As mandated under Law Number 4 of 2023 on Development and Strengthening of the Financial Sector ("P2SK Law") the insurance industry, the Government requires, among others; minimum capital, sharia industry spin-offs, guarantee funds, and digitalization of insurance industry to be able to grow, develop, and strengthen the insurance industry in Indonesia.

The Financial Services Authority (Otoritas Jasa Keuangan or "OJK") further sets the road map of development and strengthening of Indonesia's insurance industry for 5 years (2023- 2028) ("Insurance Industry Roadmap"), one initiative of which is industry consolidation. In the current Indonesian insurance industry, many small companies dominate the market. Meanwhile, higher premiums applied by big insurance companies have caused a harsh competition in the limited market share, resulting in business inefficiency and unhealthy business competition which later leading the insurance company's failure to pay the claims under the matured insurance policies to the customers (i.e., Jiwasraya case and Bumiputera case).

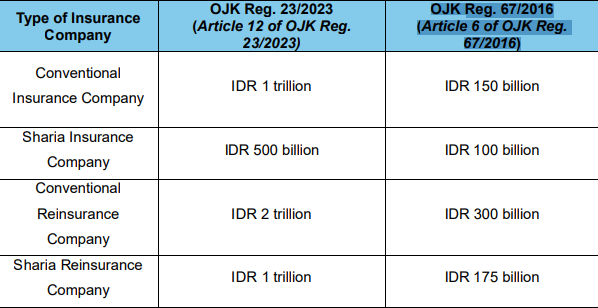

To satisfy the requirements under P2SK Law and Insurance Industry Roadmap, insurance companies can achieve the applicable requirements by various methods, including mergers and acquisitions. Historically, the Indonesian government has implemented several policies to encourage industry consolidation, such as single presence policy and separation of sharia units (spin-offs). Further, OJK is regulating the increases in the minimum capitals requirement for conventional insurance companies, sharia insurance companies, conventional reinsurance companies, and sharia reinsurance companies (hereinafter collectively referred to as "Insurance Company") based on OJK Regulation No. 23 of 2023 on Business Licensing and Institution of Insurance Company, Sharia Insurance Company, Reinsurance Company, and Sharia Reinsurance Company ("OJK Reg. 23/2023"), which has revoked the preceding regulation, namely, OJK Regulation No. 67/POJK.05/2016 on Business Licensing and Institution of Insurance Company, Sharia Insurance Company, Reinsurance Company, and Sharia Reinsurance Company ("OJK Reg. 67/2016").

Having regard to the amendment to capital thresholds of the Insurance Company, we have provided herein, a general overview of the new minimum paid-up capital requirement of Insurance Company in Indonesia pursuant to OJK Reg. 23/2023 that include: (i) Insurance Company Minimum Capital Requirement, (ii) Minimum Equity, (iii) Approaches for Compliance, (iv) Concluding Remarks.

Minimum Paid-Up Capital Requirement

OJK Reg. 23/2023, has stipulated some increases of the minimum paid-up capital for Insurance Companies. For your ease of reading, we have provided below, a comparison of the paid-up capitals that must be met by Insurance Companies at the time of establishment under the previous regulation (i.e., OJK Reg. 67/2016) and those under the current regulatory regime of OJK Reg. 23/2023

The new paid-up capital of an Insurance Company must be fully injected in the form of a deposit and/or account to any conventional bank or sharia bank in Indonesia (Article 12 (5) of OJK Reg 23/2023). This new minimum paid up capital also must be fulfilled, in the event that the Insurance Company undergone change of shareholders due to acquisition.

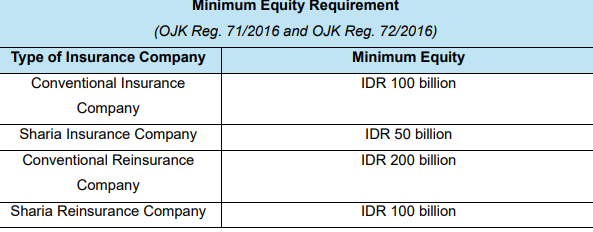

Minimum Equity Requirement for Insurance Companies1

OJK Reg. 23/2023 has also regulated new provisions regarding the minimum equity of existing Insurance Companies, which is initially regulated under OJK Regulation No. 71/POJK.05/2016 on Financial Soundness of Insurance Company and Reinsurance Company ("OJK Reg. 71/2016"), and OJK Regulation No. 72/POJK.05/2016 on Financial Soundness of Insurance Company and Reinsurance Company with Syariah Principle ("OJK Reg. 72/2016"). For further context, the minimum equities for Insurance Companies are as follows:

The minimum equities will be valid until December 2026 (Article 33 of OJK Reg. 71/2016, Article 37 (1) OJK Reg. 72/2016, and Article 161 of OJK Reg. 23/2023).

