- with readers working within the Oil & Gas industries

- within Media, Telecoms, IT, Entertainment, Tax and Technology topic(s)

- with Finance and Tax Executives

The Nigerian Oil and Gas Industry is in dire need of investments to revitalize the sector. With international oil companies (IOCs) divesting from onshore and shallow water assets and concentrating their efforts on deepwater operations, it has become crucial for government to incentivize deep offshore operations to attract the required investment. As part of the Federal Government of Nigeria's (FGN) commitment to improving the investment climate, and to position Nigeria as the preferred investment destination for the Petroleum Sector in Africa, His Excellency, President Bola Ahmed Tinubu, GCFR, signed three Executive Orders on 28 February 2024. The Executive Orders, which became effective on the same day, are as follows:

1. Oil and Gas Companies (Tax Incentives, Exemption, Remission, etc.) Order, 2024

2. Presidential Directive on Local Content Compliance Requirements, 2024

3. Presidential Directive on Reduction of Petroleum Sector Contracting Costs and Timelines, 2024

You can read our newsletter on the Executive Orders published earlier here. These measures are intended to improve the overall prospects of the Petroleum Sector.

Pursuant to section 10 of the Oil and Gas Companies (Tax Incentives, Exemption, Remission, etc.) Order, 2024, the Federal Government (via its official gazette dated 11 March 2024) issued a Notice of Tax Incentives on Deep offshore Oil and Gas Production, 2024 ("the Notice"). The Notice, which was signed by the Honorable Minister of Finance and Coordinating Minister of the Economy (the Minister), is intended to incentivize investments in deep offshore oil and gas development, and exclusively for production sharing and profit-sharing contractors.

This newsletter outlines the key provisions of the Notice and its implications for taxpayers, businesses in the oil and gas sector of the Nigerian economy and the public at large.

Highlights of the Notice

1. Tax Incentives for Deep Offshore Oil and Gas Production

1.1 Tax Credit on Crude Oil Production

The Notice introduces a production tax credit (PTC) on crude oil production in the deep offshore petroleum operations for existing deep offshore leases with a Field Development Plan (FDP), where the lessee makes a Final Investment Decision (FID) between 28 February 2024 and 1 January 2029, as follows:

(a) Lower of US$3.00 per barrel or 20% of the fiscal oil price for crude oil produced in upstream petroleum operation from commencement of production until a total of 150million barrels is reached, provided that the producible reserves for such deep offshore development do not exceed 400 million barrels of crude oil equivalent, or:

(b) Lower of US$4.50 per barrel or 20% of the fiscal oil price for crude oil produced in upstream petroleum operation from commencement of production until a total of 500million barrels is reached, provided that the producible reserves of such deep offshore development exceed 400 million barrels of crude oil equivalent.

In addition, there is a tax credit of US$1.00 per barrel applicable from the commencement of production until a total of 500million barrels is produced, for leases awarded after the effective date of the Notice (i.e., after 28 February 2024) and those derived from existing licenses or future licenses awarded after the effective date.

However, where crude oil prices fall below US$50 per barrel, the incentive will only be available at a reduced rate of 50%. Where the lessee of any lease, which is awarded before the effective date, is not able to make FID before 1 January 2029, the applicable production credit will be reduced by 50%. Also, any lessee of an existing lease that intends to take advantage of the applicable incentives must notify the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) within 30 days of the FID being made.

1.2 Tax Credit on Gas Production

The Notice also includes a PTC for gas production sold from Non-Associated Gas (NAG) developments or areas containing crude oil and gas in the deep offshore as outlined below:

(a) Lower of US$1.00 per thousand standard cubic feet (mscf) of gas sold or 30% of the fiscal gas price of such sale from commencement of production until a total gas volume of 5 trillion cubic feet (TCF) is reached, provided that the Hydrocarbon Liquids ("HCL") content in the field does not exceed 30 barrels per million standard cubic feet (mmscf), or;

(b) Lower of US$0.50 per thousand cubic feet (mscf) of gas sold or 30% of the fiscal gas price of such sale, applicable from commencement of production until a total gas volume of 5 TCF is reached, provided that the HCL content in the field is greater than 30 barrels per million standard cubic feet (mmscf) but does not exceed 100 barrels per million standard cubic feet (mmscf).

The PTC will not apply where the HCL content from the relevant development exceeds 100 barrels per million SCF (mmscf), and its determination in a NAG field will be limited to HCL within the upstream petroleum sector and based on guidelines issued by the NUPRC.

