- in United States

Introduction

Pursuant to the Oil and Gas Companies (Tax Incentives, Exemption, Remission, etc.) Order, 2024 ("Fiscal Incentives Order"), the Minister of Finance (the "Minister"), on October 3, 2024, issued a Notice of Tax Incentives on Deep Offshore Oil and Gas Production (the "Notice"). In our previous client alert on the Fiscal Incentives Order (Click to Access), we had noted that the Minister was to introduce definitive fiscal incentives for deep water oil and gas projects, and it is on this basis that the Minister has now issued the Notice.

Given the huge amount of investments required for the development of oil and gas projects in the deep offshore and the stiffer competition between host petroleum nations for the shrinking foreign investment capital available to fund fossil fuel projects in this era of decarbonisation, these incentives have been introduced to improve the ranking of Nigeria's deep offshore fields as the preferred investment destination for the limited pool of available capital. These incentives are part of a broader set of policies being driven by the President of the Federal Republic of Nigeria, and led by the Office of the Special Adviser to the President on Energy to reform the oil and gas industry.

This Client Alert provides an overview of the fiscal incentives contained in the Notice and highlights key aspects that are relevant to operators and potential investors in deep offshore oil and gas projects in Nigeria.

Tax Credit Incentives to Support Deep Offshore Developments

Crude Oil Developments

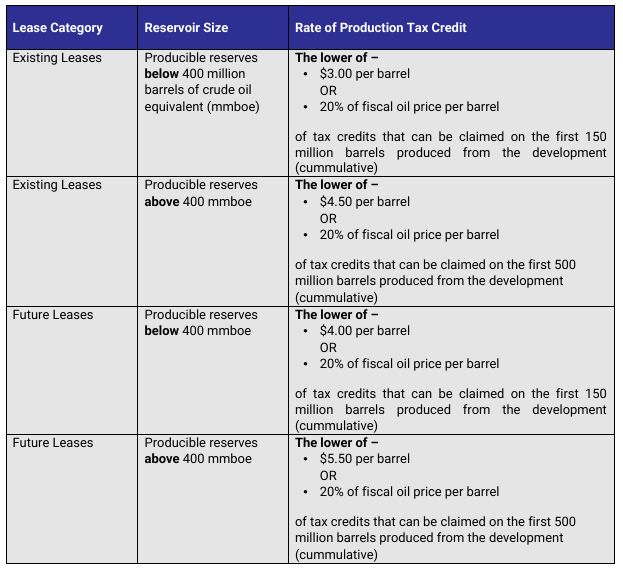

The Notice provides the following production tax credits on crude oil production:

Non-Associated Gas (NAG) Developments

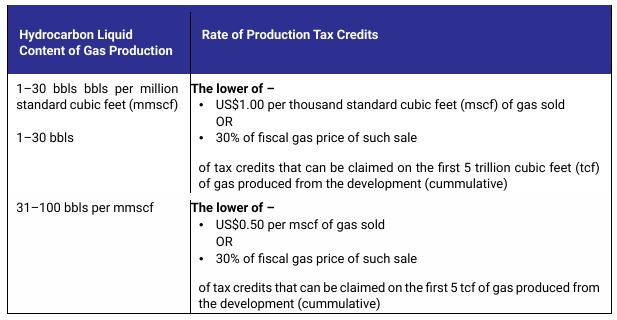

NAG developments will benefit from the following production tax credits:

Conditions Attached to the Tax Credit Incentives

- These tax credits apply to new field developments: field activities geared at implementing approved upstream field development plans to commence petroleum production, within current and future deep offshore leases (lease areas with petroleum operations in excess of 200 metres water depth). These particular tax incentives are not available to existing fields that have been developed or acreages in shallow waters or onshore.

- Only the developments that reach Final Investment Decision (FID) on or before January 1, 2029 will be entitled to the full extent of the tax credits otherwise such developments will only be eligible for half the value of the tax credits on offer. This timeline indicates that the government is offering a premium for speedy development of deep offshore assets.

- Only deep offshore assets with production/profit sharing contracts that have the Nigerian National Petroleum Company Limited (NNPCL) participating, qualify for these incentives. Presumably, these incentives help improve the economics of the development despite the participation of NNPCL in sharing profits of such development.

- Only parties that are funding the development enjoy the benefit of the tax credits on the production arising from the development.

- To enjoy the full extent of the tax credits on the relevant production, the operators must achieve cost efficiency targets set by the Nigerian Upstream Petroleum Regulatory Commission (the "Commission") on an annual basis, if not, the value of the tax credits will be reduced by 10%.

- The tax credit incentives cannot be combined with Associated Gas Framework Agreement incentives captured in the Petroleum Profit Tax Act or the production allowances already provided in the 6th Schedule of the Petroleum Industry Act, 2021.

- For crude oil production tax credits, where the crude oil price drops below $50 per barrel, the rate of the credits across board, will reduce by 50%.

- Surplus or unutilized production tax credit can be carried forward to the subsequent year, but the credits can only be carried forward for a maximum of three years.

Sharing Formula for Profit Gas in PSCs with NNPCL

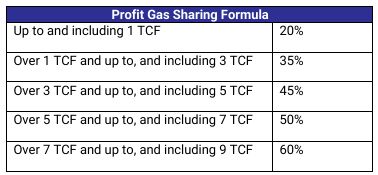

The notice also provides guidance to NNPCL on the baseline profit gas split it should negotiate for the Federal Government in its gas terms with PSC contractors developing NAG projects in the deep offshore:

The above baseline, gives potential investors in such developments clarity as to their best case profit split with the government. This clarity should help PSC parties conclude gas terms quicker and pave the way for FIDs to be taken on such developments.

Conclusion

The introduction of these tax credits for deep offshore oil and gas assets is a significant step towards stimulating investment in Nigeria's oil and gas sector in the near to mid-term. The success or otherwise of this initiative will be largely dependent on the assessments carried out by existing and potential investors in Nigeria's deep offshore PSCs in determining whether these tax credits are sufficient to generate the required economic returns.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.