Foreword

The increased focus on the quality of governance on hedge fund boards comes as a direct result of higher levels of institutional investment in hedge funds coupled with the higher governance standards that they require post- 2008. In addition, the pace of globalisation is relentless, and as a consequence we are seeing investors asking for solid and consistent governance standards that can be replicated across the hedge funds industry, regardless of domicile.

The publication of this research paper comes at a time when the investor community is becoming energised about the standards of board-level governance on hedge funds. As institutions seek to increase their allocations to hedge fund strategies, they are also seeking to ensure that high levels of governance, oversight and responsibility exist and are consistent with global governance standards.

The standards that investors who participated in this survey are asking for are neither costly nor complex to implement. But they do represent a new level of focus on their part of governance issues, and a quest for robust standards that can be applied to all hedge fund boards.

As a major allocator told me: "A manager with a good board is more likely to handle a difficult situation with aplomb and more likely to retain investors' favour and capital. Hence, they have a higher likelihood of long term success and wealth creation for their investors and themselves."

We at Carne would like to extend our thanks to all the allocators that gave freely of their time and opinion in the compilation of this white paper. We hope this will form the basis for further discussions on the issues raised, and add a more statistically informative platform for debate.

Contents:

Section

1. Introduction and Executive Summary

2. Universe of Respondents

3. Importance of Corporate Governance Standards

4. Rating of Corporate Governance

5. Areas Requiring Improvement

6. Minimum Standards of Board Composition and Oversight

7. Transparency and Conflicts of Interest

8. Partnership Fund Structures

Appendix A: Participating Firms

Appendix B: Action Points Derived From Survey

Appendix C: Weavering Judgement: Implications for Investment Managers and their Employees acting as Directors on Funds

Appendix D: Transparency Report

Introduction and Executive Summary

This research paper represents the most comprehensive survey to date of institutional hedge fund allocators' views on the issue of corporate governance in hedge funds. Hedge fund governance is an issue that has increased in importance since 2008, with allocators now actively pressing for changes in the way that hedge fund boards are managed.

The call for changes in the way that hedge fund boards are constituted, and in the role played by directors on those boards, is becoming increasingly evident in both the trade press, and in the opinions being expressed by investors in the various forums open to them.

Moody's, in its recent note on fund governance, said:

"Corporate governance practices for hedge fund firms are more closely examined today than at any other time in the history of the industry...hedge funds firms have experienced a shift in their investor composition from high net worth individual investors to institutional investors...Institutional investors have shown that they view the evaluation of governance and oversight as it relates to risk management, valuations, operational controls, transparency and the investment process as important as analysing a hedge fund manager's investment performance." 1

In addition, investors have been lobbying individual fund managers and regulators, including the Cayman Islands Monetary Authority, for change. At a time when investors are already keen to increase their allocations to hedge funds, it is becoming evident that the governance issue is acting as a drag on the flow of new investment into hedge funds. The majority of hedge fund investors want hedge fund managers to fully support investor protection values. The recent judgement by Justice Jones in the Cayman Islands relating to the Weavering case 2 also shed light on some of the expectations which the judiciary have of directors on fund boards. These include the onus on the directors to perform their duties on behalf of the investors, including demonstrating a solid awareness of the underlying activities of the fund and its investment manager. In his judgement, Justice Jones expected that investment managers and boards of Cayman Islands funds should ensure that they put in place adequate governance processes, and that any conflicts of interest are addressed. Directors, the case revealed, need to be remunerated for the work they perform, but at the same time they must be performing that work.

The Weavering case analysed the motivations of the directors as well as their actions. An obvious conclusion is that, due to potential conflicts, investment managers and the employees from their firms acting as directors on their funds [see Appendix C], require independent directors in order to demonstrate that the interests of investors can be considered and that this is properly analysed and documented. However, these independent directors must meet Justice Jones' criteria of fit and proper directors.

The changes being called for in hedge fund governance represent an opportunity for hedge fund managers themselves to seize the initiative, and to help to build new bridges with the investor community, while at the same time improving the overall image of the alternative investments industry. It is an initiative that is being increasingly supported by regulators, by the Alternative Investment Management Association (AIMA), by the Hedge Funds Standards Board (HFSB), and by other industry-level associations.

This is further encapsulated by new layers of the operational due diligence process applied to potential new investments, as evidenced in the recent Transparency Report questionnaire compiled jointly by a number of major allocators [see Appendix D]. This represents a good indicator of the levels of awareness investors are now seeking about the boards of the funds they invest in, and the credibility of firms providing independent directors to those boards.

