- within Finance and Banking topic(s)

- in European Union

- within Environment and Strategy topic(s)

- in European Union

- with readers working within the Business & Consumer Services and Insurance industries

Executive summary

As financial services organizations contend with evolving risks and demands in a cost-pressured environment, companies with a competitive edge in the sector are those who can deploy digital transformation tactics to bring enterprise-wide value. But are financial services firms ready to unlock unprecedented growth through digital innovation? As the sector faces mounting pressures, the answer to this question could determine their future success. This report is intended for CEOs, CIOs, CTOs, and senior executives in the financial services sector who are looking to harness technology to help fuel operational efficiency and growth.

Persistently high inflation, geopolitical pressures, regulatory challenges, and slow global economic growth are combining to challenge businesses across financial services. Interest rate volatility is dampening consumer spend and asset performance, while compliance and operational costs are steadily increasing, forcing executives to revisit growth strategies. At the same time, organizations across financial services are coming under pressure both to generate value and to operate within tighter margins.

Technology is proving vital for performing in this environment. The KPMG 2024 CEO Outlook across asset management, banking and insurance confirms that CEOs in these industries are continuing to prioritize digitization to galvanize business models. Despite ongoing economic uncertainty, 87 percent of financial services executives in the Kingdom see generative AI as a top investment priority. Organizations are leaning on innovative platforms and systems to help them reduce costs, improve customer experiences, and build resilience.

Our research features insights from 612 technology executives from financial services, including 15 from Saudi Arabia, across asset management, banking and capital markets, insurance, private equity, and real estate. The findings of the research further highlight the potential of technology to bolster the sector.

"This report reveals that the financial services sector is most likely to generate profit from its AI investments. However, to stay ahead of the game, financial services companies should move beyond siloed, short-sighted tactics. This will likely involve adopting multiple advanced technologies, in addition to addressing legacy solutions, to ensure enterprise-wide compatibility. A simplified, modernized architecture that reduces complexity and transforms the end-to-end customer experience should be the goal".

Ovais Shahab

Partner, Head of Financial Services"

Key findings

Managing risk with innovation and artificial intelligence

The sector's inherent exposure to elevated risk and regulatory challenges has driven a need for innovation to manage these demands. As a result, financial services is the sector most likely to be generating profit from its cybersecurity, XaaS and AI investments. But while this has brought progress, the evolving risks and responsibilities continue to weigh heavily on tech decisionmakers in the sector.

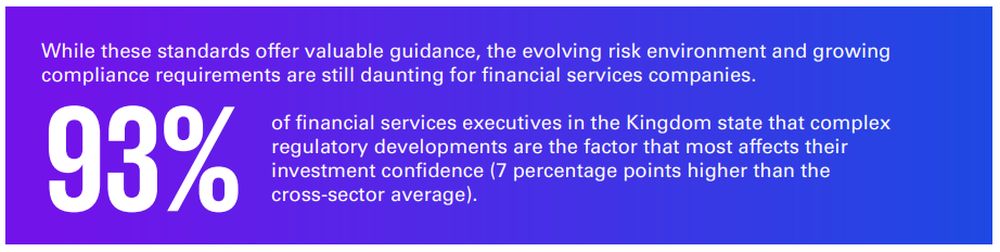

93% of financial services executives in Saudi Arabia state that complex regulatory developments are the factor most heavily denting their investment confidence.

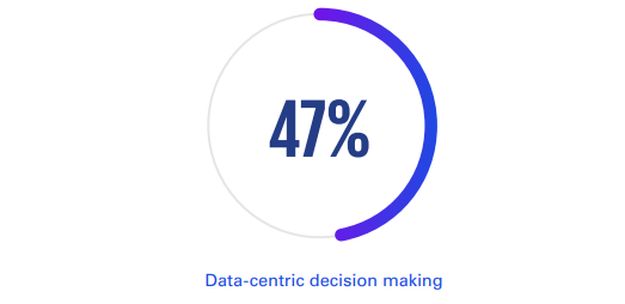

The survey finds that data-led decision-making, AI-enabled solutions and modernization of legacy platforms are at the center of the sector's coping strategies. Organizations in the financial services sector are most likely to be using data-centric decision making to adapt their digital transformation in response to evolving market risks. However, financial services executives in Saudi Arabia are most likely to use scenario forecasts and risk identification workshops. With the right data foundations in place, AI provides a means a accelerate the modernization of the control environment, predict change impacts and minimize drift.

