- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

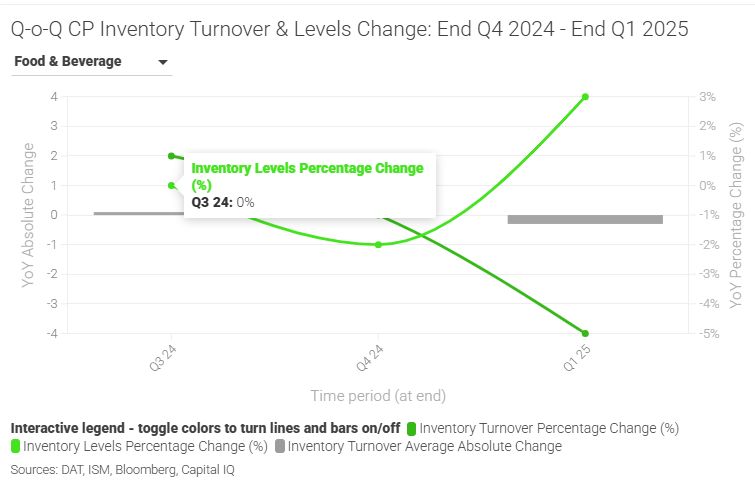

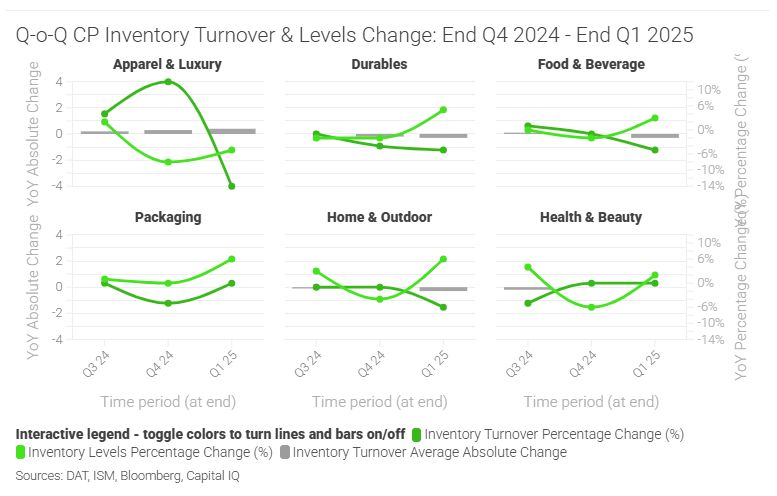

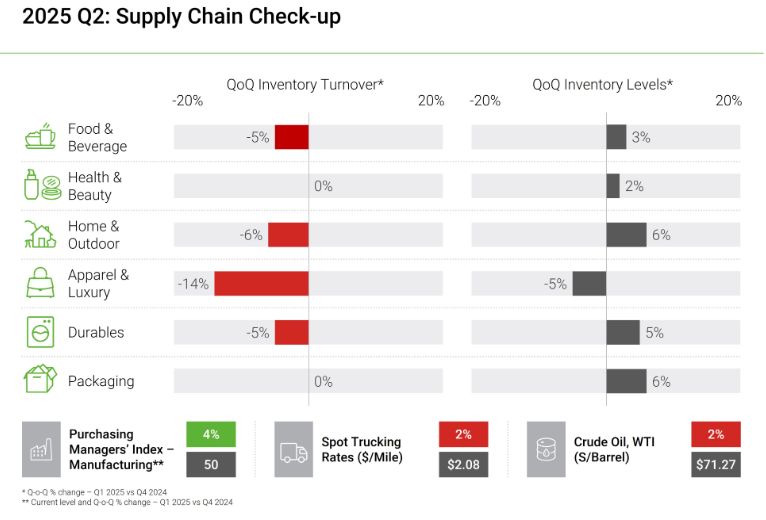

After strong inventory turnover performance exiting 2025, CPG companies reversed that trend and built inventory entering 2025 in large part to mitigate tariff volatility – no CPG sector recorded positive quarter-on-quarter turn improvement. Apparel and Luxury was most impacted, recording a double-digit decline. Trade policies, deals, and deadlines continue to evolve but despite this uncertainty, consumers have recently turned cautiously optimistic. Whether this momentum reinforces consumer spending remains to be seen as tariff-related inflation still works through CPG supply chains.

On a monthly basis, AlixPartners charts sales, sentiment and supply chains in consumer-facing businesses.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.