- within Food, Drugs, Healthcare, Life Sciences, Litigation and Mediation & Arbitration topic(s)

01 General Overview

The rules and procedures regarding tender offers for public companies in Turkey are set forth in the Capital Markets Board's ("CMB") Communiqué on Tender Offers numbered II-26.1 ("Communiqué").

There are two types of tender offers available under the Communiqué:

02 Mandatory Tender Offer

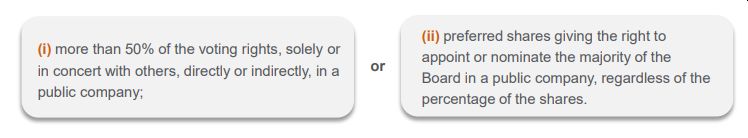

Shareholders who acquire shares or voting rights that enable them to obtain, directly or indirectly, management control of a public company, solely or in concert with others through a voluntary tender offer or through block, or individual acquisitions, are required to make a tender offer to the other shareholders at the time of the share acquisition. This type of tender offer is defined as a mandatory tender offer in the Communiqué. Therefore, an obligation to make a tender offer arises when acquiring shares that ensure management control in a public company. Management control is defined under the Communiqué as either having:

03 When is a mandatory tender offer requirement not triggered?

There are certain circumstances where a mandatory tender offer requirement is not triggered under the Communiqué. These circumstances are listed in detail under the Communiqué; below are a few examples:

- Obtaining management control as a result of making a voluntary tender offer to all of the other shareholders.

- Obtaining management control by making private agreements without share acquisition and giving the other shareholders who cast a negative vote at the General Meeting and register such vote in the Meeting minutes the right to sell out.

- Triggering of the right to squeeze out and sell out upon the share acquisition.

In the occurrence of one of the circumstances where a mandatory tender offer is not triggered, the shareholders who obtain management control must make a public disclosure of such circumstance by indicating the reason why a mandatory tender is not triggered within at least two (2) business days from the date management control is obtained.

04 Application for exemption

There are also circumstances where a shareholder can apply to the CMB to request an exemption from the mandatory tender offer requirement. Below are a few examples of such circumstances, which are listed in detail under the Communiqué.

- Acquiring the shares or the voting rights in order to strengthen the financial structure of a public company that is in financial distress.

- Transferring the shares in order to comply with regulatory requirements that determine the qualification to become a shareholder.

- Change of the management control in a public company due to inheritance or allocation of matrimonial property or other legal requirements.

In order to request an exemption, shareholders who are obliged to make a tender offer must make an application to the CMB within six business days as of the triggering date of the mandatory tender offer.

05 Who may benefit from the mandatory tender offer?

Those who are shareholders in the company at the date of the public disclosure regarding the acquisition of the shares or voting rights that provide management control in the company or at the date of the public disclosure regarding the private agreement made between shareholders in order to obtain management control in the company will be able to benefit from a mandatory tender offer.

Mandatory tender offer process

An application must be made to the CMB together with the information and documents set forth in the Communiqué within six business days as of the acquisition of the management control. The actual mandatory tender offer process must be initiated within two months as of the triggering of the obligation to make a mandatory tender offer. The process must be initiated within six business days as of the approval of the tender offer form by the CMB, and the duration must be 10–20 business days.

Mandatory tender offer price

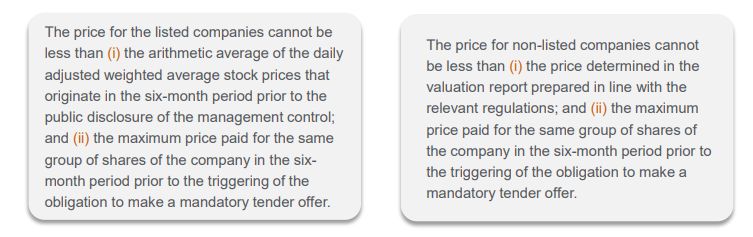

The mandatory tender offer price, which will be determined in the case of a direct change in the management control of a company, is regulated in the Communiqué separately for the shares or share groups of listed and non-listed companies. Accordingly:

The mandatory tender offer price must be paid in cash and in Turkish Lira. If the price is determined in a foreign currency, the calculation must be made based on the buying rate of the Central Bank of the Republic of Turkey. The price to be paid in the tender offer may also be determined as a security with the approval of the shareholder. The security must be listed in the stock exchange.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.