The U.K. government is proposing to reintroduce preferential status to certain taxes in U.K. insolvencies beginning 6 April 2020. If enacted:

- certain taxes owed to HM Revenue & Customs (HMRC) would rank ahead of floating charges in U.K. insolvencies;

- the legislation would be retroactive, applying to such tax liabilities incurred at any time prior to insolvency; and

- it is likely to have a significant impact on asset-based loans (ABLs) involving U.K. obligors.

Introduction

In the U.K.'s Autumn Budget of 2018, the chancellor announced a proposal (the Proposal) to grant preferential status to certain taxes in U.K. insolvencies (commonly known as "Crown Preference"). This has provoked outcry from finance and insolvency professionals alike, with R3, the trade association for the U.K.'s insolvency and restructuring professionals, openly criticising the Proposal.1

This briefing note provides an overview of what the Proposal entails and, in particular, the potential impact that it may have on ABLs.

What Is Crown Preference?

The Proposal, which, if followed through, will be introduced in the Finance Bill 2020, seeks to promote certain HMRC2 taxes to the rank of "secondary preferential creditor" in the U.K. insolvency waterfall, for insolvencies beginning on or after 6 April 2020 (the Effective Date). Specifically, this would mean that VAT, PAYE ("pay as you earn" income tax paid by employees, including student loan repayments, which are deducted at source by employers), employee National Insurance Contributions (NICs) and Construction Industry Scheme Deductions (CISDs) (collectively, the Relevant Taxes) would rank ahead of creditors with floating charge security and unsecured creditors. The status of income tax, capital gains tax, corporation tax and employer NICs would remain unchanged.

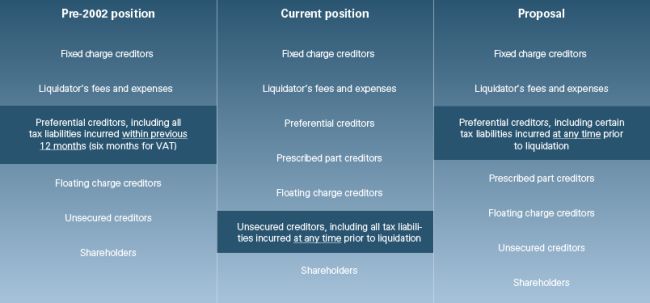

In some ways, this reverses the abolition of Crown Preference that was effected by the Enterprise Act 2002, which constituted a major overhaul of the English insolvency framework at that time.3 However, there are a number of ways in which there introduction of the Crown Preference regime would be different. First, Crown Preference only applied to taxes that had been incurred in the 12 months (six months for VAT) before the onset of insolvency. Notably, the Proposal does not include any time limit, meaning that although Crown Preference is only intended to apply to insolvencies that begin on or after 6 April 2020, tax liabilities that were incurred at any time before that date will be captured. Secondly, before 2002, all forms of tax, not just the Relevant Taxes, benefitted from Crown Preference. Thirdly, the "prescribed part"4 did not feature in the insolvency waterfall before the Enterprise Act 2002 came into effect, meaning that floating charge holders ranked just behind preferential creditors.

Figure 1 provides a graphic summary of the effect of Crown Preference on the position of tax liabilities in the distribution waterfall in a typical liquidation carried out under English law. The courts of England have a broad jurisdiction to order the winding up of companies registered in England and Wales, as well as overseas companies,5 pursuant to Parts IV and V of the Insolvency Act 1986.6

Figure 1: Distribution Waterfall

Impact of the Proposal on ABL Financings

It is important to emphasise that the Proposal, if enacted, will be retroactive in its effect. Although the Proposal will apply only to insolvencies occurring after the Effective Date, Crown Preference would apply to Relevant Taxes incurred at any time in the obligor's tax history.

Certain types of assets, such as plant and machinery and real estate, are typically secured by way of a fixed charge. Some lenders also require a fixed charge over trade receivables, often requiring the obligor to ensure customer invoices are paid into blocked accounts (so as to exercise sufficient control such that the charge is a fixed, and not a floating, charge).7 On the other hand, an obligor's inventory, which can include both raw materials and finished goods, is typically only subject to a floating charge. This is because it is impractical for an obligor to seek consent every time it wishes to sell inventory, as would typically be required if the inventory was subject to a fixed charge. For similar reasons some lenders only seek a floating charge over trade receivables.

