In this second of a series of articles on tax and corporate governance we consider the formulation of an effective compliance framework and processes over the company's tax obligations.

The Code requires that compliance with laws, which includes tax laws, must form part of the overall risk management process and that the Board should ensure that the company implements an effective compliance framework and processes.

Tax risk management should not be seen in isolation but rather as part of the overall risk management of the entity. For the purpose of this series of articles we have limited our discussion to the tax issues.

The question is how should directors go about assessing tax risk management and formulating a tax compliance framework?

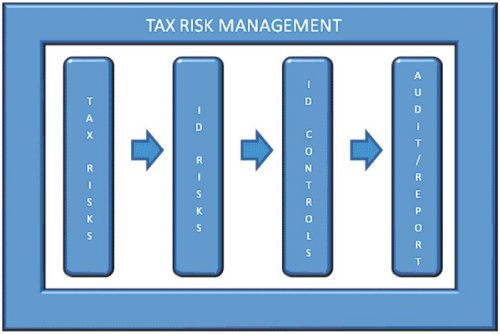

Broadly, the company needs to identify all taxes applicable to its operations, identify the risks associated with each tax, implement appropriate controls, audit these to ensure compliance and report to the board or the appropriate committee. As depicted in the following diagram:

In the rest of this article we focus on a suggested approach to the identification of risks and the establishment of appropriate controls.

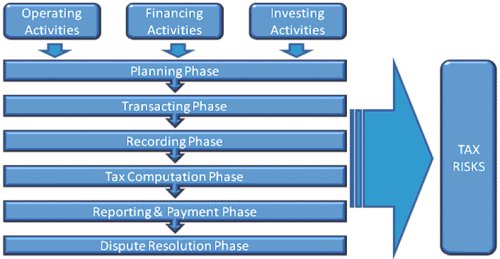

The framework suggested in this article should be seen as the 'bare-bones' of the entity's tax risk management framework. The framework adopted will depend on the nature and complexity of the company's activities. The overriding requirement is that it should be effective but should not be overly complex so that the procedures can be understood and implemented with minimum cost and disruption. The suggested process is depicted in the following diagrams, which are explained more fully below:

A suggested approach

The suggested approach is firstly to identify the various activities giving rise to tax consequences and to identify the phases in which the activities are processed.

Using this basic framework,then identify the major risks arising in each phase and the controls that could be implemented to minimise the identified risks. An effective way to identify the major risks is through a workshop conducted by internal or external tax specialists with those people in the organisation involved in the tax process.

We will first discuss the 'activities' depicted in the diagram followed by an explanation of the phases in the tax process with an example of the risks that arise in each phase.

The activities

Since most if not all of a company's financial activities will be subject to one or other piece of tax legislation, a useful starting point it is to consider the various types of financial activities as described in the company's cash flow statement used for financial reporting purposes, since these summarise the most important categories of activities. These are the operating activities, investing activities and financing activities. Operating activities entail the normal business activities, for example selling the product or service to customers, normally routine, repetitive transactions. Investing activities entail the purchase and sale of assets including any property, plant and equipment as well as businesses or shares. Financing activities include the issue of shares, loans,the payment of dividends etc.

The 'tax process'

The treatment of these activities in the 'tax process' should then be considered. The 'tax process' follows a number of phases from the planning phase to the dispute resolution phase. We have provided a brief description of what occurs in each phase including an example of a risk that may occur in each phase and a suggested control to demonstrate the process to be followed.

-The planning phase is as the name implies, where the transaction or transactions, are planned before entering into any legal relationships. This is arguably the most important phase from a tax planning perspective since the company can legally plan the transaction or transactions so as to attract the minimum amount of taxes, both in terms of direct and indirect taxes, and in terms of the timing thereof.

Example of risk and possible control

A company with an assessed loss decides to sell its business which will give rise to a capital gain. It sells the business on the first day of its year of assessment before earning any income. The assessed loss is not carried forward to the following year and the company cannot set the capital gain off against the assessed loss since the company needs to be trading and earning income from trade.

This is an example of a non-routine transaction forming part of the investing activities of the company. If the transaction was planned more carefully the business could have been sold before the end of the year of assessment.

To avoid the risks arising from these types of transactions, a policy should be in place that all non-routine transactions are only undertaken after sign off by a tax expert.

The transaction phase is where the planned transactions are actually entered into and the legal rights and obligations arise.

Example of risk and possible control

A company incurs expenditure on research and development.. The tax law changes to allow the taxpayer to claim a deduction equal to 150% of the expenditure incurred. The company is not aware of the change and fails to claim the enhanced deduction.

The tax laws change continually, which creates the risk that a taxpayer continues with a particular tax treatment.

A person or persons in the organisation should be tasked with keeping the relevant people in the company apprised of changes in tax laws. A useful way to achieve this is to form a tax committee (we will discuss this in more detail in a later article) which is attended by a tax expert that can make the committee aware of significant changes in tax laws.

In the recording phase, the transactions are recorded in the company's accounting records and supporting documentation is retained.

Example and possible control

A company that is a VAT vendor claims input tax in relation to certain expenses in the calculation of its VAT liability. Four years later SARS conducts a VAT audit and requests copies of a sample of invoices. The company has since moved premises and can no longer locate the invoices which are in storage. SARS disallows the input tax deduction and imposes penalties and interest.

A documentation retention policy should be in place to ensure this does not happen.

-In the tax computation phase the company calculates its tax liability based on the information contained in its accounting records.

Example and possible control

The financial manager calculates the tax liability incorrectly. A possible control would be a policy that requires that the tax computation be checked by a expert or performed by an expert.

-The reporting and payment phase entails the recognition and disclosure of the tax in the company's annual financial statements. The financial statements in turn are used to compile the tax return which is submitted to SARS. The company is also required to pay any taxes over to SARS when they become due.

Example and possible control

A company may underestimate its provisional tax resulting in penalties and interest. A process should be in place to ensure that provisional payments are reviewed by an internal or external tax expert.

-Finally, in the dispute resolution phase a dispute may arise between SARS and the taxpayer as to the correct tax treatment of an item in the return. This would begin with an objection to an assessment raised and end with the matter resolved between the parties or through a determination by a court.

Example and possible control

A company disagrees with an assessment and wishes to raise an objection; however, without adequate reasons, it submits the objection late. SARS disallows the objection and the assessment remains. A policy should be in place to ensure that responsibility is allocated to a particular person for the timeous submission of returns to and correspondence with correspondence with SARS.

Once the risk and control identification process is complete, there should be a good understanding of the risks and controls required to address these risks. It is recommended that the risks and controls be documented in a tax policy document. The policy document should be approved by the board so that each director has an understanding of the primary tax risks faced by the company and the framework that has been adopted to reduce these risks.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.