- within Energy and Natural Resources topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in South America

- with readers working within the Accounting & Consultancy, Oil & Gas and Construction & Engineering industries

- with readers working within the Media & Information industries

- within Insurance, Employment and HR and Technology topic(s)

1.0 INTRODUCTION

The year 2024 marked a pivotal moment for Nigeria's Power Sector. The Sector witnessed sweeping reforms aimed at repositioning it for growth and sustainability. Notably, eight Sates took decisive steps toward decentralised electricity regulation, exercising their authority under the Electricity Act to transition to State-level oversight. In parallel, the Federal Government eliminated subsidies on Band A electricity tariffs, a move designed to attract investment and strengthen commercial viability across the value chain.

The Minister of Power, Adedayo Adelabu, reported that tari adjustments alone generated an additional N700 million in revenue for the Sector and drove a record 70% year-on-year increase in collections compared to 2023.1

Yet, beneath these gains lie deeply rooted structural challenges that continue to undermine the Sector's performance, ranging from rising debt burdens and infrastructure deficits to widespread vandalism, right of way issues and persistent energy theft.

In this 2025 Power Sector Mid-Year Report, we provide key insights into the current state of the Nigerian Electricity Supply Industry ("NESI"), highlight major market and regulatory developments recorded over the past six months, and outline projections for the second half of the year.

2.0 OVERVIEW OF MARKET PERFORMANCE

Generation

Nigeria's grid-connected generation capacity continues to show signs of minimal incremental improvement despite lingering constraints. As of Q4 2024,3 the Nigerian Electricity Regulatory Commission ("NERC") reported that the 28 grid-connected power plants had a total installed capacity of 13,625MW, with an average available capacity of 5,296.89MW4 and a plant availability factor of 38.88%.

In February 2025, the Transmission Company of Nigeria ("TCN") recorded a historic peak generation of 5,543.20MW, reflecting short-term gains in output. By May 2025, although total installed capacity remained unchanged, average available generation capacity rose slightly to 5,639 MW, with an improved plant availability factor of 41%. 5

Transmission

Grid stability remains a critical indicator of the reliability of Nigeria's transmission infrastructure, measured primarily by the system's ability to maintain frequency close to the 50Hz benchmark prescribed by the Grid Code. The acceptable operational frequency range is ±0.5% (49.75Hz to 50.25Hz). 6

According to NERC, in Q4 2024, the average lower and upper daily grid frequencies stood at 49.39Hz and 50.91Hz, respectively.7 As of May 2025, lower and upper daily grid frequencies stood at 49.39Hz and 50.74Hz, both exceeding the prescribed limits by approximately 1%. 8

Distribution

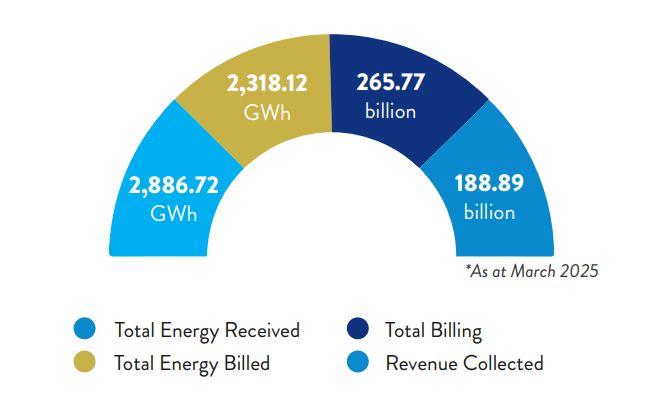

Performance in the distribution segment remains challenged by ineciencies in energy billing and revenue collection. In Q4 2024, DisCos received a total of 7,420.58 GWh and billed 6,207.84 GWh to end-users, translating to a billing efficiency of 83.66%. 9 Revenue collection stood at N509.84 billion from a total billing of N658.40 billion, reflecting a collection eciency of 77.44%. 10 In March 2025, total energy received stood at 2,886.72 GWh, with 2,318.12 GWh billed, reflecting a slightly lower billing eciency of 80.30%. Total billings amounted to N265.77 billion, of which N188.89 billion was collected, indicating a collection eciency of 71.07% and reflecting a 6.37% decline compared to Q4 2024.

