ABSTRACT

Facilitating the establishment of foreign investors in Morocco has been declared as a key objective of the Kingdom.

In order to achieve this objective, Morocco has made serious efforts in terms of downstream investment (infrastructure, training of human resources, etc.).

Currently, Morocco is more open than ever to all kinds of investments and set up a whole legal and subsidizing arsenal to succeed the establishment in the Kingdom.

Key Words: Investment, Trade Agreements, Infrastructure, Industrial Zones, Tax Advantages, Subsidies.

INTRODUCTION

Benefiting from a strategic position by reason of its proximity to the European coast, Morocco is nowadays considered as an investment bridge connecting the European continent to Africa. This position represents the culmination of the intense and steady efforts undertaken by the Kingdom to develop its international trade through the optimization of its logistical chain and the signature of numerous international agreements and conventions with multiple of countries. Furthermore, the country pays particular attention to the improvement of the business and investment's legal environment by constantly amending its laws and regulations in order to adapt them to the international context. The quality of its human capital and the strong involvement of the Moroccan banks throughout the African continent, are further factors making the country attractive to foreign investors.

For the purpose of increasing its attractiveness, and in order to meet the current and future international demand, Morocco keeps making substantial efforts to promote and facilitate investments. Indeed, the Kingdom keeps introducing new Industrial Acceleration Zones (formerly named Free zones) in order to provide investors with a flexible environment, the most recent one being inaugurated in Agadir earlier this month. The country also continuously develops mechanisms to participate in the financing of industrial projects, an array of investment advantages is provided in this regard. Furthermore, partial financing plans and training aids are put in place to encourage investors and relieve them of the cost of investment and workforce training in the event that an adjustment of profiles to the specificities of vacancies is necessary.

In the present article, we will expose key indicators about the Kingdom of Morocco, and also introduce offered investment facilities by illustrating fundamental information about the industrial acceleration zones available in the country, and the financial incentives provided for by the Government.

KEY REASONS TO INVEST IN MOROCCO:

Stability

Morocco enjoys a stable economic and political climate, confirmed in the 2021 edition of the risk maps issued by the risk valuation firm ControlRisks, which considers the Kingdom as one of the safest countries in North Africa from a political point of view. With regards to security risk, ControlRisks describes it as being low in Morocco, categorizing herewith the country alongside very developed countries such as the United States, the United Kingdom and Canada. Furthermore, ControlRisks attests that the maritime risks of piracy, criminality, conflict, territorial disputes, terrorism and militancy are very low in the Moroccan coast.

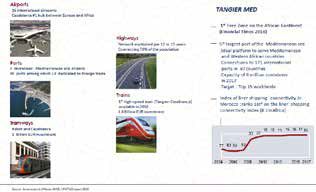

Infrastructure

Thanks to the heavy investments made by the country in order to raise motorway, rail and port infrastructure to international standards, Morocco holds today a modern infrastructure. Indeed, in terms of maritime connectivity, the Kingdom placed itself in the 22nd position in 20191, and is connected to 186 ports around the world2. With regards to air connections, the country possesses 19 international airports3. The road network is also a significant asset for the country. Indeed, according to the data published on the Moroccan Equipment Ministry's website, 44.180 km of the roads are paved.

Availability of multiple trade agreements

Morocco has concluded free trade agreements with more than 100 countries, thus giving its products access to a wide market. Indeed, the Kingdom has signed bilateral treaties with countries like the United States, Turkey, Jordan and United Arab Emirates. Morocco also has an association agreement concluded with the European Union and a multilateral agreement signed with Arab-Mediterranean countries (Agadir agreement).