To deliver on the promise of data and AI, companies must scale with purpose

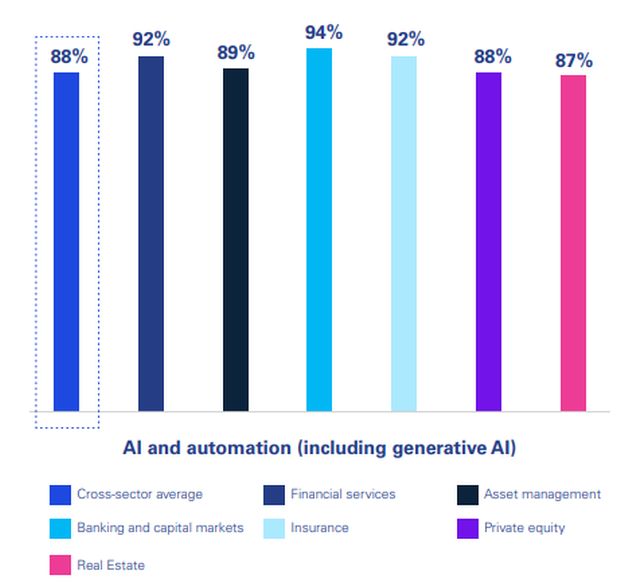

The rise of generative AI (Gen AI) is set to revolutionize financial services, enabling companies to automate complex tasks and enhance customer experiences in unprecedented ways. Financial services is the sector most likely to generate profit from its AI investments. But many organizations still encounter problems when trying to implement AI across the business in an integrated way.

100% of financial services companies in the Kingdom are generating profits from AI. However, only 20 percent are generating returns at scale.

Our research uncovers key actions that digital leaders are taking to help realize benefits at scale — taking an ecosystem approach with use cases drawing on multiple AI capability sets, pushing the envelope by seeking to radically change end-to-end value chains (compared with incremental improvements), and investing in digital and data foundations.

Simplification and modernization: Moving toward an adaptable, flexible architecture

Financial services companies are increasingly looking to modernize their systems to improve resilience and remove unnecessary complexity. These modernization efforts are essential to business continuity.

80% of executives in the Kingdom admit that flaws in their foundational enterprise IT systems disrupt business-as-usual on a weekly basis.

Across the sector, there has been an uptick in the implementation of cloud-based platforms that can help simplify digital infrastructures, with an impressive 86 percent of organizations in Saudi Arabia prioritizing investment in XaaS in 2024.

One of the core benefits of this simplification is cost reduction. Nearly one-third of respondents say that public cloud platforms or XaaS technologies have helped to reduce the cost of both technology debt and total cost of ownership (TCO).

Risk and regulation

In a mission to build consumer trust, organizations across financial services face strong headwinds. Geopolitical tensions are disrupting every sector, impacting supply chains and financial systems, limiting access to capital, pushing up the prices of goods and commodities, and, ultimately, impacting economic stability. Technological advancements and greater regulatory burdens are also creating new uncertainties, leading to a fragile reputational risk environment.

As fast as financial services companies are adapting, bad actors are weaponizing technologies with the aim of manipulating people, businesses and governments, and eroding trust. As a result, financial services companies are less confident in investing in new technology than a year ago, with the KPMG 2024 Banking CEO Outlook 1 revealing that only 43 percent of respondents are confident that their organizations' cyber security defenses can keep up with the challenges thrown up by advancements in AI. Technical debt that has built up through years of underinvestment in core systems is worsening the situation, with many financial services executives in Saudi Arabia (80 percent) in the KPMG Tech Report research saying that flaws in their foundational enterprise IT systems disrupt business-as-usual on a weekly basis.

