- within Wealth Management topic(s)

- within Criminal Law topic(s)

KEY TAKEAWAYS

- On 26 June 2025, ESMA published its keenly awaited technical advice to the Commission on the review of the UCITS Eligible Assets Directive 2007/16/EC (EAD).

- The report assesses EAD implementation across member states and makes a number of proposals, including the application of a look-through approach for determining the eligibility of asset classes.

- If implemented, ESMA's proposed legislative updates to the EAD and UCITS Directive could have a significant impact on UCITS product rules.

- The Commission is not bound by ESMA's proposals and there is a strong likelihood that it will issue its own Call for Evidence in due course before finalising the legislative proposal.

On 26 June 2025, ESMA published its final report providing technical advice to the European Commission (the Commission) on the review of the Commission Directive 2007/16/EC on UCITS Eligible Assets (the EAD) (the Technical Advice). The Technical Advice was mandated by the Commission in June 2023, as detailed in our previous advisory on the topic and follows responses received to ESMA's call for evidence (CfE) and a comprehensive survey and data collection exercise carried out with national competent authorities (NCAs).

Against the backdrop of evidence of divergences occurring between member states on the implementation and practical application of the EAD, the Technical Advice proposes a number of clarifications of various key concepts and definitions included in the EAD and Directive 2009/65/EC, as amended (the UCITS Directive) concerning the criteria for the UCITS eligibility of various asset classes. It also includes considerations and proposals to clarify cross-references and concepts including aspects of the transferable securities criteria to promote better alignment with other EU legislative regimes, such as Directive 2014/65/EU (MiFID II).

ESMA's proposed legislative updates to the EAD and UCITS Directive are included in Annex VI of the Technical Advice which, if implemented, could have a significant impact on UCITS product rules.

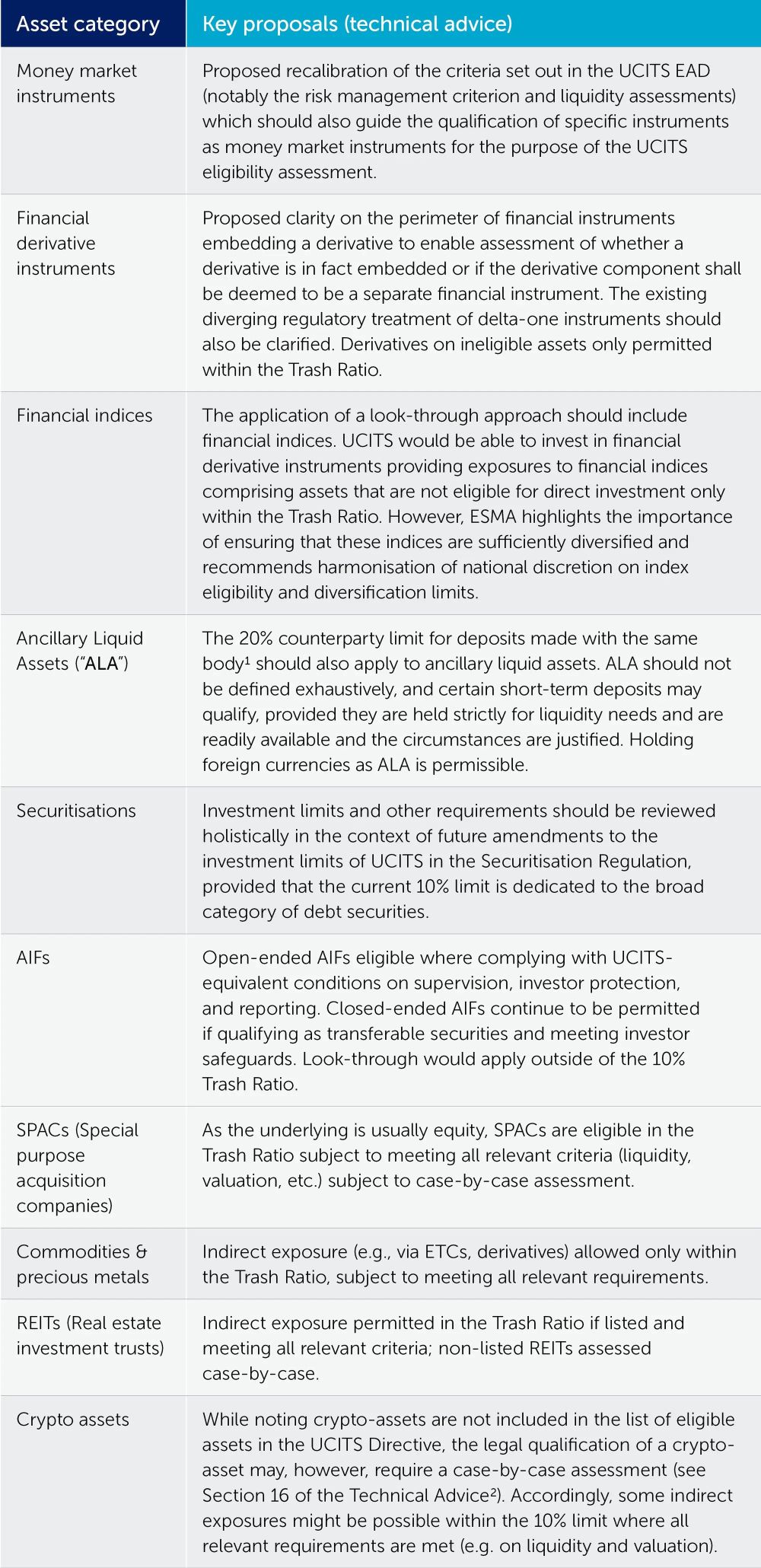

Key proposals

Look-through approach (indirect exposure)

A central element of the Technical Advice proposed by ESMA is the application of a stricter look-through approach as a fundamental criterion for determining the eligibility of securities, meaning that asset classes across 90% of the UCITS portfolio should not be backed by, or linked to the performance of, other assets which may differ from those allowed for direct investment.

