- with Inhouse Counsel

South Africa's Investment Ambitions Clash with Fiscal Reality

The South African government is walking a fiscal tightrope, attempting to fund critical investments in education, health, and infrastructure amid high debt costs, rising global trade tensions, sluggish economic growth both locally and abroad, and mounting pressure for expanded social protection spending.

Earlier this year, academic experts from the University of Johannesburg, speaking on an SNG Grant Thornton facilitated podcast titled Trade and Taxes, laid out a roadmap to stimulate long-term growth. Professors emphasised that strategic investment was urgently needed in three core areas:

- Education: A focus on early childhood development, improved access and outcomes in higher education, and a decisive shift to align curricula with future demands, including introducing AI and technology training from an early age. Improved investment on research and development to secure the future.

- Health: Tangible improvements in health outcomes through increased hospital bed capacity and better nurse-to-patient and doctor-to-patient ratios.

- Infrastructure: A significant ramp-up in infrastructure investment to bolster the economy's foundation.

The Finance Minister's initial budget appeared to heed this advice (with the exception of improved investment planned on R&D), making provisions for childhood development and infrastructure. However, the plan to fund these investments, a proposed increase in Value-Added Tax (VAT), sparked immediate backlash. Following intense pressure from civil' society, opposition parties, and a legal challenge, the government was forced to reverse the VAT hike.

Critically, the government did not scale back its planned expenditure. SARS committed to collecting additional revenue to curb the funding gap with additional savings expected in the future with the termination of the covid grant amongst other things.

SARS Misses Monthly Collection Targets, Threatening Funding Plan

In the interim, the governments funding strategy is partly predicated on the South African Revenue Service (SARS) generating more income without raising tax rates. SARS committed to collecting an additional R35 billion in 2025/26, on top of a R100 billion projection from the previous year, contingent on investment in its modernisation and debt collection capabilities.

However, newly released data from the National Treasury, which tracks collections monthly, reveals SARS has, on average over the six-month period, fallen short of their monthly targets.

Over the six months from April, revenue collection has missed its monthly goal by an average of R2.1 billion, with the target being exceeded only in the first month (April). This consistent underperformance raises doubts about achieving the full R35 billion required to balance the books.

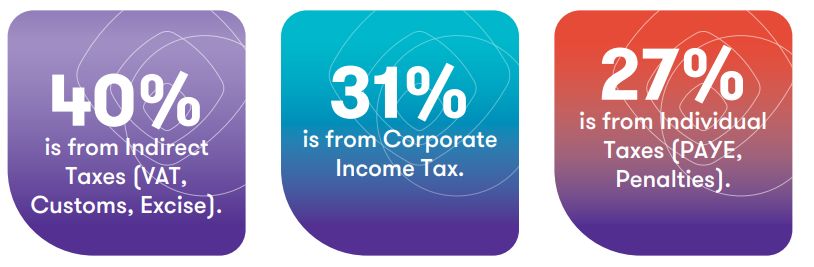

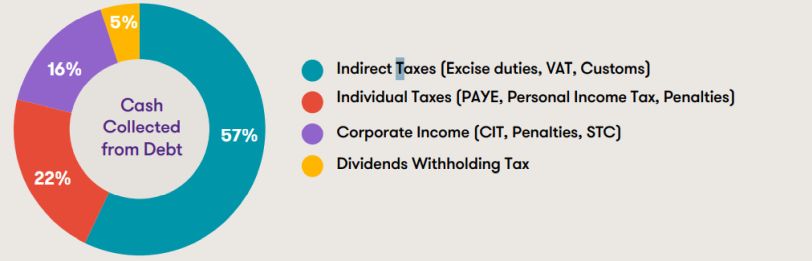

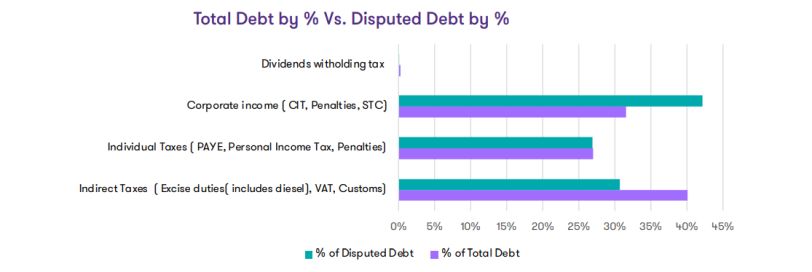

According to the National Treasury, a breakdown of debt owed to SARS (both disputed and non-disputed) reveals the following:

Indirect Taxes have a larger share of the debt and are also the most significant contributor to cash collected to date ( 57%). My Colleague, Sipho Mhaga (Customs and Excise specialist), shared some insights on possible key drivers for the high debt values under Excise and Customs. Sipho noted that under-declaration, delayed payments, regulatory complexity, and economic pressures — particularly in high-duty sectors like fuel, alcohol, and tobacco, may be driving the debt burden. Steep excise rates and a sluggish economy have strained these sectors, leading to delayed remittances. Misclassification of goods and delayed adaptation to changing rules further compound the problem.

Outlook

The combination of unplanned social spending and a widening shortfall to the target additional R38 billion in tax collection is creating a fiscal storm for the National Treasury.

With reprioritisation already exhausted as a tool to fund new investments (including the planned cancellation of the COVID Grant which was initially excluded from the 2025/26 budget). The COVID Grant will cost the government R34,9 billion in the current year and an additional R 300 million in administration costs. The ambitious investments in human capital and infrastructure, deemed essential by experts, are now under threat from a revenue base that is failing to keep pace with the state's spending commitments.

Some visuals:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.