Although the hedge funds industry continues to achieve some of the best risk-adjusted returns of any single component of the asset management sector over the last five years, it still suffers from an image problem. This industry is deserving of a better reputation, a reputation which can only be enhanced if fund managers take the opportunity to assure investors via improved governance. Pension funds, for example, continue to treat hedge funds with caution, and would no doubt be more enthusiastic if they could see that not only do hedge funds generally offer them superior returns on a risk adjusted basis when compared to investment in traditional funds, but also offer higher governance standards. Good governance can help here, by improving the culture of the industry and demonstrating that hedge funds can reduce downside risk and protect investors' capital.

Hedge funds are also coming under greater scrutiny from regulators. Better governance standards may help to mitigate some of this. As Amelia Fawcett, Chairman of the Hedge Fund Standards Board (HFSB) said: "Standards don't replace regulators, but they can do things they can't. Can standards be more effective than regulations? Absolutely." 3

Some institutional investors devote substantial amounts of time and money doing their own due diligence, to provide themselves with adequate oversight, some of which should also be delivered by the directors of fund boards.

The case for good governance is compelling: an industry-wide governance regime would reduce risk for both investors and investment managers at a time when they are seeking to trim down the number of risk factors they have to deal with. Carne believes that this research paper can form the basis for such governance standards, and represents the opinions of institutional investors.

Executive Summary

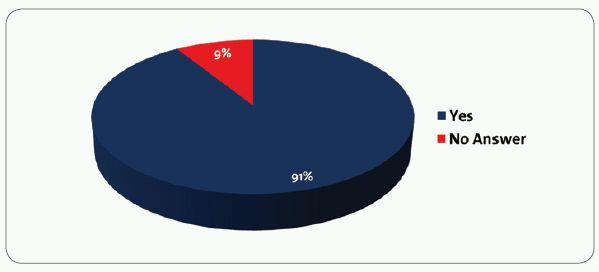

- 91% of allocators agree that poor governance would cause them to avoid investing in a fund, even if it met other operational and performance criteria

- Allocators would like to engage with managers and boards on a more regular basis on the issue of governance

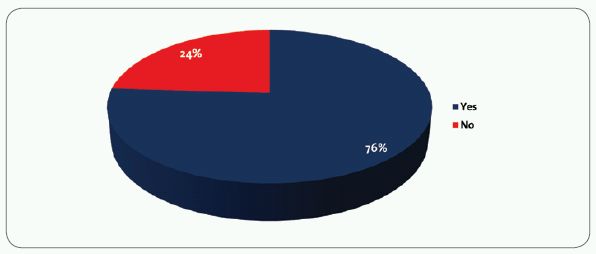

- 76% of allocators have already decided against investing on at least one occasion due to governance concerns

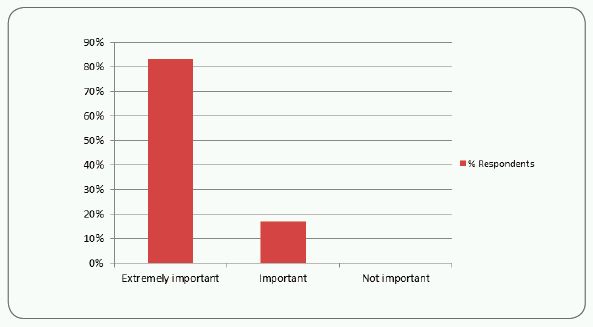

- Over 80% of investors rate fund governance as "extremely important"

- The majority of allocators are unhappy with the current governance levels of Cayman Islands funds and want improvements

- 80% of allocators have experienced difficulty in discovering how many directorships are held by independent directors on fund boards

- Allocators overwhelmingly agree that the issue of the number of total directorships held by certain independent directors must be addressed

- 58% of investors interviewed for this study said that an independent director should have no more than 20 to 30 manager relationships

- Of those allocators satisfied with the current governance regime, many stated that this is because they are carrying out ongoing due diligence independently of fund boards and place reduced reliance on the boards

- Allocators are more content with governance levels on fund boards promoted by European fund managers than North American or Asia Pacific managers

- 87% of allocators would like to see the majority of fund boards' membership held by independent directors and 80% want to see independent directors filling the role of chairman

- Defining independence and identifying conflicts of interest of directors is a key issue for investors. The relative independence of directors related to the fund's administrator or legal advisor becomes more of an issue for investors if they are the only independent directors on the fund board, due to potential conflicts.

2. Universe of Respondents

Over the spring and summer of 2011, Carne Group surveyed the largest allocators to hedge funds globally. We have approached the top 100 allocators globally, and are pleased to have received responses from allocators accounting for over $600 billion in allocations, approximately 30% of all hedge fund AuM. We have been very grateful for their candid views on the subject. A list of some of the firms responding can be found in Appendix A.