Critically, the priority of distribution in relation to assets subject to a fixed charge is unaffected by the Proposal. However, were the Proposal to become law, any asset subject to a floating charge would rank behind HMRC in the U.K. insolvency waterfall in relation to the Relevant Taxes.8

Possible Impacts of the Proposal on the ABL Market

Lenders' tax due diligence, including during periodic field examinations and appraisals, may become more onerous and expensive. Lenders may also want to ensure that the obligors are complying with their tax obligations on an ongoing basis (so as to limit the amount that HMRC may be entitled to in an insolvency scenario). This may be reflected in more restrictive covenants, undertakings, and representations and warranties in ABL credit agreements.

As discussed above, fixed charges will be unaffected by the Proposal, providing lenders with security that would rank above HMRC in the insolvency waterfall. Lenders may therefore insist on fixed charges over a greater number of assets.

Whilst the status and impact of the Proposal remain uncertain, lenders may wish to mitigate the higher level of risk associated with Crown Preference ranking senior in priority to floating charges and unsecured creditors by expressly including an additional reserve category or expanding priority payables or other categories of reserves to address Crown Preference, and by including provisions that would allow such reserves to go into effect on the Effective Date and to cover all such tax liabilities incurred prior to, on or after such date. In addition, ABL lenders also may address such risk by increasing the price of borrowings against assets of U.K. companies, restricting access to obligors with favourable assets and credit history, or by purchasing insurance to cover their additional exposure. Associated costs would likely be passed on to borrowers.

ABL agents and lenders also should consider whether existing ABL credit agreements include sufficient flexibility to impose additional reserves, whether priority payable reserves or otherwise, or adjustments to net orderly liquidation value (NOLV) calculations in the inventory appraisals, in order to address the impact of the Proposal, without amending existing ABL credit agreements.

Finally, lenders who are concerned that an existing obligor is in financial difficulties may be more inclined to enforce in advance of the Effective Date. HMRC will continue to rank behind floating charge creditors in any insolvency commenced prior to the Effective Date.

Status of Proposal

Despite the concerns raised in this note regarding the impact that may be felt by ABL providers as a result of the imposition of Crown Preference, it is important to note that the Proposal is not yet law and may never become law. Following the closing date for comments (which occurred on 27 May 2019), the government's consultation document9 indicates that it will publish a summary of the responses along with draft legislation in the summer of 2019.

Associates Riccardo Alonzi and Alexander Halms assisted with the preparation of this client alert.

Footnotes

1 https://www.r3.org.uk/index.cfm?page=1949&element=32814&refpage=1865.

2 HMRC is the non-ministerial department of the U.K. government responsible for, among other things, the collection of taxes.

3 For further information, please see " The White Paper: Insolvency — A Second Chance (2001)"

4 As part of the 2002 insolvency reforms, and essentially as a quid pro quo for the abolition of the Crown Preference, it was decided that a certain portion of net floating charge realisations should be ring-fenced in favour of unsecured creditors (partly in order to reduce the windfall for floating charge holders upon the abolition of Crown Preference). The "prescribed part" is currently 50 percent of the first £10,000 of net realisations from assets subject to a floating charge, plus 20 percent of any such further realisations, subject to a maximum of £600,000. While some may have expected a revival of Crown Preference to coincide with the abolition of the "prescribed part", the reverse may be true: In August 2018, the U.K. government announced plans to potentially increase the maximum size from £600,000 to £800,000 to reflect inflation.

5 For overseas companies, the court will only exercise its jurisdiction if: (a) there is a sufficient connection with England and Wales; (b) there is a reasonable possibility, if a winding-up order is made, of benefit to those applying for the order; and (c) one or more persons interested in the distribution of assets of the company is a person over whom the court can exercise a jurisdiction. For the time being, the English courts also are subject to forum restrictions under EU law.

6 The Proposal only refers to HMRC taxes and does not address the issue of how foreign tax claims will be dealt with. There is no basis to assume that foreign taxes would be affected.

7 The principles relating to "sufficient control" in the context of fixed vs. floating charges were laid out by the House of Lords in National Westminster Bank plc v Spectrum Plus Limited and Others ([2005 UKHL 41]).

8 Some ABL documents contain "crystallization clauses", which purport to convert the lender's floating charge into a fixed charge in an insolvency scenario (or on notice from the lender). However, in the context of the Proposal, crystallization clauses are a red herring. Section 251 of the U.K.'s Insolvency Act 1986 defines a floating charge as "[...] a charge which, as created, was a floating charge [...]". Regardless of whether crystallization takes effect automatically, or by notice from the lender, there will be no impact on the status of the security for the purposes of distribution on insolvency. This is true even where the crystallization event occurred before the onset of insolvency.

9 See " Protecting Your Taxes in Insolvency.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.