- within Real Estate and Construction topic(s)

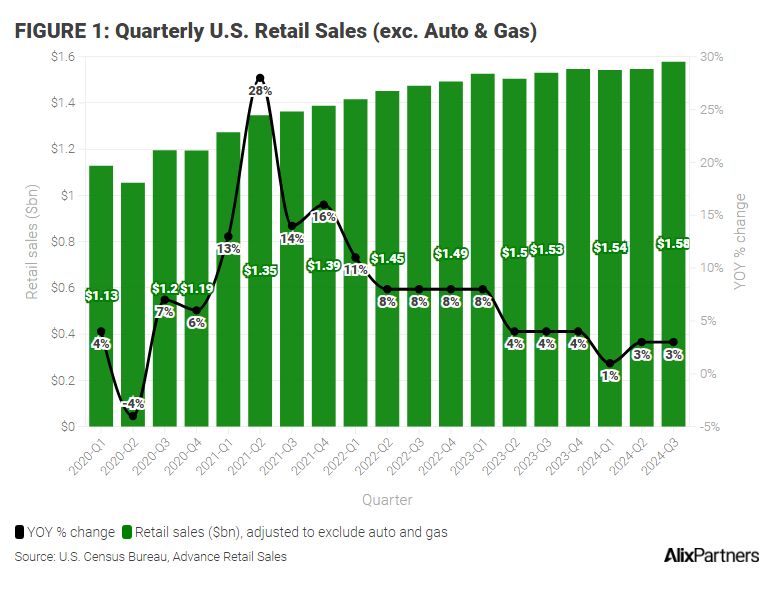

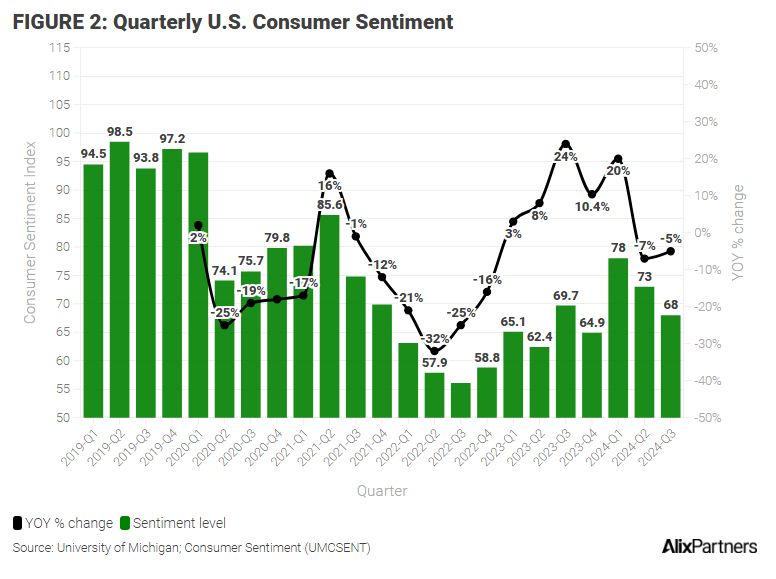

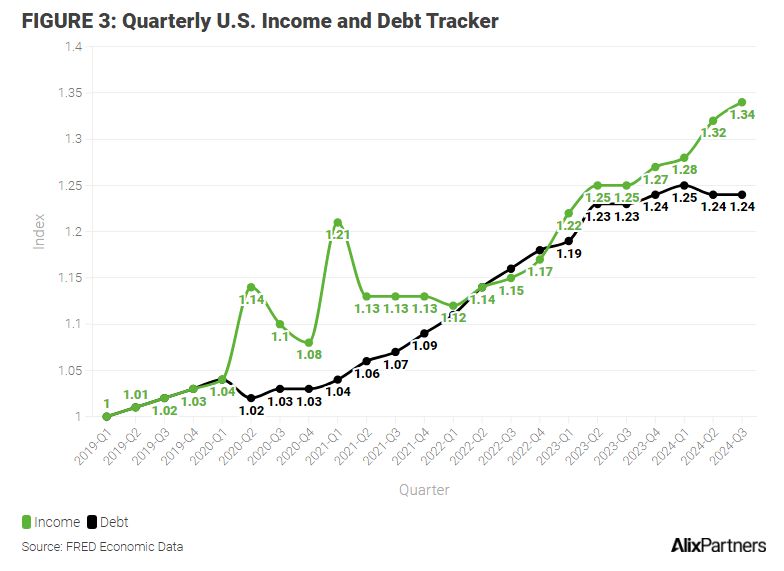

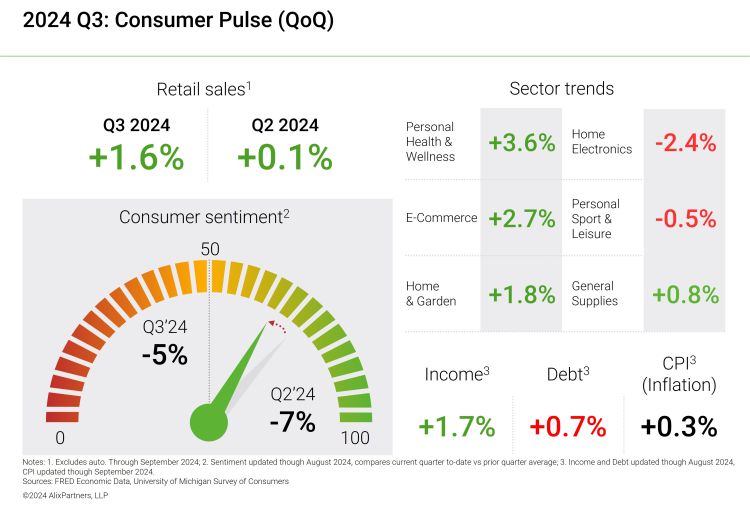

Not all consumers seem to be experiencing the same economic conditions. According to recent findings from the FED, retail spending (+1.6%) and income (+1.7%) are on the up, though this is likely driven by high-income households. By contrast, low-income households that are more vulnerable to persistent inflation (+0.3%) appear to be cutting back on spending and driving negative sentiment (-5%) due to concerns about debt payments.

With the first rate cut now official and more anticipated, will consumers' day-to-day perceptions of the economy begin to align more holistically with the strong indicators that economists have highlighted for months?

Retail sales increase...

...while sentiment continually declines

Gap widens as income increases and debt remains

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.