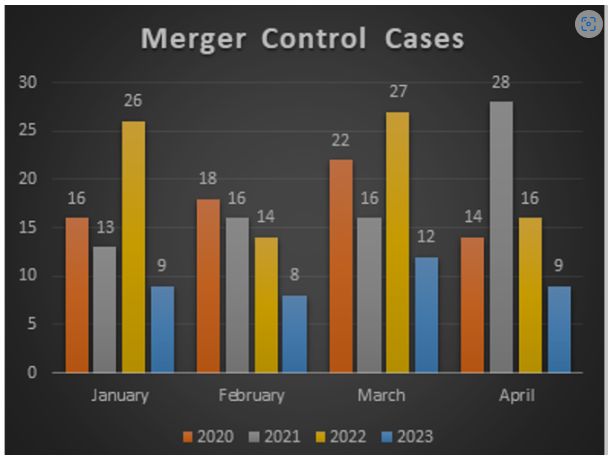

In April 2023, the Turkish Competition Board (the "Board") published 58 reasoned decisions and decided on nine merger and acquisition transactions.

The highlight of Turkish competition law in April was that the Board demonstrated its focus on digital industries by publishing two analyses pertaining to online advertising and digitalisation, as well as launching one sector enquiry regarding mobile ecosystems.

The Authority publishes its preliminary report on online advertising industry

On 7 April, Turkey's Competition Authority (the "Authority) published its preliminary sector enquiry report regarding the online advertising industry. As per the preliminary report, the Authority's findings within the scope of the sector enquiry are as follows:

- The display advertising services market and search-based advertising market demonstrate a concentrated structure given Meta's and Google's market power.

- Google holds a high market share in terms of each service that it offers in the advertising technology supply chain (i.e., the tools concerning the attribution, measurement and verification of advertisements such as servers for advertisers and publishers, DoubleClick for Advertisers and DoubleClick for Publishers).

- Operating through fully integrated ecosystems provides a significant advantage to undertakings. In this vein, the use of data collected by undertakings provides significant benefits in the advertising services, both for advertisers and consumers.

- The data collected raises privacy concerns for consumers. In this respect, it is important to establish an optimal balance between the benefits and harms of targeted advertising.

- Practices involving self-preferencing and data aggregation directly impact the competitive level in the online advertising industry. Additionally, transparency is one of the major concerns for the advertising technology supply chain. In this context, the Authority evaluates that there is a significant information asymmetry to the detriment of advertisers and publishers.

- The Authority also indicates that digital platforms are an essential partner for news publishing websites. In this context, the Authority considers that the absolute acceptance of the conditions offered by the platforms is also among the competition law concerns regarding digital platforms.

For more detailed information on the preliminary sector enquiry report, please refer to our analysis here.

Eyes on the digital industries!

As per the announcement dated 12 April, the Authority instigated a sector enquiry regarding mobile ecosystems. Accordingly, the Authority indicates that certain competition law risks may arise due to the close link that each component of mobile ecosystems (e.g., operating systems, applications, application stores, etc.) has with each other. The Board in particular reiterates that undertakings with a certain market power due to network effects and data advantage increase competition law concerns by operating simultaneously in many of the downstream markets.

In addition to the sector enquiry on mobile ecosystems, the Authority announced its work regarding the effects of digitalisation on aspects of competition law (i.e., Reflections of Digital Transformation on Competition Law). The mentioned work covers a broad range of areas within digital services, such as search engines, social media networks, video sharing services, cloud services and services of online advertising. In this respect, the Authority reflects on the various competition law concerns (e.g., self-preferencing, possible obstacles for market entry, data privacy, tying practices, etc.) for each of the digital services as well as mentions the structure of the market on each service basis. The Authority also emphasises the need for secondary legislation for fundamental regulations concerning digitalisation.

For our article regarding the Authority's sector enquiry on mobile ecosystems, please refer here.

Turkey has a different view than the EU on online sales restrictions

As per its decision published on 12 April, the Board analysed the commitments offered by the household appliances distributor, BSH. The decision involves the Board's assessments regarding the restrictions on reseller sales via online portals and brick-and-mortar stores.

Most notably, the Board inspected each of the criteria to be applied to the online sales of resellers in its decisions and approved:

- the provisions directed at the same purposes as the criteria applied to the resellers' sales through brick-and-mortar stores. These provisions may be exemplified as (i) applying exclusivity provisions to online sales, (ii) the exact application of BSH's campaign types to the sales via platforms, (iii) offering the same delivery types applied in physical stores to online stores, (iv) using the marks indicating the authorisation of an authorised reseller, and (v) using images supplied only by BSH.

- the provision that stipulates that resellers within a selective distribution system may only operate on the platforms that apply objective criteria such as ranking and customer scores to resellers.

- the provision that aims to prevent authorised sellers from selling to unauthorised sellers through online platforms.

- the provisions (e.g., the obligation to respond any customer enquiries within two days) that aim to protect the brand image and quality of the distribution system.

- the provision that demands resellers to provide accessible data obtained from platforms to BSH, as this provision aims to protect BSH's brand image, to protect the provisions imposed for sales via brick-and-mortar stores and to measure the efficiency of the distribution network.

- the provisions aiming to preserve the selective distribution system on online platforms.

- the provisions that improve the consumer's purchasing experience and/or protect the consumer are considered as reasonable. Examples of such provisions include (i) demanding resellers to offer the relevant channels for consumers to ask questions, (ii) not disclosing the prices of products that are not in stock and not offering them for sale, (iii) not cancelling orders due to lack of stock, and (iv) allowing the consumer to follow the stages of delivery.

- Furthermore, the Board, concluded that it is in line with the nature of the selective distribution systems for BSH to demand resellers that wish to sell on online platforms to also operate a brick-and-mortar store.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.