Mining rights (i.e. exploration and operation licenses) cannot be divided into smaller shares and transferred to third parties since there is an accepted public interest in the rational and economic operation of license fields in their entirety. However, the players in the mining sector require funding and the prohibition of division of mining rights creates an important obstacle. Therefore, the sector players utilize royalty agreements as funding tools, whereby a license holder transfers its operating right to a third party in return for a royalty payment. In practice, royalty agreements are not the only tools for funding and other arrangements such as mining right transfers and pledge agreements are also utilized. However, it is safe to say that royalty agreements are used on a more frequent basis.

What is the legal nature of royalty agreements?

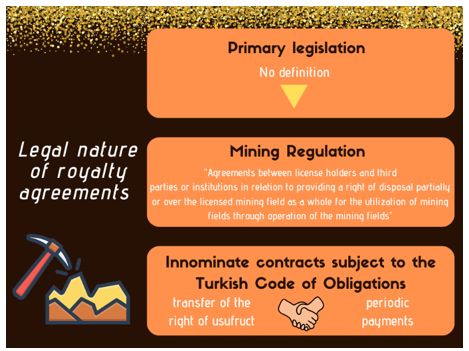

Royalty agreements are not explicitly defined or specified under any primary legislation (i.e. the Mining Act or the Turkish Code of Obligations). However, as secondary legislation, the Mining Regulation defines royalty agreements as "Agreements between license holders and third parties or institutions in relation to providing a right of disposal partially or over the licensed mining field as a whole for the utilization of mining fields through operation of the mining fields". Having said that, the mining legislation does not provide any insight on the general terms of royalty agreements.

Considering this,

these agreements are regarded as innominate contracts that are

subject to the general terms of the Turkish Code of Obligations. In

essence, one party (i.e. the license holder) transfers its right of

usufruct to a third party in relation to its operating permit and

receives periodic payments from the other party. Considering this,

the royalty arrangement is very similar to usufructuary lease

agreements recognized under the Turkish Code of Obligations. In

practice, the established case law of the high courts also supports

the view that royalty agreements should be read as usufructuary

lease agreements1. Hence, the primary and secondary

obligation of parties to a royalty agreement are defined within the

framework governing usufructuary lease agreements.

Considering this,

these agreements are regarded as innominate contracts that are

subject to the general terms of the Turkish Code of Obligations. In

essence, one party (i.e. the license holder) transfers its right of

usufruct to a third party in relation to its operating permit and

receives periodic payments from the other party. Considering this,

the royalty arrangement is very similar to usufructuary lease

agreements recognized under the Turkish Code of Obligations. In

practice, the established case law of the high courts also supports

the view that royalty agreements should be read as usufructuary

lease agreements1. Hence, the primary and secondary

obligation of parties to a royalty agreement are defined within the

framework governing usufructuary lease agreements.

It is also argued that royalty agreements, as defined above, cannot be considered as permanent transfer agreements since the parties' intention is to grant the right to usufruct to the third party for a temporary period of time, regardless of whether the royalty agreement is executed for a definite or indefinite term2.

Are royalty agreements subject to any form or registration requirements?

There are several requirements which the parties are required to fulfil in order to execute a valid royalty agreement. Examples of obligations of the parties include:

- Being fully competent to engage in mining activities (i.e. being a Turkish citizen or a Turkish entity authorized to engage in mining activities3).

- Having adequate financial capability. The level of financial capability required is subject to change depending on the mineral groups.

- Not executing a royalty agreement in relation to an underground mining facility unless the parties are public institutions or their subsidiaries.

As for the form requirement, neither the Mining Regulation nor the Turkish Code of Obligations require a specific form to be followed for royalty agreements (or usufructuary lease agreements). However, some argue that most mining fields are considered to be commercial enterprises and therefore royalty agreements must be executed in writing4. The parties may choose to execute the agreement in plain writing or conduct the required processes at the notary. Please note that execution of the royalty agreement before the notary will result in additional fees.

