Following a relatively benign year for loss activity, rating pressure in the international liability market has continued to soften — particularly for the most soughtafter business — however, power companies will need to address key trends to build longer term resilience.

At a glance

- The international liability market has stabilized with a small uptick in capacity and softer market conditions, leading to greater competition and downward pressure on rates.

- Placements containing coal and/or wildfire exposure continue to face greater scrutiny, as do those with significant United States (U.S.) exposure.

- While the U.S. market remains stable from both capacity and rating standpoints, carriers remain concerned with claims inflation stemming from both auto and general liability risk and remain extremely concerned about potential wildfire exposure due to transmission or distribution line exposures.

- In order to secure optimal terms, early engagement with markets and providing a robust and comprehensive underwriting submission remains paramount.

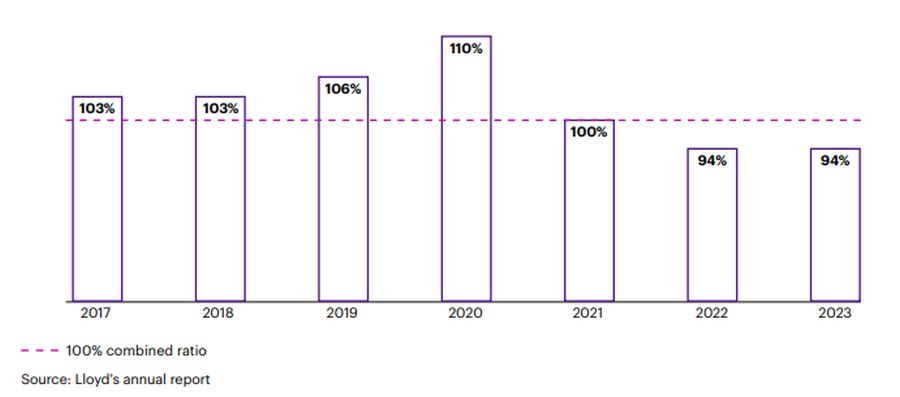

Figure 1:

Lloyd's results 2023: Casualty insurance segment

Aggregate combined ratio reported by Lloyd's casualty segment since 2017.

The balance is shifting in buyers' favor

After a sustained period of unprofitability for casualty as a class of business, in 2023, Lloyd's of London announced a second consecutive year of underwriting profit1 . A more buoyant underwriting environment, combined with limited loss activity and pressure to achieve topline growth targets, is driving the softening of the international liability market. The emergence of some new capacity, coupled with a greater willingness from existing insurers to deploy their full-line size, has driven competition and enabled buyers to better optimize their program structures and terms.

Generally, underwriters are increasingly willing to challenge technical pricing and take a longer-term view on program that they are keen to retain. This is borne out of a growing recognition that it may be more challenging to regain positions on sought-after programs in a softer market.

While a softer market has helped to reset base-level rating, the distinction between favorable and harder-to-place programs persists. Greater underwriting scrutiny and requirements continue to be applied to placements that are exposed to coal, wildfire, and the U.S.. Buyers who are able to produce high-quality risk information and evidence the highest standards of risk management will continue to benefit from the most favorable terms and put themselves in the strongest possible negotiating position.

Partnering with a specialist broking team that is able to access sector-specific capacity and has deep understanding of industry issues, remains paramount to unlocking the best possible program terms.

Claims activity and concerns over prior reserving in the wider liability market are counteracting downward pressure on rates

The absence of major headline losses in the power sector has helped to support market appetite and capacity, but wider trends in the general liability market are acting as a counterbalance.

Despite catastrophic casualty losses such as explosions, (wild)fires and hydrodam failures being largely short-tail in nature, the adequacy of reserving for long-tail exposures remains a key consideration for underwriters and is likely to prevent any freefall of rates in the year ahead.

"While the international liability market has performed better in recent years, the power sector is also bound by trends in the wider liability market, where rising social inflation and increasing third-party litigation funding are driving an uptick in the frequency and quantum of claims — particularly in the U.S..

Matt Clissitt, Senior Director and Deputy Head of Liability, Natural Resources, WTW

The U.S. liability marketplace continues to combat rising claims inflation and nuclear verdicts. While the power liability market has been a profitable line of business for most of the domestic liability carriers, continued rating pressure exists due to underlying casualty challenges.

