INTRODUCTION1

The Indian Mergers and Acquisitions are growing exponentially. Not only are foreign investors entering corporate India, but also, Indian entrepreneurs are eyeing foreign acquisitions. The liberalization of Indian economy which commenced sometime in early nineties, gave a great amount of boost to mergers and acquisitions. M&A is the buzzword amongst top Corporate Houses as everyone has become conscious of competitiveness and scalability. The restructuring of businesses and/or companies have resulted in long lasting benefits due to enhancement of competitiveness and sustainability. The globalization has opened floodgates for various international players to enter the Country and at the same time many Indian companies have gone ahead and acquired companies abroad. Investors have become more active in protecting their value. Any transaction of purchase/ sale of business/ companies require determination of fair value for the transaction to satisfy stakeholders and/or Regulators. Business valuation is an unformulated and subjective process. Understanding the finer points of valuing a business is a skill that takes time to perfect. There are various methodologies for valuing a business, all having different relevance depending on the purpose of valuation.

PURPOSE OF VALUATION

An important concept in valuation is recognizing the intended purpose of valuation. The value often depends on its purpose.

Some of the purposes for which valuation may be required are as follows:

- Determining the consideration for Acquisition/ Sale of Business or for Purchase/Sale of Equity stake

- Corporate Restructuring

- Sale/ Purchase of Intangible assets including brands, patents, copyrights, trademarks, rights.

- Determining the value of family owned business and assets in case of Family Separation.

- Determining the Fair value of shares for issuing ESOP as per the ESOP guidelines.

- Determining the fair value of shares for Listing on the Stock Exchange.

- Determining the Portfolio Value of Investments by Venture Funds or Private Equity Funds

- Liquidation of company

- Other Corporate restructuring

The four most commonly techniques in company valuati ons are

1. Discounting cash flow technique (DCF) Analysis

2. Market Valuation

3. Comparable public company methods

4. Comparable transactions Methods

1. Discounted Cash Flow (DCF)2

DCF method proceeds on the assumption that "Cash is King". The traditional earnings related methods do not take into account the capital gearing of the enterprise, resources blocked in the Working Capital, requirements for capital expenditure, periodic tax benefits, etc.

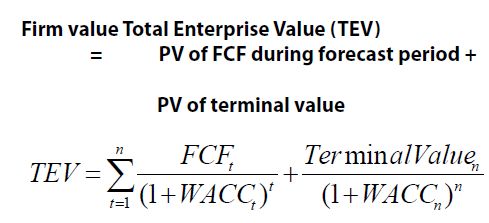

The DCF method values the business by discounting its free cash flows for the explicit forecast period and the perpetuity value thereafter. The free cash flows represent the cash available for distribution to both the owners and the creditors of the business.

- Discount FCF at WACC

Discount cash flows of the "unlevered" firm WACC uses after tax cost of debt - Adjusted Present Value (APV)

Discount cash flows of unlevered firm plus cash flows from interest tax shield Discount rate does not include interest tax Shield

Free Cash Flow (FCF)3

Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

Operating cash flow (OCF)

= EBIT (1-T) + depreciation

Where EBIT stands for Earnings before interest and tax FCF = OCF - capital spending – Change in working capital spending

Discounting FCF @ WACC

WACC stands for weighted average cost of capital

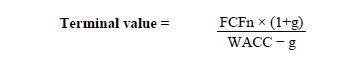

Terminal value (TV) captures the value of a business beyond the projection period in a DCF analysis, and is the present value of all subsequent cash flows.

Terminal value can be estimated as:

- Multiple (of EBITDA, or final year's FCF)

- Growing perpetuity

2. Market Value4

This valuation method is applicable for quoted companies only. The market value is determined by multiplying the quoted share price of the company by the number of issued shares. This valuation reflects the price that the market at a point in time is prepared to pay for the shares. This valuation method broadly takes into account the investors' perceptions about the performance of the company and the management's capabilities to deliver a return on their investments.

3. Comparable Public Company Method5

Public markets are generally considered efficient at valuing companies. Each day, stock prices reflect the instantaneous and independent pricing decisions of buyers and sellers around the world. Thus, using existing public companies as a benchmark to value similar private companies is a viable valuation methodology. The comparable public company method involves selecting a group of publicly traded companies that, on average, are representative of the company that is to be valued. What is important is that investors would view the comparable companies and the target company as similar. Each comparable company's financial or operating data (like revenues, EBITDA or book value) is compared to each company's total market capitalization to obtain a valuation multiple. An average of these multiples is then applied to derive the company's value. If several metric multiples are used, professionals will often weigh each metric based on the relative importance of the metric in the valuation of the company.

Because the comparable public companies will have different characteristics than the firm undergoing the valuation, premiums or discounts may be applied to the target company. These valuation premiums or discounts are based on generally accepted research and empirical data and involve such adjustments as discounts for lack of marketability or control premiums. Unlike public companies, privately held firms do not have an actively traded market for their shares. This significant factor, referred to as liquidity or marketability, will result in private companies almost always being valued at a discount to their public company peers.

4. Comparable Transactions Analysis6

Comparable transactions analysis involves obtaining financial and operating data from other, similar transactions and applying it to the target company to obtain a predicted value. These historical transactions involve companies that have similar lines of business as the company being valued. In analyzing comparable transactions, valuation professionals will often divide deal price by some industry standard metric, such as EBITDA, or number of subscribers. An average or the median of the resulting multiples is then multiplied by the target company's metrics to obtain a company valuation.

Depending upon the relative similarity or difference of the target company's characteristics to the group of comparable transactions, analysts may apply a discount or premium to the multiple before it is multiplied by the target company's metrics.

Although comparable transactions analysis can be an important valuation methodology, its usefulness is dependent on the relevance, quality and timeliness of historical transactions data. In addition, due to the fact that the overwhelming majority of acquisitions involve privately-held companies, there is often a dearth of financial data available to track the financial characteristics of these transactions.

Footnotes

1 http://wirc-icai.org/wirc_referencer/Income%20Tax%20&%20Wealth%20Tax/Valuation_of_Business.htm

2 http://wirc-icai.org/wirc_referencer/Income%20Tax%20&%20Wealth%20Tax/Valuation_of_Business.htm

3 http://www.investopedia.com/terms/f/freecashflow.asp

4 http://www.secondventure.com/business-valuationmethods.asp

5 http://www.bizquest.com/resource/valuation_methodologies-18.html

6 http://www.bizquest.com/resource/valuation_methodologies-18.html

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.