When psychologists talk about a "growth mindset," they refer to people who believe their success is not based on innate, fixed traits of intelligence, talent, or privilege, but comes instead from learning, persistence, training—that is, growth. Executives like hiring people with growth mindsets, because they take their current situation as a starting point, not a constraint.

Companies have growth mindsets, too, as this year's list of Supergrowers amply shows. Among the 60 companies on this year's list are some that seem to have been lucky, blessed with a rising tide and favorable winds, but even those need more than luck to outrace their peers. And by far the majority of supergrowers are companies that forged their own destiny, navigated by starlight of their own or made their own weather. These companies that had a growth mindset—and a growth toolkit.

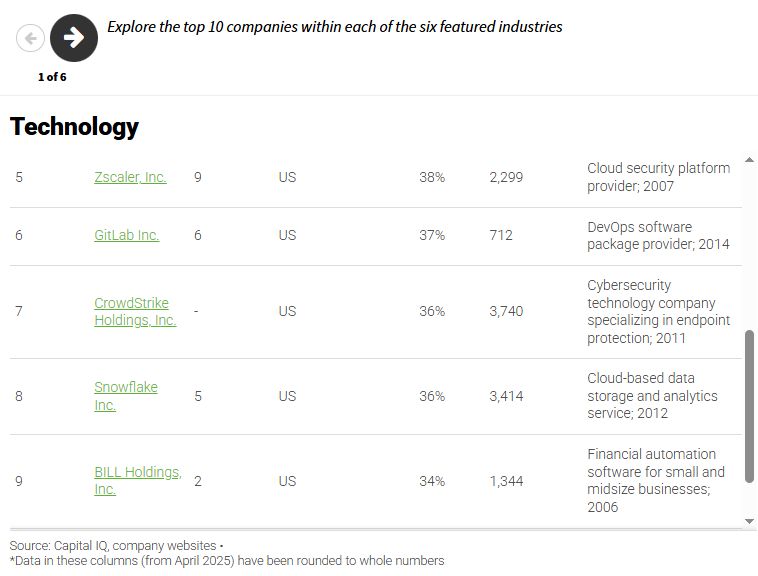

This is the second year AlixPartners has assembled a list of the world's fastest growing companies. We compiled it by identifying the ten large North American and European public companies in each of six industries—sixty companies in all—that have grown fastest. We narrowed the list in three ways. We eliminated companies with annual sales below $500,000. We excluded companies that owe most of their growth to M&A, so as to focus on how successful companies maximize organic growth. And we calculated a two-year growth rate, to reduce the likelihood of including a company that benefited from a blip. (As it is, 28 companies have made the list both years.)

The supergrowers come from countries big and small—from Romania and Slovenia as well as from the United States, Germany, and Canada. Some are famous (NVIDIA, Spotify) but most are little known, despite being publicly traded top performers. Indeed, one purpose of this study is to look past the growth stories of the rich and famous and discover patterns and insights—the secrets of the supergrowers—that aren't known. We also examine industry effects in separate articles, since industries have unique opportunities and obstacles. The American school bus manufacturer Blue Bird, whose revenues increased 68% over two years, has more in common with other industrial companies than with a media company like Bloomsbury Publishing (a 49% two-year increase, riding the continuing success of books by Sarah J. Maas and J.K. Rowling).

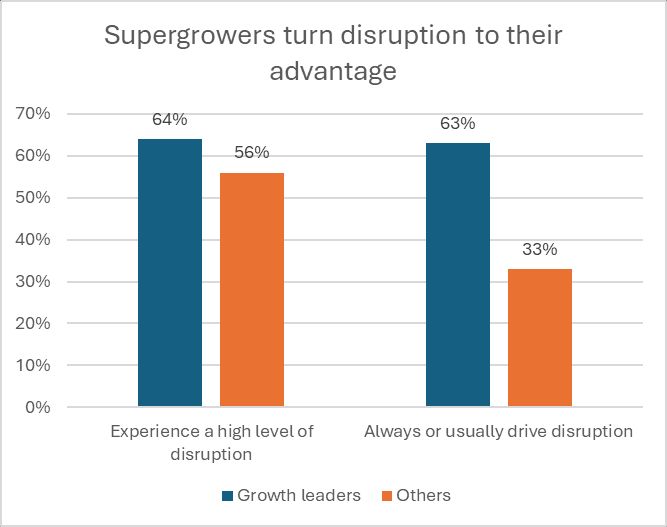

But experienced leaders know that some of their best ideas come from outside their industry, and many themes are common across industries. Customer centricity is one; so is the use of AI to make big gains in product and process innovation. These are also confirmed by the AlixPartners Disruption Index, our annual survey of 3,200 senior executives from around the world. Sixteen percent of these say their company sets the pace for growth in their industries. One clear lesson from the Disruption Index is that fast-growing companies are not derailed by disruption; instead, they exploit it.

Growth leaders are four times more likely than the others to say that they drive disruption in their industries—shaping trends rather than reacting to them. They are, for example, much more successful when it comes to using digital tools, and artificial intelligence in particular. Thirty-nine percent of growth leaders say their investments in digital transformation returned more than 10% in the last 12 months, something achieved by only 9% of slower-growing companies.

Many companies have seen their growth strategies suddenly upended by tariffs and trade conflict. One clear lesson from the supergrowers is that disruptive times demand solid tactical growth capabilities like marketing, sales, and pricing effectiveness, along with procurement and distribution capabilities. These can mitigate much of the damage from disruption, while providing companies tools to take advantage of opportunities.

For example, growth leaders are 35% more likely to say they are taking proactive measures to prepare for supply chain disruptions. They are more likely to be addressing the need to get real-time visibility into their supply chains, use machine learning to understand the customer impact of price changes, and deploy AI and machine learning to improve operations. In this context, it is striking that many supergrowers cite their capabilities in logistics and distribution as a reason for their superior growth. Trinity Industries, for example, has achieved a 97.5% utilization rate for its fleet of leased freight cars thanks in part AI-driven insights that enable predictive maintenance and reduce downtime, fleet management solutions for industrial shippers that ensure long-term customer relationships, and a digital railcar tracking and analytics system that enhances visibility and efficiency for itself and its customers.

We are struck once again by the outsized role that execution plays in the stories of these fast-growing companies. Many of them, to be sure, have positioned themselves in strategic strongholds. Compared to their competition, supergrowers invest far more in innovation—roughly twice as much as a percentage of sales—but even the highest entry barriers and greatest differentiation cannot succeed without superior management sales coverage, pricing, customer insights and experience, and reliable, on-time delivery. Growth, as we have said before, is a practical matter. It happens when mindset and toolkit come together.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.