- within Corporate/Commercial Law topic(s)

- with readers working within the Law Firm industries

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Oil & Gas and Securities & Investment industries

June 2025

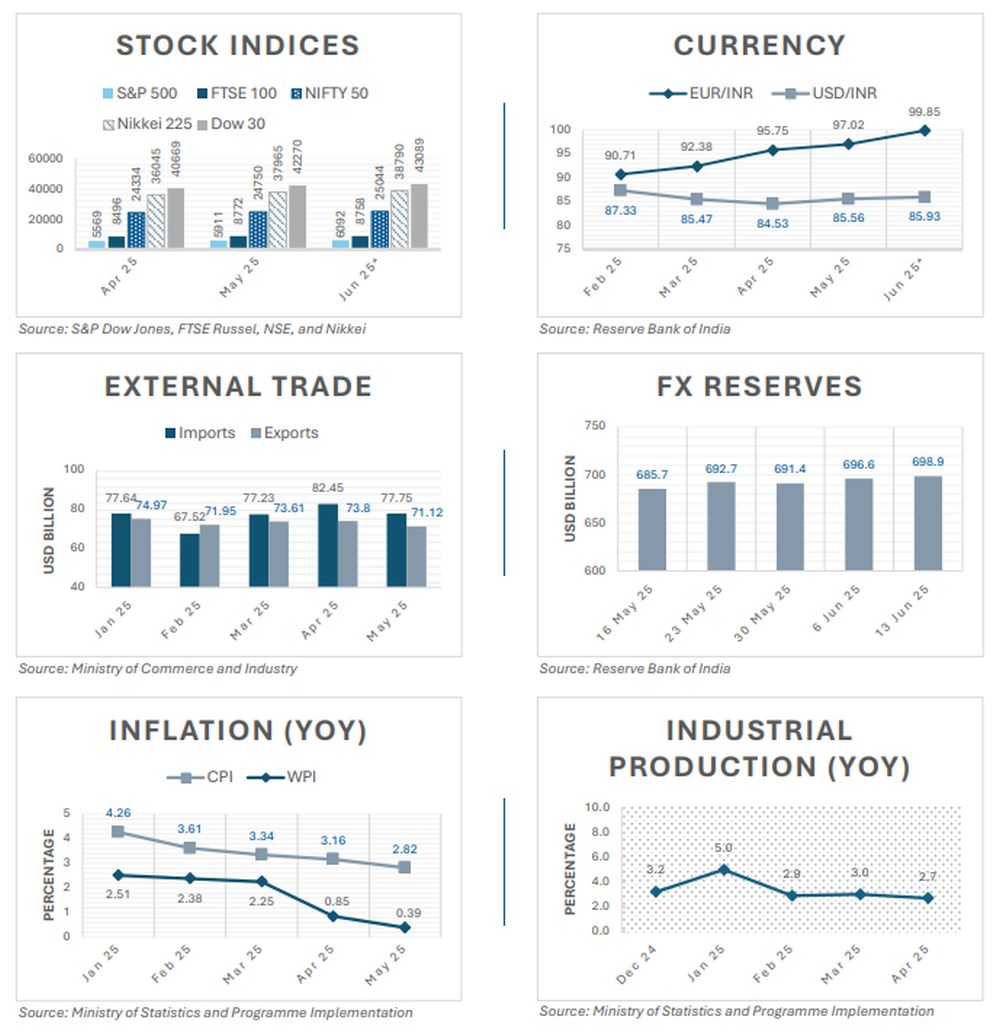

Indian economy | Snapshot of key indicators

HIGHLIGHTS

- Real GDP rose by 7.4% in Q4 FY 2024-25 and is projected to grow by 6.5% in FY 2025-26. For South Asia, however, after an unexpectedly weak performance of 6.0% in 2024, growth is expected to soften further to 5.8% in 2025 amid increasing uncertainty in the global economy, before ticking up to 6.1% in 2026

- In May 2025, CPI inflation (2.82%) and CFPI inflation (0.99%) were the lowest since February 2019 and October 2021, respectively. Highest inflation was seen in gold (32.21%); refined oil (24.27%); mustard oil (19.61%); apple (19.33%); and silver (17.78%).

