KEY POINTS

Private Equity (PE) has mostly avoided the semiconductor industry for years, but a perfect storm of supply and demand trends plus government intervention has created an environment that better aligns to PE investors' requirements.

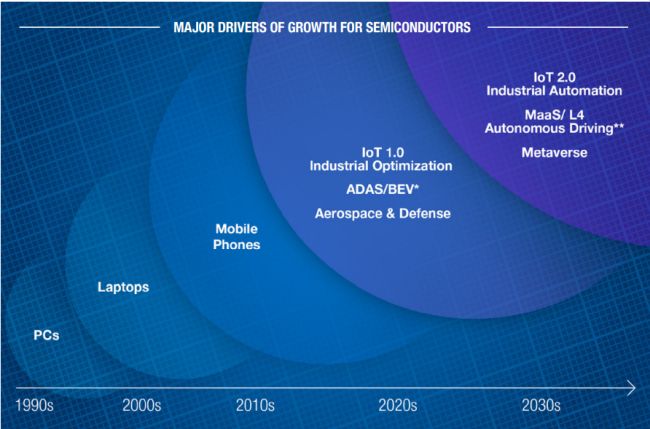

Growth drivers for the next 20 years in the industry will be different than those of the last 30 years, with Automotive and Industrial segments leading the way. These end markets have more stable demand patterns and less reliance on leading edge investment.

The pandemic highlighted the risk of having such intense supply chain concentration in a few markets in Asia. The Ukraine War has further escalated concerns over having secure supply chains and domestic capabilities that align with Western needs.

The CHIPS Act was passed to incentivize more investment in U.S. based manufacturing capabilities and will create a number of opportunities across the value chain from suppliers to semiconductor makers to distributors and customers.

These recent events create a major opportunity for PE firms to take a fresh look at semiconductor companies and for semiconductor companies to think of PE firms as key strategic capital partners or potential buyers of businesses that no longer fit into core strategies.

Private Equity (PE) firms have largely avoided investments in semiconductor companies for the last 15 years as the perception of cyclical demand patterns along with high levels of capital and research and development (R&D) spend have kept PE investors away. But recently, a perfect storm of supply chain shortages and massive government subsidies through the CHIPS Act coupled with major shifts in demand patterns across end markets have brought semiconductors more in line with the typical investment thesis of PE firms. Because of this, we have seen more PE funds begin investing in semiconductors or parts of the semiconductor value chain.

The pandemic highlighted several vulnerabilities in the supply chain for semiconductors as well as the deep reliance we have on semiconductors for key industries such as automotive, aerospace and defense (A&D) and communications. This is exacerbated by several megatrends in key end markets such as the growth in electric vehicles and additional safety features in the automotive industry and the modernization and restocking of equipment in the A&D sector as a result of war in Europe. Additionally, the CHIPS and Science Act of 2022 in the U.S. is pouring $52 billion in funding into the sector to incentivize semiconductor manufacturing and R&D in the U.S., drawing global venture capital interest. This has already brought more PE interest than the sector has seen in the past 15 years, but we expect more interest as investors observe the resiliency of certain segments of the semiconductor industry.

Seismic Shifts in Demand Creating New Opportunities

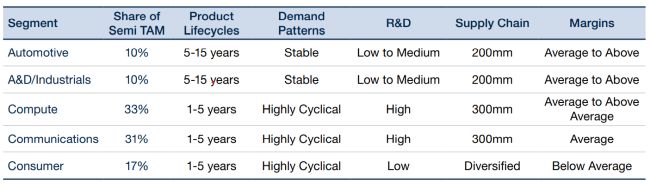

For the past two years semiconductors have enjoyed massive growth as a result of the pandemic and historic pricing power that drove revenue growth to its highest levels in 20 years in 2021. As demand levels softened in 2022, we have been able to observe which end markets had more resilience. While demand fell off in the largest end markets, computers and communications, it has remained strong in automotive and industrials. These markets are expected to be the strongest drivers of growth over the next two decades as 5G enables more semiconductor content to be introduced into automotive and industrial products, increasing the share of these end markets from 18 percent of the semiconductor industry in 2022 to over 33 percent of the industry by 2040 due to higher growth in these end markets relative to the larger computer, communications and consumer markets. These end markets have several attributes that set them apart from the larger segments for semiconductors. They leverage older technologies, many of them based on 200mm process technologies as opposed to the more leading-edge technologies manufactured on 300mm wafers. The product lifecycles are more stable in these industries as the platforms they support have much longer usable lives, and therefore more predictable sales and maintenance patterns to support revenue forecasts – see chart below. All these factors give these segments a more favorable demand profile than the other segments that have driven growth for the semiconductor industry over the past thirty years.