Royalty agreements are subject to the permission of the Ministry of Energy and Natural Resources ("MENR"). In case parties to the royalty agreement fail to obtain such permission and yet enter into a royalty agreement, their mining activities shall be terminated and administrative fines shall be imposed. Such agreements would also be deemed null and void. Additionally, the royalty agreements as well as any assignment or amendments to such agreements must be provided to General Directorate of Mining and Petroleum Affairs ("MAPEG") and recorded in the Mine Registry for information purposes. Please note that this disclosure obligation does not require MAPEG to become a party to the agreement; in fact under no circumstances should MAPEG be considered as a party to a royalty agreement. Such examination power granted to MAPEG is basically to investigate whether the third party, to whom the rights arising from the operating permit will be assigned, possesses the requirements stipulated by the legislation to engage in mining activities.

Once MAPEG reviews the submitted royalty agreement, the agreement is registered to the mine registry. Although the case law in relation to the effect of the registration is not fully established, we understand that the recent tendency of the high courts is to accept that the royalty agreement would become binding on third parties following its registration since it becomes publicly available information5. Therefore, should a license be transferred to another party, the new license holder would also be bound by the existing royalty agreement.

What are the rights and obligations attached to royalty agreements?

Rights and

obligations attached to royalty agreements arise from the general

rules governing usufructuary lease agreements as well as the mining

legislation. Parties to a royalty agreement can be stated as the

license holder and the lessee and each party is granted a separate

set of rights and also bound by a separate set of obligations.

Rights and

obligations attached to royalty agreements arise from the general

rules governing usufructuary lease agreements as well as the mining

legislation. Parties to a royalty agreement can be stated as the

license holder and the lessee and each party is granted a separate

set of rights and also bound by a separate set of obligations.

Needless to say, royalty agreements also carry primary and secondary rights and obligations assigned to its parties. In this regard, procurement of the relevant mining field in a manner that allows for proper operation and payment of the royalty fee are the primary obligations of the parties that constitute the essence of the agreement. Although the primary obligation of the license holder is rather straightforward, the royalty fee payment schedule may vary in practice. A royalty fee is a payment made to license holders in return for the transfer of the operation rights of a mine.

Accordingly, the calculation of this royalty fee may vary. For instance, parties may agree on a one-time advance payment for the transfer of operation rights of a mine. Examples of more common practices include periodic payments that are dependent on the production from the mining field. In case the royalty fee is calculated based on production, the payment may be determined based on each unit of production and paid at an increasing, decreasing or fixed percentage. As a general practice, parties also include a specific payment clause, protecting the license holder in cases where the production level realized in the contract period falls short of the commitment made by the lessee. In short, royalty fee arrangements may vary based on the needs of the parties and the status of the mining field subject to the agreement.

Intrinsically, the license holder, as the primary right holder, has the following rights:

- Right to request the proper management and operation of the leased mining field.

- Right to request the performance of any and all obligations of the lessee as stipulated under the contract (i.e. regular payment of the royalty fee).

- To exercise its right to lien in order to secure the non-fulfilled payment obligation of the lessee.

However, in order to claim such performance, the license holder is obliged to deliver the relevant licensed mining field to the lessee in a manner that allows for the proper operation of the field (i.e. providing adequate and operational mining equipment). On a separate note, although the field would be operated by the lessee, the license holder will still be liable before the administrative authorities for obligations arising from its title, such as the reporting and payment requirements as stipulated under the mining legislation.

On the other hand, the lessee may request the proper performance of the license holder's obligations to be able to engage in mining activities in the leased field without any legal or de facto prohibition. In return, the primary obligation of the lessee is to engage in the production of ores in the leased mining field and consequently make the royalty payments to the license holder as stipulated under the contract. Such payment may be determined at a fixed monetary rate or calculated based on the extracted ores. In practice, it is observed that parties either request a fixed fee per each ton of production or a portion of the sales value of the produced ores. If the royalty payments are not determined in the royalty agreement, the contract is deemed to be null and void. Moreover, the lessee is also responsible for operating the mining field in a proper manner with due care and taking the relevant precautionary measures. There are also other requirements such as abiding by the occupational health and safety rules arising from the employer status of the lessee.

How do royalty agreements come to an end?

There are no special set of rules governing the termination of royalty agreements, therefore the general rules governing usufructuary lease agreements would be applicable[6]. Since these rules do not introduce a new or special case in relation to the royalty agreements, this issue will not be dealt with in detail. However, possible causes for the termination of royalty agreements may be listed as follows:

- Breach of agreement.

- Expiry of the term of agreement.

- Release of parties from their obligations.

- Merger of the license holder and the lessee into a single entity.

