Latest Index Shows a Decrease from Q2 Default Rate of 2.71%

NEW YORK, October 24, 2024 – Leading international law firm Proskauer today revealed the results of its Q3 2024 Private Credit Default Index ("Default Index" or the "Index"), with an overall default rate of 1.95%. The Q3 default rate is a decrease from 2.71% in the prior quarter. However, the overall default rate is still higher than the default rate for Q1, which was 1.84%.

"We continue to see a relatively stable default rate across our portfolio, in contrast to the rising default rates we see in the syndicated markets," said Stephen A. Boyko, partner in Proskauer's Private Credit Group and co-chair of its Corporate Department. "The lower default rates are likely a result of some of the structural differences of private credit: more rigorous underwriting, constant monitoring, greater access to information/management, a small group of lenders, and in some cases, financial maintenance covenants."

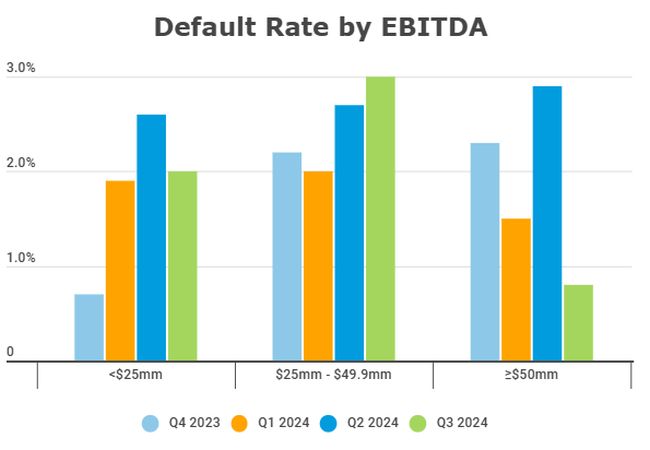

Proskauer's Q3 Default Index includes 872 loans representing $152.1 billion in original principal amount. The index tracks senior-secured and unitranche loans in the United States and breaks the default rate down both by EBITDA (less than $25 million in EBITDA, $25 million to $49.9 million in EBITDA and at least $50 million in EBITDA) and industry (health care/life sciences, software & technology, manufacturing, consumer goods and services/retail and business services).

For companies with EBITDA of less than $25 million, defaults decreased from 2.6% in Q2 to 2.0% in Q3, a similar rate to what was observed at the end of Q1 (1.9%). For companies in the $25 million to $49.9 million EBITDA band, default rates slightly rose from 2.7% in Q2 to 3.0% in Q3. For the largest companies, those with at least $50 million in EBITDA, defaults decreased by two percent from the previous quarter - from 2.8% in Q2 to 0.8% in Q3.

This quarter, all industries experienced a decline in default rates, although rates mostly remained higher than where they were in Q1.

Proskauer's Default Index contains a comparison to default rates published by the rating agencies, historical trends by industry and EBITDA bands, defaults by type, defaults in cov-lite loans and defaults by year of origination. It is available only to the Firm's direct lending clients.