To protect citizens and vulnerable members of the community, and ensure the continued functioning of capital markets, regulators are responding by expanding legislation, intensifying the legal burden on the financial services sector. Some of the most significant new pieces of legislation include the Cyber Resilience Act (CRA), the Digital Operational Resilience Act (DORA), and the EU AI Act.

However, inadequate and divergent approaches to the regulation of emerging technologies, in particular artificial intelligence (AI), is seen by many organizations as a barrier. This is evident in recent research by KPMG, which identifies that 70 percent of insurance CEOs believe that the lack of current AI regulation within the sector could become a barrier to the organization's success.2

Published in December 2023, ISO/IEC 42001 is the first international standard that provides a framework with which to manage AI. The standard addresses the unique challenges AI poses, such as the need for ethical considerations, transparency, and continuous learning. For financial services organizations, it sets out a structured way to manage risks and opportunities associated with AI, balancing innovation with governance. Importantly, implementation of the standard can help companies build trust with their stakeholders, providing an opportunity to differentiate.

From analyzing the tactics of digital leaders in this space, it is evident that many leading organizations navigate this complexity by developing digital transformation strategies that balance addressing immediate needs with planning for predicted future requirements. In terms of knowing how to strike the right balance and adjust it in response to evolving market trends and risks, data-centric decision-making is a crucial tool for high performing organizations. The KPMG 2024 Global Tech Report shows that, across sectors, in comparison with non-leaders, global leaders are 18 percentage points more likely to use data-centric decision-making to align their digital transformation strategies with evolving market trends and risks.

When it comes to data-informed decision-making, financial services is already making confident strides forward. Our research shows that, when responding to evolving risk and trends, global financial services companies are more likely than other sectors to take a dataled approach. In the Kingdom, financial services executives lean more towards using scenario forecasts and risk identification workshops to adapt their digital transformation in response to evolving market risks. However, the sector cannot rest on its laurels; it is imperative that it continues to build its data maturity.

"Navigating complex regulations in risk management and compliance demand advanced intelligence and operational efficiency. Rapid technological innovation is opening new doors to solve these challenges using modular, adaptable systems, AI, and data."

Furkan Ali Hamid

Financial Services Leader,, Digital and Innovation Advisory

Financial services is more likely to take a data-centric approach to responding to market risks with agility

Which of the following tactics do you use to adapt your digital transformation strategy in response to evolving market trends and risks?

"Excellent digital leaders don't just respond to change, they plan for it. By building strong data foundations and aligning technology with risk strategies, they can anticipate disruptions, strengthen controls, and reduce exposure before issues arise".

Justin Malta

Partner, Risk and Regulation Leader

Drawing on our experience working with digital leaders in highly regulated sectors, we suggest the following actions are critical:

Baseline

Develop an understanding of current and future risks, regulatory

obligations, and critical operations and controls at an

organizational level. Consider how technologies and solution

options are evolving that could have an impact on your strategy and

decisions taken in the short term. Prioritize those areas most

critical to resolve now while forming a position on future

scenarios.

Manage

Build and implement a robust risk management framework,

incorporating certifications such as ISO 42001, to hone best

practice and strengthen controls. Explore how AI can be leveraged

to accelerate the modernization of your controls, predict the

impact of control changes to your processes and systems, and

sustain them in a rapidly evolving and uncertain environment.

Implement

Prepare a vision and strategy that consider the evolving risk and

technologies environment, immediate priorities and future scenarios

that could play out. Evaluate architectural options, with a view

towards a cloud-based composable architecture that can adapt to

future changes, leveraging XaaS solutions to accelerate and

de-risk, enabled by AI and data.

Prepare

Design and mobilize the program teams needed to uplift your control

environment, leveraging third party providers that bring grounded

advice and global experience. Establish the delivery cadence and

governance needed to surface and resolve design and delivery issues

as they arise. Design and prepare the 'business-asusual'

operating model to sustain the control environment and avoid

drift.