- Electronic goods (54.1%); marine products (26.79%); and tobacco (22.69%) saw the highest growth in merchandise export in May 2025.

- The top 3 positive contributors for industrial production in April 2025 were the manufacture of machinery and equipment (17%); motor vehicles, trailers and semi-trailers (15.4%); and basic metals (4.9%).

SEBI proposes a new category with streamlined rules for sovereign debt investors

Consultation paper on regulatory compliance relaxation for FPI applicants investing in Indian Government Bonds

The Securities and Exchange Board of India (SEBI) has proposed major regulatory relaxations for Foreign Portfolio Investors (FPIs) investing solely in Indian Government Bonds (IGBs), aimed at streamlining compliance and attracting greater foreign participation in India's sovereign debt market By appreciating the fundamentally diferent risk profile of sovereign bonds compared to corporate debt, the proposed framework seeks to tailor compliance requirements for IGB-focused investors. In doing so, it aligns with global regulatory best practices and reduces unnecessary burdens on long-term institutional participants.

Recognising that certain regulatory requirements prescribed for regular FPIs are not relevant for investors who invest in government bonds through the Voluntary Retention Route (VRR) and Fully Accessible Route (FAR), where traditional investment limits and monitoring requirements do not apply, SEBI has proposed the following changes:

- Introduction of 'IGB-FPI' category: Creating a specialised category called 'IGB-FPI' for FPIs that invest only in IGBs under VRR and FAR routes, which would be subject to relaxed regulatory requirements while maintaining appropriate oversight.

- Simplified Know Your Customer (KYC) requirements: Under the current framework, FPIs undergo KYC review every 1 year/3 years based on risk categorisation. Aligning KYC review cycles with Reserve Bank of India's (RBI) timelines for regulated entities, IGB-FPIs would follow extended timelines of 2 years for high-risk, 8 years for medium-risk, and 10 years for low-risk customers. This would significantly reduce compliance cost for long-term institutional investors.

- Exemption from investor group details: IGB-FPIs would be exempt from providing investor group details, which are currently required from all FPIs, for monitoring investment limits since such investment limits do not apply to VRR and FAR investments.

- Relaxed Non-Resident Indian (NRI)/Overseas Citizen of India (OCI) participation rules: Currently, NRI and OCI contributions are limited to 25% individually and 50% collectively in the FPI corpus, with further restrictions on control. For IGB-FPIs, these restrictions would be completely removed, enabling greater participation from the Indian diaspora in government bond investments.

- Standardised disclosure timelines: While current rules require material changes to be disclosed within 7 days and 30 days for Type I and Type II changes, respectively, IGB-FPIs would follow a uniform 30-day timeline for all material changes.

- Flexible transition mechanism: Presently, regular FPIs seeking to transition would need to divest all non-eligible holdings and close their trading and demat accounts before conversion. A flexible transition mechanism is proposed to enable existing FPIs to convert to IGB-FPI status and vice versa, providing operational flexibility as investment strategies evolve.

- Operational simplifications: IGB-FPIs would not be required to open traditional trading and demat accounts and obtain Custodial Participant (CP) codes. Since IGBs are primarily traded through the RBI's Negotiated Dealing System – Order Matching (NDS-OM) platform and settled through the Clearing Corporation of India Ltd (CCIL), the proposal eliminates several operational requirements that are redundant for IGB-FPIs.

The proposed amendments come at an opportune moment, amid rising global investor confidence in the Indian sovereign debt market. India's inclusion in major global bond indices – including the JP Morgan Global EM Bond Index (June 2024), the Bloomberg EM Local Currency Government Index (January 2025), and the upcoming FTSE Russell Emerging Markets Government Bond Index (September 2025) – is already reflective of significant foreign inflows, as FPI holdings in FAR-eligible IGBs increased from INR 32,411 crore in March 2021 to INR 3,06,249 crore in March 2025, representing a nearly tenfold increase. If implemented, the changes would not only deepen the government securities market but also serve as a blueprint for asset-specific regulation across India's capital markets, advancing regulatory eficiency while attracting more stable and enduring foreign capital.