3.0 H1 MARKET OVERVIEW

The first half of 2025 laid bare the critical state of the Power Sector. According to the United Nations Development Programme, Nigeria continues to lose over N2 billion annually due to unreliable electricity supply.11 Even more alarming, 28.1% of the electricity generated is lost, placing Nigeria among the top three countries in Africa with the highest rate of energy loss.12

At the heart of this ineciency is a mounting debt crisis. The Federal Government's outstanding liabilities to Generation Companies ("GenCos") and Distribution Companies ("DisCos") now exceed N4 trillion, comprising legacy debts and market shortfalls.13 This financial strain continues to threaten the survival of these market players and their capacity to sustain electricity supply, prompting urgent calls on the Federal Government from stakeholders, including the Senate Committee on Power.14

This liquidity issue has triggered a ripple eect across the value chain. By Q1 2025, Geregu and Transcorp Power had accrued a combined debt of N216 billion to gas suppliers, an increase of N19.7 billion from the figures recorded by 2024 year-end.15 In the same period, the TCN reported that it was owed N457 billion by various market participants, further compounding the liquidity crisis across the Sector.16

Despite ongoing grid expansion projects and regulatory reforms, TCN's operations remain constrained by vandalism and chronic underinvestment. Meanwhile, the refusal of some DisCos to take up allocated loads, due to commercial and technical limitations, has led to the shutdown of 40 transmission substations across the country.17

Generation

a. Legacy Debt

In December 2024, the persistent inability of GenCos to settle outstanding liabilities led gas suppliers to halt supply to the Power Sector.18 Given that over 70% of on-grid electricity is generated from thermal sources, the disruption necessitated urgent intervention by the Federal Government to avert a nationwide Power crisis.19

At a recent NESI stakeholders' meeting, a representative of the Special Adviser to the President on Energy, Olu Verheijen, acknowledged the Federal Government's outstanding debt of over N4 trillion and the critical financial and operational challenges facing both GenCos and DisCos.20 The representative also noted that while repayment options were actively being explored, no definitive timeline for settlement could be provided at the time.21

b. Review of Gas Pricing

In response to the ongoing operational challenges faced by GenCos, the Nigerian Midstream and Downstream Petroleum Regulatory Authority, pursuant to Section 167 of the Petroleum Industry Act 2021, revised the domestic base price of natural gas for the Power Sector to US$2.13/MMBtu.22 This followed an earlier upward review of about 11% in 2024.23

c. Privatisation of NIPP Power Plants

For over eight years, discussions have persisted around the privatisation of select power plants under the National Integrated Power Projects ("NIPP"), 24 managed by the Niger Delta Power Holding Company ("NDPHC"), which is jointly owned by the Federal, State, and Local Government Councils. However, progress has been hindered by persistent liquidity constraints, bankability concerns, protracted approval processes, and ownership disputes among the three tiers of government.25

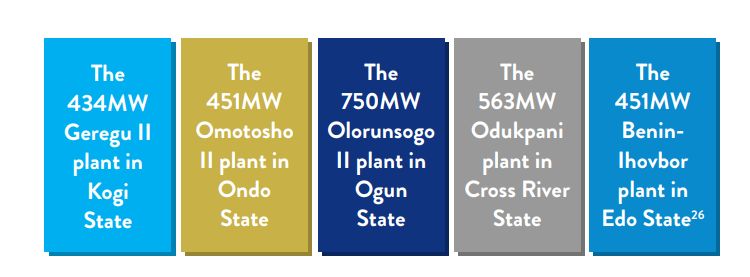

In 2022, reports indicated that the Federal and State Governments had reached an agreement to proceed with the sale of five power plants:

It was anticipated that 47% of the proceeds would be applied to funding the 2023 Federal budget, with the remaining 53% allocated to the States.27 However, as of June 2025, the process remains stalled. Reports suggest that the transaction has reached a stalemate due to uncompetitive and relatively low pricing from bidders, undermining the valuation expectations of the government stakeholders.

Transmission

a. Vandalism

In response to the escalating vandalism of transmission infrastructure, the Minister of Interior, Olubunmi Tunji-Ojo, announced in February 2025 the formation of a specialised security unit, "Power Rangers", comprising ocers of the Nigeria Security and Civil Defence Corps ("NSCDC"). 28 The initiative, inspired by the success of the Mines Marshals in the Mining Sector, is aimed at safeguarding critical electricity infrastructure nationwide.29 While an official launch date has not been confirmed, the screening and selection of officers is reportedly underway.

According to the TCN, 178 transmission towers were vandalised in the first half of 2025 alone, exceeding the record numbers reported in 2024.30 Incidents were more concentrated in Bayelsa, Rivers, Abia, and Kano States.31 The General Manager of Transmission Services at TCN attributed the attacks to a mix of economic hardship, political sabotage, and criminal activity,32 which have led to prolonged outages and disrupted eorts to stabilise and expand the transmission network. TCN is reported to have intensified eorts in collaboration with the Oce of the National Security Adviser33 to secure critical infrastructure. Pilot schemes are being developed to deploy state-of-the-art monitoring technology in vulnerable locations. In addition, media campaigns and community engagement initiatives are ongoing to raise awareness and strengthen local cooperation against vandalism.34

To view original Tope Adebayo article, please click here.