Data and AI

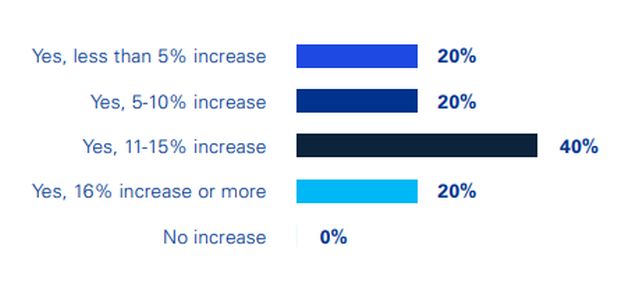

The evolution of AI is transforming numerous industries. The rise of Gen AI has caused many organizations to rethink their AI investment strategies with a view to accelerating and building on their experience with machine learning (ML). Financial services companies have always been quick to embrace new technologies.3 As such, all of the financial services executives in our research indicated their AI investments have generated profits over the last 24 months, compared with 92 percent of global companies.

Over the past 24 months, have your digital transformation efforts with AI and automation (including generative AI) positively impacted your organization's profitability? If so, what was the approximate size of the increase?

Global financial services' proportion of AI-driven profitability, including subsectors, compared with the cross-sector average

Over the past 24 months, have your digital transformation efforts with the following technologies positively impacted your organization's profitability/performance?

Our discussions with financial services business and technology leaders suggest they are continuing to be inundated with requests for Gen AI support, with delivery backlogs growing. There are multiple high value use cases, including automated claims, automated credit assessment, fraud detection, risk assessment, controls optimization and development, personalization of products and services, fighting cyber-crime and code generation. Financial services organizations are increasingly looking to AI to help tackle complex and time-intensive tasks and to streamline processes.

Along with the opportunities, obstacles and barriers to adoption are also growing. Our research confirms that the sector has yet to master the art of scaling AI use cases to fully realize their potential. While 33 percent of financial services companies in Saudi Arabia are already generating AI returns, 66 percent have not yet reached this stage.

Rapidly evolving technologies are butting up against legacy IT systems, siloed data, and fiscal constraints. AI is the next technology solution that financial services companies are investing in to become more modular and fast-moving. This has cost implications, especially since the wide range of digital solutions they are managing simultaneously turns digital debt into a serious risk.

One of the biggest concerns among financial services leaders is the state of their current systems. According to the 2024 KPMG Global AI in finance report nearly 30 percent of financial executives agree that difficulty with integrating existing tools is one of the biggest barriers to AI adoption. Legacy systems limit the ability to innovate, whether it be due to less money being made available for AI use cases, an inability to capitalize on new capabilities or difficulty accessing siloed data sets. A failure to address these barriers risks increasing the divide between digital leaders (including fintechs) and the wider functions.4

In parallel with unwinding legacy tech, digital leaders are shifting how they think about their AI investments from a technology perspective. Historically, organizations have looked at automation and AI technologies through a tool or platform-specific lens (applying robotic process automation [RPA] to processes and ML models). The landscape has shifted to a much more integrated ecosystem, in which use cases may draw from multiple AI capability sets.

Ecosystem level AI blueprints consider how end-to-end value chains can be transformed, beyond automation of certain process steps that solve specific pain points but risk missing the wider change opportunity or impacts. As technologies mature and gain traction across the enterprise, we are seeing a significant and important interplay with how business leaders consider the future service delivery model for their respective functions, whether it be to transform the customer experience or optimize the cost base.

Footnotes

1. https://kpmg.com/xx/en/our-insights/value-creation/kpmg-2024-banking-ceo-outlook.html

2. https://kpmg.com/xx/en/our-insights/value-creation/kpmg-2024-insurance-ceo-outlook.html

3. https://www3.weforum.org/docs/WEF_AI_in_Financial_Services_Survey.pdf

4. KPMG, 'Global AI in finance report', 2024

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.