MCA mandates gender- related disclosure

Companies (Accounts) Second Amendment Rules, 2025

The Ministry of Corporate Afairs (MCA) has amended the Companies (Accounts) Rules, 2014 (Rules) to promote gender-sensitive corporate governance. Efective from July 14, 2025, the amended Rules require enhanced disclosures on workplace sexual harassment and maternity benefits, as well as digitised financial reporting protocols.

Key changes introduced by the Rules

- Sexual harassment complaints: Companies must now disclose specific details related to sexual harassment complaints in their board's report, including the number of complaints received, disposed of, and pending for more than 90 days, during the financial year. This marks a significant shift from the earlier framework which only required a general statement confirming the constitution of an Internal Complaints Committee (ICC) under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (POSH Act), without mandating disclosure of complaint statistics.

- Maternity benefits compliance: Companies are required to declare compliance with the Maternity Benefit Act, 1961, including benefits such as 26 weeks of paid leave, nursing breaks, and crèche facilities. Earlier, there was no such reporting obligation.

- Gender-wise employee data: As per the revised board report format under Rule 8(3)(j) of the amended Rules, companies must disclose the total number of employees based on gender – female, male, or transgender – as on the financial year-end.

- E-forms for financial disclosures: The amended Rules also replace Forms AOC-1 and AOC-2 with e-Forms AOC-1 and AOC-2 and introduce new e-form requirements for filing board report extracts, auditor's reports, and financial statements in XBRL format (a globally recognised standard for electronically communicating business and financial data) along with AOC-4.

Even companies otherwise exempt from constituting an ICC or from extending maternity benefits, due to statutory employee thresholds, must include a statement of compliance or non-applicability. Non-compliance with these disclosure requirements may attract penalties under Sections 134(8), 448, and 449 of the Companies Act, 2013.

The amended Rules mark a significant step toward strengthening legal compliance on employee welfare and gender-related matters, reinforcing companies' obligations to maintain safe, equitable workplaces while embedding gender sensitivity into corporate governance and reporting frameworks. By mandating detailed disclosures on compliance with sexual harassment laws and maternity benefit provisions, the MCA has shifted the emphasis from mere procedural formalities to substantive accountability.

RBI eases investment norms for FPIs in corporate debt market

Short-term and concentration-based restrictions under the General Route lifted

The Reserve Bank of India (RBI) has issued a circular removing two key restrictions applicable to Foreign Portfolio Investors (FPIs) investing in corporate debt securities through the General Route – the short-term investment limit (maturity up to 1 year) and concentration limit – previously prescribed under the RBI (Non-resident Investment in Debt Instruments) Directions, 2025.

Earlier, FPIs were limited to investing a maximum of 30% of their total corporate debt portfolio in short-term instruments. In addition, a single FPI or group of related FPIs could not exceed 10% (for short-term) and 15% (for long-term) of the overall corporate debt investment limit. These restrictions have now been withdrawn, allowing greater flexibility in structuring and diversifying FPI investments under the General Route.

By allowing FPIs to fully utilise their investment headroom without being constrained by short-term or exposure caps, this move is expected to enhance short-term investment flows and deepen liquidity in the corporate bond market and make the General Route more attractive, especially for investors unwilling to commit to the 3-year lock-in under the Voluntary Retention Route (VRR).

While these regulatory changes mark a positive step toward liberalising the FPI investment framework and addressing underutilisation of debt limits under the General Route, other limitations, such as the minimum residual maturity requirements and issue-wise investment limits, remain in place. Additionally, the increased withholding tax on interest income (20% post-July 2023) continues to be a deterrent for many FPIs. Market participants have also reiterated the need for easing the single/group investor-wise limits, which remain unchanged. As such, further reforms, particularly around tax and issuer-level caps, may be necessary to significantly boost foreign interest in India's corporate debt market.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.