However, ample capacity due to the low frequency and severity of claims in the sector is continuing to stabilize pricing. Any power-related accounts with transmission or distribution electrical line exposure are being underwritten in a different manner, with wildfire exclusions becoming more prevalent and actual wildfire liability capacity being reduced year-over-year.

Power liability market trends to watch in 2025

Growing appetite for greener portfolios

But evolving technologies carry inherent risks

Underwriters continue to place emphasis on insureds' environmental, social and governance (ESG) credentials in view of sustained commercial pressures and commitments. While greener technologies are welcomed by underwriters as a means of diversifying underwriting portfolios, insurers are cognizant of the new exposures that these technologies pose

Photovoltaic panels and battery storage sites have proven themselves to be susceptible to fire risks while the complex contractual arrangements underpinning renewable power projects can also present increased liability exposures. In addition, offshore wind and interconnector assets can require access to the marine liability market which creates additional layers of complexity — and on occasion, cost — to placements.

Increased prevalence of wildfire and flooding are keeping climate change a focus for underwriters

And power companies need to look intrinsically and externally at risk

While the U.S. and Australia have historically presented the most significant wildfire exposures, recent events in Europe and Canada have broadened underwriters' geographical focus in this domain. Articulating measures taken to address wildfire risk — such as managing vegetation around the asset(s) and casing or burying power lines — can be key to negotiating cover, as will the ability to articulate contractual arrangements with any third parties responsible for maintenance.

Underwriters are also paying greater attention to the potential link between changing climatic conditions and the risk of dam overtopping. There is a growing expectation for insureds to provide information on monitoring and mitigation measures in place to ensure compliance with regulatory standards and prevent the increased prevalence of dam failure caused by the impacts of climate change.

Understanding the technical aspects of the power industry points to the value a sector-focused broker will bring to the table. A specialist broker can highlight counter arguments to any perceived increase in risk, for example, where rising temperatures can in fact reduce the risk of flooding as less ice is formed upstream which reduces the risk of severe flooding caused by the rapid melting of ice. The role of a broking partner will be increasingly critical in helping buyers better quantify and mitigate perils that could adversely affect the liability risk.

The market position on coal is not black and white

Power companies still need to demonstrate a compelling energy transition plan

While property damage and business interruption lines are seeing a tentative return of coal-related risks to the market, corporate positioning on ESG issues is meaning that the only sources of additional capacity for coal in the international liability market is coming from new entrants. Although incumbent insurers continue to offer (albeit limited) capacity for coal-exposed risks, nonincumbent insurers have more limited appetite. The key to securing capacity is evidencing a robust energy transition plan with certain insurers having greater flexibility in the application of their ESG guidelines where this can be provided.

Greater consistency in the application of PFAS clauses

Making it more widely excluded

The incorporation of per- and polyfluoroalkyl substances (PFAS) exclusions into reinsurance treaties, and subsequently some market standard wordings, has led to a more widespread and consistent application of PFAS exclusions within policy wordings. In certain cases, partial writebacks can be negotiated back into cover however this is very much subject to additional requirements.

For power companies, assessing and addressing PFAS issues — particularly in firefighting foams — will be an area of focus. Ironically, the efficacy of PFAS replacements in firefighting equipment and materials could lead to a greater fire and therefore third-party liability exposure, particularly in the case of battery storage fires (where PFAS firefighting foams are considered to be effective). The ability to remove PFAS from lubricants entirely can also be a challenge.

Take action: where power companies need to focus for the year ahead

Get ahead of the curve: early engagement with your broker remains key, as allowing sufficient time to engage with underwriters is critical to unlocking optimal capacity. This could be through roadshows facilitated by your broker to support the development of key strategic relationships and promote effective engagement with the market.

Provide a robust and data-led underwriting submission to help markets understand your risks. Gathering data, partnering with experts and engineers to answer any technical questions, and aligning the narrative with brokers will put buyers in a stronger position when negotiating with insurers.

Consider reassessing program structures to capitalize on evolving market conditions. In a softer market, some carriers may be willing to challenge their own technical rates in order toto win and/or retain business, however, relationships with longstanding incumbents should be carefully considered. While new capacity might be cheaper in the short-term, taking a strategic view to risk and aligning with long-term insurer partners is key to optimizing insurance program terms and conditions, and ultimately building resilience within your business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.