- Termination of agreement.

Please note that if the royalty agreements do not possess valid conditions (i.e. parties not having the capacity to engage in mining activities, absence of a MENR permit etc.), the agreement will be considered null and void and therefore, non-existent. Considering this, the conditions set out above would not be applicable under such a scenario since the agreement has never been in effect.

Other agreements in the mining industry

Pledge agreements

Pledge of ores

The Mining Law and Mining Regulation allow exploration and operation license holders to pledge the ores extracted from the mine. License holders wishing to pledge the ores extracted must file a written request before MAPEG and the date, duration and degree of the pledge must be recorded in the Mine Registry. Pledged ores may not be sold for the duration of the pledge without the written consent of the pledgee. The scope of such pledge agreements is limited to the produced ores only and does not cover the mining licenses.

Pledge of mining licenses

It is also possible to put mining licenses on pledge. Pledging the mining licenses is explicitly regulated under the Mining Act. However, this opportunity is only provided to operation license holders, therefore exploration license holders may not benefit from such a funding opportunity. Please note that the subject of the pledge is restricted to the present or future indebtedness borne by the operation license holder in relation to the mining field itself7. A mining pledge may not be established for any other purposes. Important points to note in relation to pledge of mining licenses include:

- The pledge covers the pre-operating and operating licenses as well as the enterprise and its machinery and equipment as a whole.

- The term of the pledge may not exceed the term of the operation license subject to pledge.

- As per the general rule governing mining rights, such a pledge may only come into effect after it is registered in the Mine Registry.

- If the pledge becomes due, the pledge holder has the right to request the sale of the pledged license.

Transfer of mining rights

Even though royalty agreements are used as a means for transferring certain mining rights (i.e. operating permits) to third parties, a royalty agreement and a transfer of mining rights agreement are essentially different arrangements. Parties conducting a transfer agreement intend to assign the mining rights to the transferee permanently and as a whole. Therefore, this agreement also contains the transfer of the licenses to the transferee and results in the change of the primary right holder.

Despite their differences, royalty agreements and transfer agreements also carry similarities. Generally, the transferor that is transferring its mining rights requests a payment from the transferee that resembles the royalty fee in royalty agreements. This payment is called a net smelter royalty and in order for the transferee to make such a payment, active production (operation of the transferred mining field) is a general requirement. Net smelter royalty resembles the royalty fee structure, where one party receives payments based on the transfer of operation rights of a mine, however it covers a more general scope since the transfer agreements govern the transfer of mining rights in their entirety.

Transfer of mining rights is subject to the permit from the MENR. Until such a permit is obtained, the agreement would not be in effect and would actually be considered as a suspended agreement pending approval8. In case MENR rejects granting a permit, then the agreement will become null and void in its entirety.

Mining rights become publicly available information and binding on third parties upon their registration in the Mine Registry. Considering this, a transfer of mining agreement would have no effect on third parties unless duly registered in the Mine Registry.

Footnotes

1 Olgun, Emre, Rödövans Sözleşmesi, 2019; Court of Cassation 14th Chamber Decision dated 20.02.2007 and numbered E.2007/111, K.2007/1552.

2 Topaloğlu, M. Rödovans Sözleşmelerinin Şekli ve Tescili, 2015; Court of Cassation 14th Chamber Decision dated 13.02.2007 and numbered E.2006/15092, K.2007/1210.

3 Please note that as per Turkish legislation, the regulation applicable for the establishment of a Turkish entity with local and/or capital is the same. In this regard, a Turkish entity may easily be established by foreign shareholders with no additional obligations and/or requirements.

4 Topaloğlu, M. Rödovans Sözleşmelerinin Şekli ve Tescili, 2015.

5 Topaloğlu, M. Rödovans Sözleşmelerinin Şekli ve Tescili, 2015; Council of State 8th Chamber Decision dated 02.12.2014 and numbered E.2014/6656, K.2014/9520

6 Uyumaz, A. and Güngor, F. Rödövans Sözleşmesi, 2015.

7 Özdamar, D. Maden Hakkının Verilmesi ile Bu Hakkın Devri, 2001; Topaloğlu, M. Maden İpotekleri, 2010.

8 Erdoğan, K. Maden Hakkını Devir ile Rödövans Sözleşmesi Arasındaki Ayrım, 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.