Supply Challenges

The pandemic highlighted several vulnerabilities in the supply chain for semiconductors as well as the deep reliance on semiconductors for key industries such as automotive, A&D and communications. Moreover, the semiconductor supply chain is imbalanced, with approximately 85 percent of today's chip supply coming from Asia. Today, the U.S. accounts for only about 10 percent of the total supply compared to 30 percent in the 1990s. This imbalance puts a lot of risk not only on the semiconductor value chain but also on the supporting key end markets as well, as we have seen within the U.S. automotive sector.

It will be important to invest in areas of the supply chain that will help de-risk supply issues we have seen most recently (e.g., wafer fabs, OSATs, etc.) Furthermore, focusing on end markets that have longer product lifecycles and less volatility will also help reduce investment risk. Most of the longer product lifecycle chips are made with the 200mm wafer fabrication process where significant capacity additions are unlikely to occur.

CHIPS Act

When President Joe Biden signed the CHIPS and Science Act into law in August, it promised to launch a bevy of new investments in domestic semiconductor production, boost innovation and U.S. competitiveness and improve national security.

The act will direct $280 billion in spending over the next decade, with the bulk of it targeting research and development, and $52 billion directed toward semiconductor manufacturing. Additionally, $24 billion in tax credit incentives will be available to encourage domestic chip production.

Building state-of-the-art semiconductor plants is capital intensive and will require substantial private investment. The tax credit incentive is designed to cover 25 percent toward advanced semiconductor production and equipment. The Act will also spend $10 billion to create 20 innovation hubs beyond existing areas of innovation, such as Silicon Valley, Boston and Seattle, and invest in more rural areas of the U.S.

Investment Opportunities

Automotive, industrial and A&D make up just under 20 percent of the market for semiconductors but have attractive attributes such as more stable demand patterns, longer product life cycles, lower levels of R&D and a less concentrated supply chain. These factors make companies focused on those segments more attractive for private equity investors.

The fact that these segments leverage older technology is an advantage since they are not exposed to the massive capital investments that occur on the leading edge or have only a small number of supplies that can support the fabrication of those chips. They are also not subject to the supply and demand mismatches that create volatility in markets like dynamic random access memory (DRAM). Legacy 200mm technologies are still the primary platforms for automotive and industrial chips, but less than 10 percent of capital investment is going towards their manufacturing. This creates more stability, ensuring that there will not be significant over-supply of these markets. Also, the R&D for the chips that go into these markets is not as speculative or risky as the R&D required for smart phones or data center chips that have very tight time to market requirements and support very short product cycles. These leading-edge designs require very large markets to support the R&D for their design and manufacture, but the market sizes required to support designs in the automotive and industrial markets are much lower.

Other Areas of Opportunity for PE Investment

Outside of the core semiconductor industry, there are several adjacent sectors that PE firms can invest in to get exposure to the semiconductor industry and take advantage of the headwinds created by these demand trends and government subsidies. These additional areas include, but are not limited to:

Why the Time is Now for PE & Semis

Recent events have created an opportune environment for PE funds to evaluate potential investments in semiconductor companies and peripheral businesses within the ecosystem. Semiconductor industry growth is shifting towards end-markets with more stable demand. These end-markets – industrials and automotive – typically run on more mature process technologies that require less intensive capital investment, relative to other end-markets that are more on the leading edge. More stable end-market demand and lower capital investments and R&D requirements make certain semiconductor-related companies more attractive to PE funds.

Additionally, the pandemic-driven supply chain shortages drove the U.S. government to significantly incentivize investments in expanding domestic semiconductor capacity. With hundreds of billions of dollars of funds available, the time is now for PE funds to explore opportunities to take advantage these shifting demand and supply dynamics.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.