- in United Kingdom

- with readers working within the Banking & Credit and Securities & Investment industries

- with readers working within the Banking & Credit and Securities & Investment industries

If you are involved in issuing or trading securities, you are familiar with CUSIP numbers, the nine-digit alphanumeric codes that identify specific securities in the United States and Canada. What you may not know is that sometimes you will need a temporary CUSIP number (also known as a contra CUSIP) in connection with a reopening (or a "tap") of a series of outstanding debt securities. In a reopening, the issuer will issue and sell additional debt securities having the very same terms and conditions as those that are already outstanding with the intention of having the additional securities form part of the same series. However, depending on the timing or circumstances of the reopening, the additional debt securities may require a temporary CUSIP number in order to distinguish these from the issued and outstanding securities. This distinction is essential to ensure that clearing systems, underwriters, and beneficial owners receive the correct economic and regulatory treatment.

Temporary CUSIPs

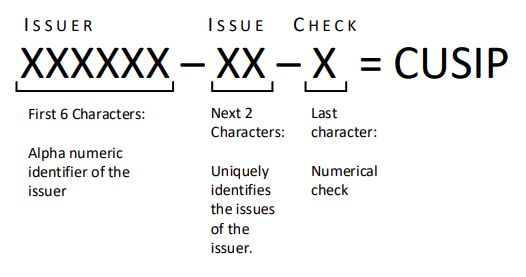

A temporary or contra CUSIP (which stands for "Committee on Uniform Security Identification Procedures") is a temporary identifier used to segregate positions of securities. Often, temporary CUSIPs are used during corporate actions, such as in a tender offer, to identify and track tendered securities from un-tendered securities. A CUSIP consists of nine digits; the first six digits identify the issuer and are assigned to issuers in alphabetic sequence (also known as the base or CUSIP-6), and the next two characters (alphabetic or numeric) identify the issue. The ninth digit is a check digit to ensure the CUSIP's accuracy. Therefore, a temporary CUSIP will have the same CUSIP-6 as the issuer's other securities. CUSIPs are assigned by CUSIP Global Services, which is managed on behalf of the American Bankers Association by S&P Global Market Intelligence, a division of S&P Global.

Debt Reopenings

In a debt reopening, additional securities are issued that are intended to be fungible with the original securities. For more information on reopenings, see "Reopenings: Issuing Additional Debt Securities of an Outstanding Series" (Lexis subscription required.) In certain circumstances, these new securities must be distinguished from the original securities for a period of time; this is where a temporary CUSIP is used. For example, when a reopening settles after the record date but before the interest payment date on the original securities, the new debt securities must be distinguished from the original debt securities, because they were not outstanding on the record date and therefore are not entitled to the interest payment. To ensure that only the holders of the original securities receive the interest payment, the new securities are issued under a temporary CUSIP, permitting custodians and clearing systems to segregate the positions. After the relevant interest payment date has passed, the temporary CUSIP can be exchanged for the same permanent CUSIP assigned to the original securities, so the new securities are fully fungible with the original securities.

Although a temporary CUSIP solves the problem, many issuers simply avoid that timing altogether by pushing the reopening's closing to a date after the interest payment date (even if this means extending settlement). Alternatively, the indenture may permit setting a special record date or employing other bespoke solutions, but these often require additional disclosure and can cause investor confusion. As a result, the temporary-CUSIP approach remains the market-standard fix where timing cannot be shifted.

While the interest record date/payment date scenario is the most common reason to use a temporary CUSIP, there may be other situations in which the issuer may want to temporarily distinguish the new securities from the original securities. In an A-B exchange offer, debt securities that are initially offered in a exempt offering in reliance on Rule 144A and/or Regulation S (the "A notes") are subsequently exchanged for identical, freely tradeable debt securities registered with the Securities and Exchange Commission (the "B notes") in an exchange offer conducted by the issuer in accordance with its obligations under a registration rights agreement entered into in connection with the initial offering. In this instance, the additional B notes will often be offered and sold in the same manner with similar registration rights and, as a result, will bear a temporary restricted Rule 144A/Reg S CUSIP number until the registered exchange offer is consummated, at which point they will bear the same unrestricted CUSIP number as the outstanding A notes. During the exchange process, both the unregistered A notes and the registered B notes may be outstanding at the same time. Assigning a temporary restricted CUSIP to the A notes helps differentiate them from the B notes, preventing confusion and errors in settlement, trading, and recordkeeping. In an exchange where only a portion of the A notes holders exchange for B notes, two permanent CUSIPs may be necessary to distinguish the unexchanged and unregistered A notes from the exchanged A notes for registered B notes.