The proposal is intended to alleviate the risk of allowing UCITS to gain significant exposures to ineligible assets (e.g., by using delta-one instruments, exchange-traded notes or exchange-traded commodities (ETCs) providing exposures to alternative assets) which could otherwise have the effect of blurring the lines between UCITS and AIFs.

A number of respondents to the CfE highlighted the benefits of investments in commodities, catastrophe bonds and crypto-assets (see Technical Advice, Annex IV for an overview of data collected and ESMA's risk/economic analyses in this respect). However, conceptually, ESMA is of the view that large-scale investments in such alternative assets with their idiosyncratic risks would be more appropriately situated under the AIFMD framework given its more suitable risk management, valuation and safekeeping provisions for such asset classes. ESMA also points out that that the EAD (Level 2) cannot expand the list of eligible assets set out in the UCITS Directive (Level 1) and therefore, legislative amendment would be required to the UCITS Directive to accommodate such alternative asset classes. ESMA is of the view that any such expansion or restriction of the list of directly eligible asset classes would need to be carefully assessed in a future separate workstream.

Article 50(2)(a) 10% Limit (Trash Ratio)

Article 50(2)(a) of the UCITS Directive currently limits a UCITS to not invest more than 10% in aggregate of its assets in transferable securities and money market instruments which do not meet the UCITS eligibility requirements as detailed in Article 50(1) (i.e. they are not admitted to or dealt in on a regulated market which operates regularly and is open to the public).

Allowing a certain degree of flexibility and with a view to improving risk diversification and generating returns from uncorrelated asset classes, the Technical Advice proposes to permit within the Trash Ratio indirect exposures to otherwise ineligible assets (known as 'alternative assets') of up to 10%, subject to meeting other relevant eligibility criteria conditions and criteria set out in the EAD for the eligibility of the asset class (e.g. on risks, liquidity or valuation). UCITS will need to assess the liquidity of all transferable securities including those acquired under the 10% limit. The assessment should be done both at asset level and portfolio-level.

ESMA proposes the Trash Ratio should also be extended to all eligible asset classes listed in the UCITS Directive, including financial derivative instruments and units or shares of open-ended AIFs. Investments made under this 10% limit would be exempted from the look-through approach.

ESMA highlights the importance of ensuring adequate disclosures to investors for all exposures, especially those within the Trash Ratio, ensuring that retail investors are able to understand the benefits and risks associated with the envisaged investments and how those risks are managed.

Additional recommendations

Liquidity

ESMA sees merit in not presuming the liquidity and negotiability of listed instruments which should be assessed ex-ante and on an ongoing basis.

ESMA also proposes amending the legal text to clarify that the liquidity assessment to determine the eligibility of individual assets is to be distinguished from the broader liquidity risk management at portfolio level.

Convergence of eligibility interpretation

ESMA carried out a survey to understand the level of convergence regarding the UCITS eligibility of relevant asset classes. Annex III to the Technical Advice provides an overview of the current diverging NCA positions on UCITS eligibility of relevant asset classes.

In order to promote harmonisation and convergence in practice

and to reduce technical complexities for firms, ESMA invites the

Commission to use directly applicable EU regulations in the UCITS

space (as done in other areas of financial law), as opposed to the

current legislative approach of using minimum harmonisation

directives.

Retail AIF products

Against the backdrop of the EU's ambitions to create an EU Savings and Investment Union and to in turn alleviate the concerns raised regarding the adverse impacts of applying a look-through approach, ESMA sets out high level considerations for improving retail investor access to EU AIFs. Subject to analysis in a future workstream, these include harmonising currently divergent national rules on the distribution of AIFs to retail investors and the potential creation of a new harmonised EU retail AIF product dedicated to investments in those asset classes that would be deemed not eligible under the proposed revised UCITS framework.

The retail AIF product could enable investors to safely access the desired investment strategies and products within another sound regulatory framework with adequate investor protection safeguards tailored to the product-specific risks, as opposed to accessing them via unregulated or less-regulated products. Such an AIF product might address the potential investor demand for a "semi-liquid" product situated between UCITS and ELTIF, e.g. focused on private market or (re)insurance-type of asset classes

Timing and next steps

The Commission will now commence its review of ESMA's proposals to ascertain whether any proposed amendments are required to the EAD and/or the UCITS Directive. It is expected that ESMA will cooperate closely with the Commission during the course of its review. The Commission is not bound by ESMA's proposals and there is a strong likelihood that it will issue its own consultation or CfE in due course to canvass broader stakeholder opinions before finalising the legislative proposal.

As part of the Technical Advice, ESMA recommends granting a sufficiently lengthy transitional period to allow UCITS products adequate time to comply with any updated requirements and advises against grandfathering to avoid any further division of the UCITS brand. During this transitional period, ESMA anticipates that UCITS products would reduce their exposure to ineligible asset classes or convert into an AIF product.

Footnotes

1 Article 52(1)(b) of the UCITS Directive

2 Noting a case-by-case analysis may lead to a conclusion of eligibility taking into account the following: (1) the qualification as a financial instrument under MIFID II (and, where relevant, other EU acts such as the AIFMD); (2) the instrument meeting the criteria and conditions set out in the UCITS Directive and in the EAD for being an eligible asset; (3) the UCITS being able to comply with all the requirements set out in the UCITS Directive and other regulations applicable to it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]