January). AlixPartners Disruption Index. https://www.alixpartners.com/media/43nn-dqfg/2025-alixpartners-disruption-index.pdf (access date: March 18, 2025).

6 Exemplarily, refer to Harbert S. (2024, 26 April). Are businesses backtracking on ESG commitments?. https://grain-sustainability.com/thoughts/are-businesses-backtracking-on-esg-commitments/ (access date: March 18, 2025); Martin B. (2025, 10 March). Lloyds weakens diversity target for bonus payouts. https://www.thetimes.com/business-money/companies/article/lloyds-weakens-diversity-target-for-bonus-payouts-sng3nlnv9 ? (access date: March 18, 2025) ; Verdict (2025, 7 February). Accenture DEI dump joins Trump 2.0 ESG fragmentation. https://www.verdict.co.uk/accenture-drops-dei/#:~:text=Accenture%20has%20announced%20it%20has,an%20evaluation-%27%20of%20its%20policy (access date: March 18, 2025).

7 Segal, M. (2025, 24 February). Standard Chartered Earns Nearly $1 Billion in Sustainable Finance Income . https://www.esgtoday.com/standard-chartered-earns-nearly-1-billion-in-sustainable-finance-income/ (access date: March 18, 2025).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.