- within Insurance topic(s)

- with readers working within the Insurance industries

- within Insurance topic(s)

- within Insurance, Real Estate and Construction and Employment and HR topic(s)

- with readers working within the Retail & Leisure industries

The Indonesian Financial Services Authority (Otoritas Jasa Keuangan or "OJK") recently issued Circular Letter No. 7/SEOJK.05/2025 on the Implementation of Health Insurance Products ("Circular Letter 7/2025") on 19 May 2025. This new circular letter is issued to stipulates the implementing standards under its umbrella regulation, namely OJK Regulation ("OJK Reg") No. 36 of 2024 that amends the previous governing regulation for businesses of insurance, sharia insurance, reinsurance, and sharia reinsurance companies (i.e., OJK Reg No. 69/POJK.05/2016) ("OJK Reg. 36/2024"). Circular Letter 7/2025 will be effective starting 1 January 2026. Therefore, it will be anticipated that there will be other regulations which may be issued in the future concerning this matter.

By way of a background, the issuance of OJK Reg. 36/2024 has introduced a more structured and expansive framework for the operation of insurance and reinsurance companies in Indonesia.

Key updates in this regulation includes among others, requiring companies to operate strictly within their designated business lines, adhering to the general or life insurance principles (Article 3A and 3B of OJK Reg. 36/2024), while also allowing new activities such as sharia compliant financing and suretyship (Article 4 (b) OJK Reg. 36/2024).

In view of the above, OJK deems it necessary to issue a specific regulation addressing the latest developments in Indonesia's insurance regulatory framework. This Legal Insight provides a summary of the key provisions and requirements introduced by Circular Letter 7/2025, particularly with respect to the (i) Eligible Criteria and Requirement, (ii) Health Insurance Products, (iii) Co-Payment, (iv) Risk-Selection, and (v) Coordination and Collaboration of the insurance activities.

Eligible Criteria and Requirement

Insurance Companies, Sharia Insurance Companies, and Sharia Insurance Units ("Insurance Entities") now have to meet certain criteria before they can offer health insurance products. Each of these companies or business units:

- must have a qualified medical practitioner for medical treatment analysis and utilization review;

- has employed a staff who has obtained the required health insurance expertise certificate with a level at least one level below the highest qualification from a professional certification agency in the insurance sector registered in OJK; and

- has established the Medical Advisory Board (Dewan Penasihat Medis or "DPM").

(Section II of the Circular Letter 7/2025)

The DPM must consist of a group of specialist doctors with the expertise correlated to the health insurance product(s). The board's primary purpose is to provide advice on utilization reviews and to offer inputs on the health and medical services. To this end, Insurance Entities may establish the DPM independently, in cooperation with other Insurance Entities, or in collaboration with a company engaging in a Third-Party Administrator (Administrator Pihak Ketiga or "TPA") that provides administrative services (Section III of the Circular Letter 7/2025).

In addition to the above, Insurance Entities may also implement a digital platform capable of facilitating secure electronic data exchange with healthcare service providers. These platforms should support real-time access to policyholder data and claims information, including medical summaries, medical utilization review, and fraud detection systems, particularly those designed to identify fictitious or irregular claims.

Health Insurance Products

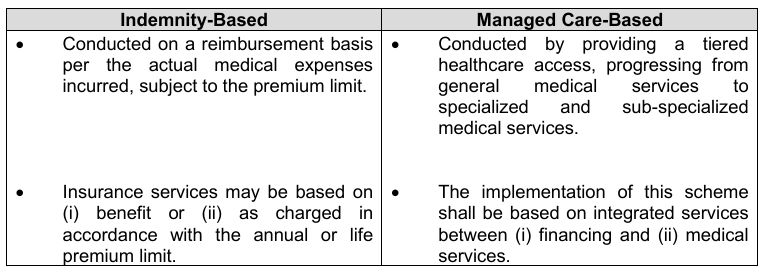

Health insurance products may be offered in 2 schemes: (i) indemnity-based (similar to a reimbursement scheme) and (ii) managed care-based. For the comparison of these schemes, kindly refer to the following tables below.