Source: Moroccan Investment and Exports Development Agency

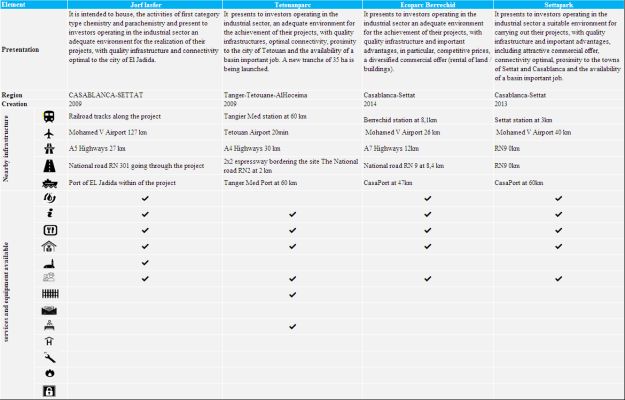

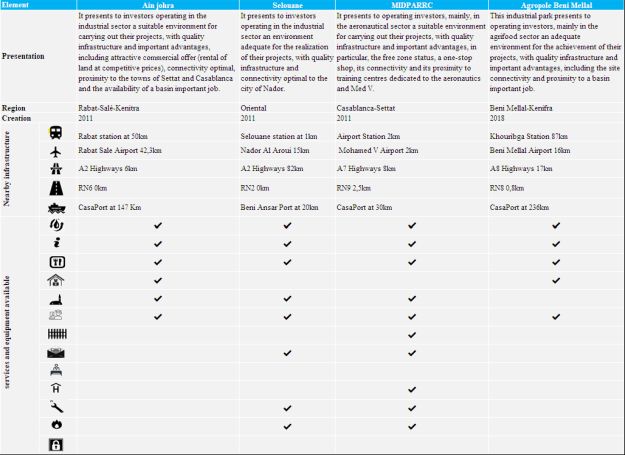

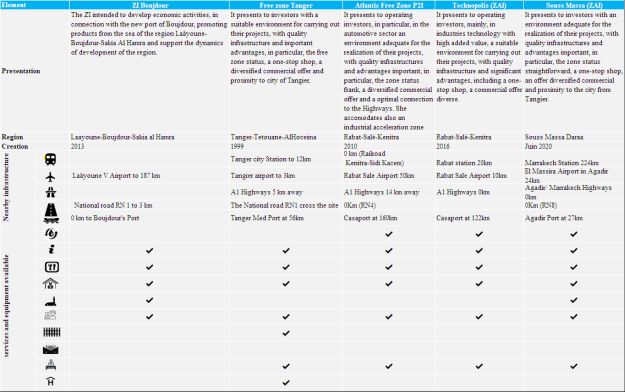

PRESENTATION OF THE INDUSTRIAL ZONES AVAILABLE IN MOROCCO:

In order to guarantee a better installation for foreign investors in the country, Morocco has set up a vast range of industrial acceleration zones (formerly named free zones) spread over the entire territory of the Kingdom, which grant the established companies various advantages. A non-exhaustive list includes:

- Total exemption from Corporate Income Tax (CIT) during the first five consecutive years following the date of commencement of their operations; and a taxation at the specific rate of 15% beyond this period.

- Exemption from withholding tax of dividends originating from activities carried out in industrial acceleration zones, which are paid to non-residents.

- Exemption from VAT with right of deduction for operations carried out inside or between industrial acceleration zones;

- Exemption from registration fees applicable to acts of incorporation and capital increase, as well as to acquisition of the necessary land for the realization of the company's investment project.

- Exemption from professional tax for the first 15 years consecutive to their operation;

- Facilitation of the foreign exchange transfer abroad for incomes generated by foreign investments made in Morocco, such as dividends and interests generated by shareholders' loans.

- Special customs regime allowing the companies located in industrial acceleration zones to benefit from various advantages, mainly the exemption of the goods entering or leaving free export zones, as well as those obtained or staying there, from all duties, taxes or surcharges on import, circulation, consumption, production or export.

Morocco keeps also widening its offer of industrial parks, which are located all over the country, some of them are even categorized by type of activity.

A summary4 of the useful information on the most important industrial acceleration zones and industrial parks, illustrating the positioning and proximity to basic infrastructures, are presented in the appendices 1 and 2.