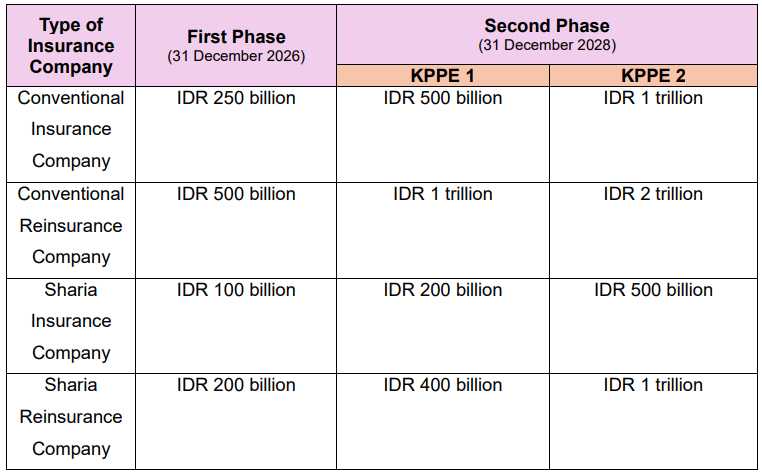

Based on OJK Reg. 23/2023, the Insurance Companies must comply with new minimum equities gradually, in 2 phases. The first phase must be completed by 31 December 2026, and the second phase by 31 December 2028 (Article 56 (2) of OJK Reg. 23/2023). OJK, in its discretion, may extend this fulfilment of new minimum equity requirement upon prior request from such Insurance Company due to special condition (Article 61 of OJK Reg. 23/2023). The special condition further explained as the condition, among others the process of consolidation or merger cannot be completed before or on the deadline of phase 1 or phase 2.

In the first phase, a Conventional Insurance Company must fulfil the minimum equity of IDR 250 billion. In the second phase, the minimum equity fulfilment is carried out according to the Insurance Company Group by Equity (Kelompok Perusahaan Perasuransian Berdasarkan Ekuitas or "KPPE"). Insurance companies are divided into KPPE 1 and KPPE 2. Please note that KPPE will determine the scope of activities of Insurance Companies. Pursuant to Article 56 (4) of OJK Reg. 23/2023, an Insurance Company categorized as KPPE 1 is prohibited from engaging in activities other than the basic business activities and/or providing insurance products other than the basic insurance business activities or insurance products.

To further understand the mandatory minimum equity provisions applicable to Insurance Companies, we have provided a table below, on minimum equity fulfilment in each Phase.

(Article 56 of OJK Reg. 23/2023)

If the Insurance Company's current equity is still below the required amount after the first phase, the Insurance Company is obligated to prepare the Minimum Equity Fulfilment Plan as reported to OJK no later than 6 months after the enactment of OJK Reg. 23/2023 (i.e., June 2024) (Article 57 and 58 of OJK Reg. 23/2023).

Non-compliance with this new minimum equity requirement is subject to administrative sanctions in the form of written warning and/or reduction of Financial Soundness of the Insurance Company. In addition, the Insurance Company could be imposed on a penalty fee in the amount of IDR 500,000 to IDR 100 million per day of delay for violating the minimum equity fulfilment (Article 62 (2) of OJK Reg. 23/2023).

Approaches to Fulfil the New Higher Minimum Equity

To meet the new minimum equity, OJK Reg. 23/2023 has provided alternative schemes to be taken by the Insurance Company:

a. Merger or consolidation: this scheme can be conducted by a party who is the Controlling Shareholder – Pemegang Saham Pengendali (PSP)2 . This merger or consolidation can be done by two insurance companies that have the same PSP, or by an insurance company owned by PSP of another insurance company.

A merger or consolidation can be made by two or more insurance companies in a similar type of legal entity, having similar principles of insurance business activities (conventional or sharia), and obtaining prior approval from OJK. The merger or consolidation must be conducted within 60 working days after the issuance of OJK approval. Following such merger or consolidation, the receiving/consolidating company must report it to OJK within 15 working days since the date of general meeting of shareholders approving such merger or consolidation; and further, report the implementation of merger or consolidation to OJK within 15 working days since the approval of the change of articles of association.