Special Considerations for Regulation S Reopenings

In Regulation S offerings, securities are exempt from registration under the Securities Act of 1933, as amended, if sold outside the United States to non-U.S. persons and are subject to certain restrictions to ensure they are not offered or sold to U.S. persons in violation of U.S. securities laws. The two core requirements of Regulation S (as set outlined in Rules 902 and 903 of Regulation S) are, accordingly, that the offering (and sale) of the securities be an 'offshore transaction' and that there be no directed selling efforts in the United States. There are, however, additional requirements of the Regulation S exemption, depending on the 'Category' into which the offering of securities falls. One of the key restrictions of Category 2 (which applies to debt securities of foreign issuers for which there is 'substantial U.S. market interest' (SUSMI) in respect of its debt securities) is the 40-day distribution compliance period, during which the securities cannot be resold to U.S. persons or into the United States. Even if an issuer of securities might fall within another Category, it has become customary for issuers to adopt Category 2 requirements if there is any doubt as to whether SUSMI exists in the issuer's debt securities or where a Regulation S offering will be combined with a private placement with U.S. investors. When a reopening of a Regulation S offering occurs during this 40- day period, the use of a temporary CUSIP may become necessary.

When a Regulation S offering is reopened during the 40-day distribution compliance period that has begun running for the original securities in order to not have the 40-day clock start over for the original securities, a temporary CUSIP can be used to distinguish the new securities issued in the reopening. In practice, often the need to use a temporary CUSIP is not necessary if "flowback" into the United States is not a concern and therefore extending the 40-day distribution compliance period would have no practical effect. However, if there is a risk that the securities may be resold to U.S. persons or into the United States, then it is prudent to restart the 40-day distribution compliance period for the original securities or use a temporary CUSIP so that holders of the original securities do not unintentionally resell in violation of Regulation S before the extended distribution compliance period imposed by the reopening elapses. The temporary CUSIP will act as a clear identifier that the new securities are still subject to Regulation S (Category 2) restrictions, helping custodians, clearing systems, and intermediaries enforce the transfer restrictions and prevent unauthorized resales during the distribution compliance period. Once the 40-day period for the new securities expires, the temporary CUSIP can be exchanged for the same permanent CUSIP as the original securities, at which point the new securities become fully fungible with the original tranche and are no longer subject to the distribution compliance period restrictions.

Special Considerations for Regulation S Reopenings of Bearer Securities

European issuers of debt securities offered on a Regulation S basis only continue to regularly issue their securities in the international capital markets in bearer form, typically represented by one or more global bearer notes held by the international central securities depositaries of Euroclear and Clearstream, Luxembourg (the "ICSDs"). Debt securities issued into the ICSDs and offered on a Regulation S basis only will not carry a CUSIP. Such debt securities will, however, be issued with an XS ISIN and Common Code (two other securities identifiers required of debt securities settled into the ICSDs and other similar clearing systems).

The U.S. Tax Equity and Fiscal Responsibility Act ("TEFRA"), enacted in 1982, restricted the issuance in the Unites States of debt securities in bearer form to, among other things, reduce tax evasion by U.S. taxpayers. Issuers of debt obligations in bearer form in violation of TEFRA were subject to the disallowance of interest deductions and the imposition of an excise tax. Various sanctions also applied to the holders of those debt securities. The TEFRA rules required that bearer securities with a maturity of more than one year:

- be sold pursuant to "arrangements reasonably designed" to ensure that the securities are not sold to U.S. persons;

- pay interest only outside the United States; and

- bear a legend stating that the requirements of TEFRA apply.

Although TEFRA was repealed for issuances of securities after March 18, 2012, as part of the 2010 HIRE Act, similar rules relating to bearer securities remain in place in the United States. Included within the TEFRA rules is the TEFRA D safe-harbor, which provides for a restricted period of 40 days from the issue date of the debt securities and requires that certification of non-U.S. beneficial ownership be obtained before definitive bearer notes can be issued, or interest amounts on the global bearer notes represented by the securities can be paid to holders. When a Regulation S offering of bearer securities in global form is reopened, the new securities must be subject to their own restricted period of 40 days if the TEFRA D safe-harbor is to be available to the issuer. The use of a temporary ISIN (and temporary global bearer note) for the restricted period of 40 days facilitates the provision to the clearing systems of certification of non-U.S. beneficial ownership of the new securities before payments on them can be made. Interests on the new securities may be transferred to a global bearer note representing the original securities only at the conclusion of the 40-day restricted period and on the certification of non-U.S. beneficial ownership of such interests having been completed. At this point, the temporary ISIN for the new securities is cancelled and the original and new securities can be represented by a single XS ISIN and global bearer note.

Although there are other rules (such as the TEFRA C rules) that may be applied by certain issuers to comply with TEFRA, the TEFRA D rules continue to be frequently applied by European debt securities issuers as, if the requirements of the safe-harbor are satisfied, inadvertent sales to US persons will not result in the imposition of the sanctions on the relevant issuer.

Key Takeaways

- Review the record dates when planning a reopening; if the deal must settle after a record date but before the next interest payment date, a temporary CUSIP may be the best way to segregate the positions.

- Temporary CUSIPs ensure correct interest, tax and regulatory treatment during the non-fungible period.

- In Regulation S reopenings, temporary CUSIPs prevent the restart of the 40-day distribution compliance period.

- For reopening bearer securities, issuers need to consider TEFRA and whether a temporary ISIN is needed for TEFRA D.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.