PRESENTATION OF THE SUBSIDIES, FINANCING PLANS AND TAX BENEFITS OF WHICH INVESTORS CAN BENEFIT IN MOROCCO:

With regards to the financing of investments, Morocco has subsidy funds, the Kingdom also provides financing plans and grants tax advantages. A non-exhaustive list is presented below:

- Industrial Development and Investment Fund (FDII): Companies can benefit from a subsidy for tangible and intangible investment that can be up to 30% of the investment's amount excluding taxes;

- Morocco PME:

-

- ISTITMAR CROISSANCE program for VSEs: Support for extension and diversification projects that can reach 30% of the investment's amount capped at 2 Mn MAD, for very small businesses having achieved or forecasted a turnover less than or equal to 10 Mn MAD.

- IMTIAZ CROISSANCE program for SMEs: support for extension and diversification projects that can be up to 20% of the investment program, capped at 10 Mn MAD, for small business which carried out or forecasted turnover does not exceed 200Mn MAD.

- Investment Promotion Fund (FPI): This fund manages the operations relating to the assumption of certain advantages by the Government granted to companies which investments respect the conditions set forth in the investment charter:

-

- Support for the acquisition of a land in specific areas up to 20% of the purchase cost.

- Participation in external infrastructure expenses up to a limit of 5% of the investment program's total amount.

- Contribution to training costs up to a limit of 20% of the incurred expenses.

- Finishing, Printing, Dyeing Fund (FIT): This fund grants a 20% premium on equipment investment dedicated to upstream textile projects.

- "IDMAJ" program: This program aims to promote recruiting young graduates by granting companies offering a first professional experience the exemption from social contributions and payroll taxes.

- "TAEHIL" program: This program offers trainings to future hired employees and job seekers in order adjust their profiles to the specificities of the position to be filled and to the market's requirements.

- "INMAA" program: This program aims to improve the industrial performance and the competitiveness of Moroccan industries by providing their teams training and support in Lean management for the implementation of Lean tools. The cost of this service can be subsidized up to 60% through the MOUSSANADA program.

- Value Added Tax (VAT) exemption5: Companies established in Morocco can benefit from the exemption or reimbursement of the VAT provided for by the Moroccan Tax Code, in the event of:

-

- Local acquisition of import of investment goods within the limit of 36 months starting from the beginning of the company's activity.

- Import of the capital goods, materials and tools necessary for the completion of investment projects undertaken within the framework of an agreement concluded with the State under certain conditions.

- Existence of a VAT credit arising from the acquisition of certain investment goods that could not be absorbed by the collected tax.

- Corporate Income Tax (CIT) exemption:6 Industrial companies operating in activities included in the list provided for by the Government benefit from the advantages below:

-

- Total exemption from CIT for the first five consecutive fiscal years starting from the date the company starts operating.

- Application of a reduced tax rate of 28% to the local turnover carried out by industrial companies specialized in manufacturing or transforming tangible personal property and which tax result is less than MAD 100M (Approx EUR 9M).

- Professional tax: Companies established in Morocco exercising a professional, industrial or commercial activity benefit from the exemption from professional tax during the first 5 years of operation7. The aforementioned exemption also applies, for the same duration, to lands, buildings of any kind, additions to buildings, new equipment and tools acquired during operation, directly or by way of leasing.

CONCLUSION

The current Covid-19 crisis has brought important learning to the Kingdom, which is adopting a new policy aiming to substitute the importations by the local production. In order to encourage the domestic industries, the country has recently increased the custom duties applicable to a range of imported finished products and is strengthening its support for industrial enterprises. In this context, a study conducted by NAZALI based on project fiches published by the Moroccan Ministry of Industry, Trade, Green and Digital economy has shown that the country presents interesting industrial investment opportunities.

APPENDICES

APPENDIX NO:1

APPENDIX NO:2

KEYS

Footnotes

1. Moroccan Investment and Exports Development Agency (AMDIE), Booklet Morocco now, Investment and export, p. 14.

2. ibid, p.14.

3. ibid, p.14.

4. Moroccan Ministry of the Economy Industry and Trade (MMEIT), Project files of acceleration of the internal market.

5. Moroccan Tax Code (MTC), the 123th-22 article.

6. MTC, ibid, the 6th-I-B-6 article.

7. Moroccan tax Code of Local Collectivities, the 6th -II-1 article.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.