- within Law Department Performance, Antitrust/Competition Law and Family and Matrimonial topic(s)

NEW SUMMARY APPROVAL PROCEDURE

The Companies Act 2014 (the "Act") came into operation on 1 June 2015 and has introduced significant reforms in company law in Ireland. One of the key innovations is the summary approval procedure ("SAP"), a new streamlined process for the authorisation of up to seven different types of activities that would otherwise be prohibited or, in some cases, require a High Court order.

PROHIBITION ON FINANCIAL ASSISTANCE

Section 82 of the Act prohibits any Irish company from directly or indirectly providing financial assistance for the purpose of an acquisition (by subscription, purchase, exchange or otherwise) of shares in itself or in its holding company. Section 82 can be breached by providing financial assistance by way of a loan, guarantee, security or otherwise and such assistance is not lawful unless exempted, or validated using the SAP. The SAP is only available to private limited companies, designated activity companies or companies limited by guarantee. Notably it may not be used by a "private limited subsidiary" of a public company in relation to the acquisition of shares in its parent public company.

VALIDATION OF FINANCIAL ASSISTANCE USING THE SAP

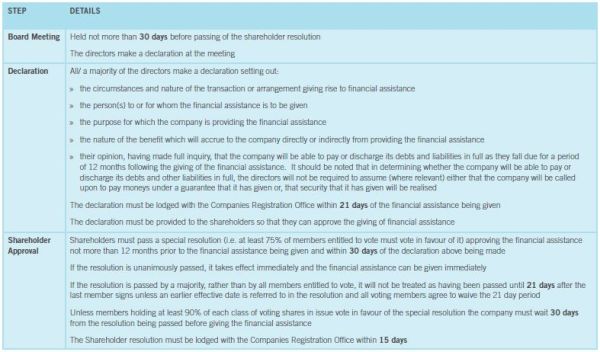

To validate the giving of financial assistance by SAP, certain steps must be taken by the company:

FINANCIAL INFORMATION

An accountant or auditor's report is not required for the financial assistance SAP. However, given the potential liability for directors in carrying out a SAP (discussed below), directors will require financial information on which to base their declaration and, in particular, projections for a 12 month period.

PERSONAL LIABILITY

Where a director makes a declaration without reasonable grounds for the opinion as to the solvency of the company, the director may be found to be personally liable for all of the debts of the company. If the company is wound up within 12 months of the date of the declaration and its debts are not paid or provided for within 12 months of the winding up commencing, it will be presumed, until the contrary is shown, that each director who made the declaration did not have reasonable grounds for doing so.

Practical steps that can be taken by the directors to support their opinion include the review at board level of projected cash-flow and working capital for the coming 12 months (at a minimum).

Transactions in breach of Section 82 are voidable at the instance of the company against any person who had notice of the facts constituting the breach.

CONCLUSION

The revisions to the treatment of financial assistance brought about by the Act have been largely welcomed. Section 82(5) of the Act clarifies that financial assistance in relation to the acquisition of shares in a company or its holding company is not prohibited if the company's principal purpose in giving the assistance is not to give it for the purpose of any such acquisition. This has brought transactions which in the past, might have been "whitewashed" as a precautionary measure outside the scope of the prohibition. The changes to the wording of the refinancing exemption have also been helpful for companies and their advisors. In addition, the fact that directors will not be required to assume (where relevant) either that the company will be called upon to pay moneys on foot of a guarantee given or, that security given will be realised in determining its solvency is informative and helpful.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.