Due to the global spread of both their investments and their investment operations, it was difficult in most cases to categorise the allocators by region, but we were able to evaluate the universe by type of investor, and by hedge fund assets under management.

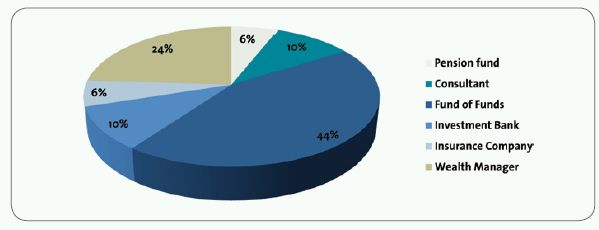

Respondent by type

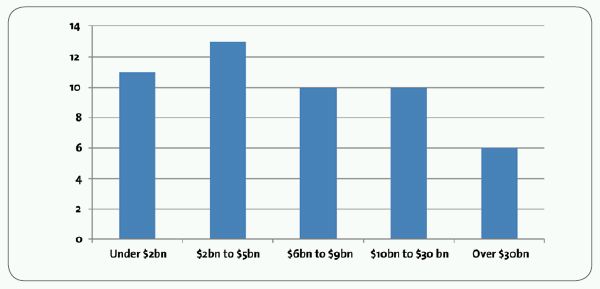

Respondents by assets invested in hedge funds

3. Importance of Corporate Governance Standards

83% of respondents considered corporate governance in hedge funds to be "extremely important." For all the investors we interviewed, the issue was currently top of their operational agenda.

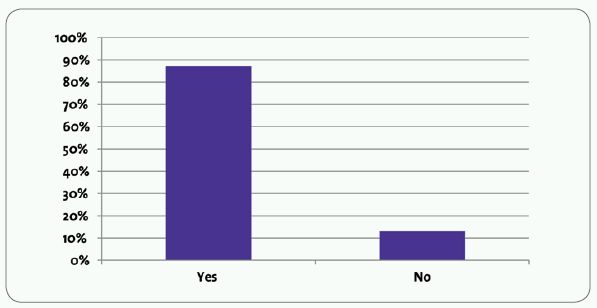

Have you ever decided not to invest because of concerns over a fund's corporate governance?

A very high proportion of hedge fund allocators have, at some point, chosen against investing in a fund because of corporate governance concerns. This represents a significant proportion of investment capital that has been lost by deficiencies which include poor corporate governance arrangements.

Would you choose not to invest as a result of poor corporate governance on a hedge fund?

This clearly demonstrates the importance of solid corporate governance arrangements for hedge funds so that they can continue to attract capital, particularly from new investors. No allocators have said they would invest in a fund with poor corporate governance. We can surmise that those managers with ambitious growth plans going forward should address this issue so that they can fulfil them.

Has fund governance become more of an issue for you in the last three years?

87% of allocators said that governance had become much more of an issue since 2008. This has partly been driven by increased concerns surrounding the independence and involvement of fund directors in the wake of the problems experienced by some hedge funds in 2008-09.

In addition, while other areas of operational risk have been addressed in the interim, allocators are more aware of corporate governance as an outstanding issue on their operational risk agendas.

4. Rating of Corporate Governance

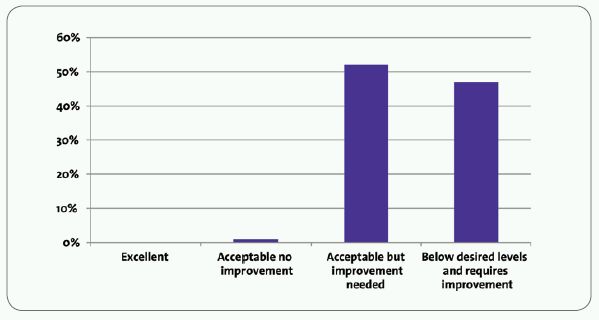

How do you rate the average standard of fund corporate governance in the hedge fund industry?

Not surprisingly, almost all allocators want to see improvement in the prevailing average standards of corporate governance in the hedge funds industry. Again, it is worth stressing that where allocators find the situation "acceptable", they have said that this is partly because they are spending time and resources in carrying out their own due diligence and receiving regular information from the manager.

Footnotes

1. Hedge Fund Governance and Oversight, Moody's Investor Service, July 2011

2. Weavering Macro Fixed Income Fund Limited (in liquidation) vs Stefan Peterson and Hans Ekstrom.

To view this article in full together with its remaining footnotes please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.