Additionally, OJK may conduct reassessment on the Main Parties of Insurance Companies, being PSP, and members of the Board of Directors and Board of Commissioners.

b. Acquisition followed by the merger or consolidation: This scheme can be carried out by:

(i) the parties who are PSP and who conduct the acquisition on one or more insurance companies, or

(ii) the parties who will become PSP and will conduct the acquisition on one or more insurance companies, later followed by the merger or consolidation.

An acquisition3 can be made after obtaining prior approval from OJK. Further, the acquisition must observe the single presence policy. A party can become PSP only for one life insurance company, general insurance company, reinsurance company, sharia life insurance company, sharia general insurance company, or sharia reinsurance company. In essence, one PSP cannot be PSP for any other company of similar type.

If the acquirer is a foreign entity, it must comply with the following requirements:

(i) it has similar insurance business activities, or it is a holding company that has subsidiaries having similar type of insurance business activities;

(ii) it has an equity of, at least, five times of the direct participation at the time of acquisition; and

(iii) it has the minimum A rating or equivalent rating from a recognized international rating agency.

In addition, the prospect acquirer must show that it has good financial performance for, at least, the last two years, and the fund for the acquisition does not come from a loan or money from unlawful transactions, such as money laundering, terrorism funding, or other financial crimes.

c. Establishment of a group of business entities – Kelompok Usaha Perusahaan (KUPA): it is defined as insurance companies within the same group due to the ownership and/or controlling shareholders consisting of two or more Insurance Companies. This scheme can be made by:

(i) an insurance company having PSP of one or more insurance companies, or

(ii) a PSP of a company in financial, non-insurance services, or a PSP who is an Indonesian individual, or a foreign legal entity, or a foreign individual who owns two or more insurance companies.

KUPA allows an insurance company not fulfilling the requirement (i.e., low equity) to join its affiliated company or companies to be able to meet the minimum equity requirement.

KUPA can be established by a holding company and/or an organizer of a holding company that has the ability to fulfil the capital sufficiency and liquidity of the insurance companies in KUPA. The structure of KUPA will consist of a holding company or an organizer of the holding company and its subsidiary company. The holding company can be a PSP or shareholder other than PSP who has, at least, 10% ownership in the insurance company. Further, the organizer of the holding company can be an insurance company that has the same shareholders as the subsidiary company and has the biggest equity.

The establishment of KUPA can be made by applying the plan of KUPA establishment to OJK by submitting the required documentation, including (i) the structure of KUPA; (ii) the assignment of the organizer of holding company; and (iii) the commitment of shareholders of the subsidiary company in solving their capital insufficiency and liquidity of such subsidiary company. Upon the complete documentation and assessment, OJK will issue the declaration on approval of KUPA establishment.

The subsidiary company can retain its minimum equity and meet the minimum equity of the first phase under KUPA scheme, where a conventional Insurance Company must fulfil the minimum equity of IDR 250 billion, while a Sharia Insurance Company must fulfil the minimum equity of IDR 100 billion.

Concluding Remarks

OJK Reg. 23/2023 brings stringent rules to prospective or existing Insurance Companies in Indonesia, particularly in increasing the minimum paid-up capital and equity requirements which at least, the insurance company is required to have minimum equity with paid up capital of IDR500 billion for KPPE 1 and IDR 1 trillion for KPPE 2. This significant changes are made to strengthen the financial health of insurance companies and create a competitive market, with a plan to gradually meet the equity requirements by 2028.

Fulfilling them will make it more challenging for both new and existing insurance companies to enter and stay in the Indonesian market. Insurance Companies must ensure they have sufficient financial resources to meet the new standards. In addition to merger and consolidation, KUPA is also introduced by OJK as the alternative scheme for insurance companies to meet these new minimum paid-up capital and equity requirements. It is also worth noting that irrespective of these stringent requirements, OJK also provides the flexibility for the Insurance Company to fulfill the requirements later than 2028 upon request of the Insurance Company to OJK due to special conditions.

Footnotes

1 Equity means the equity as referred to the applicable financial accounting standard in Indonesia

2 The parties who own the insurance company directly or indirectly of 25% or more of total issued capital.

3 Foreign shareholders can only own maximum 80% shareholding as regulated under Government Regulation No. 14 of 2018 (as amended)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.