Footnotes

1. https://nairametrics.com/2025/04/17/power-sector-revenue-surges-by-n700-billion-in-2024-hits-record-70-growth-minister-adelabu/ (Last accessed June 21, 2025)

2. https://dailytrust.com/n457bn-debt-right-of-way-aecting-electricity-transmission-tcn/#google_vignette (Last accessed June 22, 2025)

3. https://nerc.gov.ng/wp-content/uploads/2025/03/2024_Q4-Report.pdf (Last accessed June 21, 2025)

4. https://punchng.com/nigeria-hits-record-5543mw-power-generation/ (Last accessed June 21, 2025)

5. https://www.linkedin.com/posts/nercng_nerc-operationalperformance-powerplants-activity-7341368654824890368-7kjS/?utm_source=share&utm_medium=member_desktop&rcm=ACoAADEtokQBRzeQ WuiwYTocV6N5sJ82keD1buY (Last accessed June 21, 2025)

6. Ibid

7. Ibid

8. https://www.linkedin.com/posts/nercng_nerc-operationalperformance-powerplants-activity-7341368654824890368-7kjS/?utm_source=share&utm_medium=member_desktop&rcm=ACoAADEtokQBRzeQWuiw YTocV6N5sJ82keD1buY (Last accessed June 21, 2025)

9. https://nerc.gov.ng/wp-content/uploads/2025/03/2024_Q4-Report.pdf (Last accessed June 21, 2025)

10. Ibid

11. https://punchng.com/nigeria-loses-over-n2bn-annually-to-poor-power-supply-undp/ (Last accessed June 21, 2025)

12. https://www.vanguardngr.com/2025/04/how-nigeria-loses-28-of-generated-electricity-adoghe-cu-don/ (Last accessed June 21, 2025)

13. https://www.channelstv.com/2025/06/03/presidency-to-pay-%E2%82%A62tn-from-%E2%82%A64tn-electricity-debts/#:~:text=The%20Federal%20Government%20in%20February, over%20N4%20trillion%20in%20debt.&text=A%20file%20photo%20of%20electricity,supplied%20to%20the%20national%20grid. (Last accessed June 21, 2025)

14. https://punchng.com/fgs-electricity-debt-balloons-by-n800bn-senate/ (Last accessed June 21, 2025)

15. https://businessday.ng/market-intelligence/article/nigerias-power-crisis-deepens-as-geregu-transcorp-gas-debts-hit-n216bn/ (Last accessed June 21, 2025)

16. https://www.vanguardngr.com/2025/06/electricity-transmission-companys-debt-rises-to-n457bn/ (Last accessed June 21, 2025)

17. Ibid

18. https://punchng.com/n2-7tn-debt-fg-intervention-halts-gas-supply-cut/ (Last accessed June 21, 2025)

19. Ibid

20. http://channelstv.com/2025/06/03/presidency-to-pay-%E2%82%A62tn-from-%E2%82%A64tn-electricity-debts/ (Last accessed June 21, 2025)

21. https://www.arise.tv/fg-begins-talks-with-gencos-over-%E2%82%A64tn-debt-vows-urgent-payment-to-avert-sector-collapse/ (Last accessed June 21, 2025)

22. https://kadunaelectric.com/power-generation-nmdpra-slashes-gas-price-for-gencos/#:~:text=However%2C%20in%20a%20new%20document%20titled%20'Announcement,at%20the%20rate%20of%20$2.13 %20per%20MMBTU.&text=For%20the%20commercial%20sector%2C%20the%20DBP%20is%20put%20at%20$2.63%20per%20MMBTU. (Last accessed June 21, 2025)

23. Ibid

24. https://www.thisdaylive.com/2017/10/09/fg-approves-sale-of-three-nipp-gencos/ (Last accessed June 22, 2025)

25. Ibid

26. https://punchng.com/govs-fg-agree-on-nipps-sale-to-fund-budgets/ (Last accessed June 22, 2025)

27. Ibid

28. https://persecondnews.com/2025/02/14/fg-launches-power-rangers-to-protect-power-installations/#:~:text=Nigeria's%20Minister%20of%20Interior%20Olubunmi,and%20infrastructure%20across%20the% 20country. (Last accessed June 22, 2025)

29. Ibid

30. https://dailypost.ng/2025/06/20/178-transmission-towers-vandalised-within-six-months-tcn/ (Last accessed June 22, 2025)

31. Ibid

32. Ibid

33. Ibid

34. Ibid

To view original Tope Adebayo article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.