Notwithstanding the above, both schemes have similar conditions, whereby the health insurance product must incorporate a waiting period before benefits become active. Standard coverage is up to 30 calendar days, while critical, chronic, and specific illnesses can be covered up to one year.

(Section IV of the Circular Letter 7/2025)

Co-Payment Scheme

Circular Letter 7/2025 also introduced a new co-payment scheme. This mechanism provides risk sharing that will be borne by the policyholder, the insured, as well as the participant in the amount of 10% co-payment with a maximum threshold as follows:

- Outpatient Claims: IDR300,000 per claim; and

- Inpatient Claims: IDR3,000,000 per claim.

In addition to the above, this mechanism is specifically limited to the indemnity-based scheme and the medical tier in the managed care-based scheme. However, micro-insurance products are exempted from this mechanism, thereby ensuring continued accessibility for the low income policyholders.

(Section V paragraph A of the Circular Letter 7/2025)

Risk-Selection

In addition to the co-payment mechanism, Insurance Entities are also obligated to perform a risk-selection as part of their risk-management requirement, including:

- ensuring that the individual prospect policyholder understands the health insurance request letter (Surat Permintaan Asuransi Kesehatan);

- ensuring that the individual prospect policyholder receives a medical check-up consideration;

- ensuring that the individual prospect policyholder completes the medical questionnaire;

- ensuring that the group health insurance product collect the claim performance data, which includes the reporting period, the tax identification number (Nomor Pokok Wajib Pajak), the total number of policyholder, the total contributions, the total paid claims, and the loss ratio information.

(Section V paragraph A of the Circular Letter 7/2025)

Coordination and Collaboration

Insurance Entities must incorporate features to enable coordination between themselves and other guarantee providers. These coordination processes are required to adhere to strict risk management principles, promoting financial sustainability and fairness in co-payment cost sharing.

Each of the Insurance Entities offering the relevant health insurance product is required to collaborate with third parties to implement the principle of prudence and sufficient risk management, which such parties may include:

- healthcare facilities,

- TPA,

- other Insurance Entities,

- digital service providers, and

- Social Security Administration for Health (Badan Penyelenggara Jaminan Sosial Kesehatan) or other similar social security administration.

It is important to note that all collaborations must be formalized through an agreement between the Insurance Entities and the aforementioned relevant parties. Such agreement must include standard provisions, including but not limited to: party details, term, rights and obligations, scope of collaboration, force majeure, and other generally applicable contractual provisions. Furthermore, the agreement must contain a specific covenant and commitment to protect the personal data of policyholders, which shall be binding upon all parties thereto.

(Section VII of the Circular Letter 7/2025)

Concluding Remarks

Circular Letter 7/2025 marks a pivotal development in Indonesia's health insurance regulatory framework and commitment. By introducing more provisions on risk management, product structuring, co-payment mechanisms, and inter-institutional coordination, OJK has taken a significant step toward building a more transparent, accountable, and sustainable health insurance ecosystem.

The issuance of this OJK circular letter has important implications for the two corresponding sectors. For Insurance Entities, it introduces a stricter regulatory compliance requirement and serves as a safeguard against potential moral hazard by the policyholder. For policyholders, the new standard present new liabilities and offers better transparency as well as better health insurance services across the insurance industry.

Considering that Circular Letter 7/2025 merely serves as a guideline for Insurance Entities in conducting their business activities in Indonesia, there remain varying views and debates among the public and professionals. A circular letter, unlike a regulation, does not have the power to regulate of sanctions. In this regard, OJK is expected to issue more comprehensive regulations in the new future, to address broader issues and specific matters not currently regulated under Circular Letter 7/2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.