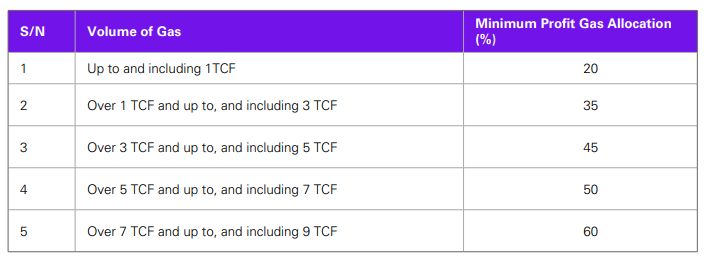

2. Minimum Profit Gas Allocation

Paragraph 4 of the Notice establishes the framework for the determination of the minimum profit gas allocation to the FGN under the existing NAG deep offshore PSC, with the Nigerian National Petroleum Company Limited (NNPCL) representing the Federation. The bases are as follows:

:

:

3. Other Key Provision

The Notice also provides as follows:

- The PTC will be reduced by 10% for qualifying developments, where the unit technical cost (UTC) of development exceeds the benchmarked cost levels set by the Commission. For 2024, the benchmark cost has been set at US$20.00 per Barrel of Oil Equivalent.

- The PTC shall not be combined with the production allowance incentives provided in the Sixth Schedule to the Petroleum Industry Act (PIA) or the Associated Gas Framework Agreement (AGFA).

- iSurplus PTC can be carried forward to subsequent years, subject to a maximum of three years.

- The fiscal price used for calculating the PTC will be the same price used for determining royalties under the PIA, and the PTC will be based on total annual production from the development after production commences and allocated based on the capital contributions by each investor in the development.

- v. The Notice emphasizes that the tax credit incentives are designed to stimulate investments in the deep offshore development. Consequently, the tax credit incentives are intended for parties to a PSC, who are directly providing funding for developments that lead to production.

- vi. The Federal Inland Revenue Service (FIRS) is to issue implementation guidelines with respect to the incentives within fifteen (15) days from the date of the Notice.

KPMG's Commentary

n May 2023, the Oil and Gas Sub Committee of the Presidential Advisory Council had set the following performance targets for the country by 2030 - 4 million barrels of crude oil per day and 12bcf of gas per day1 . It is in recognition of these ambitions that the government issued the 3 Executive Orders in February 2024 and this Notice of incentives for the deep offshore oil and gas production.

It is a welcome development that the Government has now reintroduced tax credits rather than the production allowances contained in the Petroleum Industry Act (PIA). Undoubtedly, tax credits have a more significant impact than production allowances given that operators can claim 100% deduction from the tax liabilities due, unlike production allowances whose impact is limited to the applicable tax rate. Under the PIA, PSC operators involved in deep offshore gas production cannot claim the production allowances as the allowances are limited to hydrocarbon liquids – crude oil, condensates, and natural gas liquids. Even then, the operators are unable to utilise the allowances since they are only subject to companies income tax and there is no provision for the deduction of production allowances under the Companies Income Tax Act.

However, the jury is out on whether this incentive package is competitive enough to ignite the expected reaction from investors. Investors will only invest where there is an expectation of high returns on their investment.

Consequently, all potential projects will have to be evaluated in terms of the rate of return they generate. The government will need to monitor the response of investors on a periodic basis and make the necessary adjustments when needed given the competitive landscape for oil and gas projects.

The decision to cap the HCL content of a gas field to 100 barrels per million standard cubic feet (mmscf) is commendable as this will help to develop fields with lower liquid content; thereby making them more economically viable. Generally, a high HCL in a field is considered desirable as it enhances the field's value, recovery, and production rates. Consequently, there will be a tendency for operators to focus on only liquids to the detriment of gas production, which is required to help unlock Nigeria's energy potential while also improving energy security on a sustainable basis.

We also note the intention of the Government to encourage operators to drive down unit technical cost of production by reducing the incentives granted under the Notice by 10% for qualifying developments when costs exceed the benchmark set by the NUPRC, which is $20 per barrel of oil equivalent for 2024. While this is commendable, it is essential to ensure that the benchmark price remains competitive for operators in the sector – i.e., it considers the unique challenges faced by Nigerian oil and gas producers, such as security cost, bureaucracy, and excessive regulatory oversight.

The opinion expressed in this article is solely personal and does not represent the views of any organization or association to which the authors belong.

[View Source]