- within Antitrust/Competition Law topic(s)

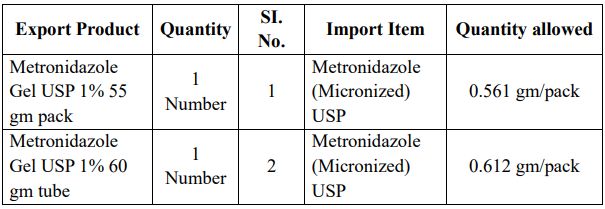

Fixation of new Standard Input Output Norms (SIONs) under 'Chemical and Allied Product' group (03 Mar)

The Directorate General of Foreign Trade has notified the following new SION under the 'Chemical and Allied Product' group:

Amendment in the Handbook of Procedures with regards to Procedure for General Authorization for Export after Repair (10 Mar)

The Directorate General of Foreign Trade has revised the Handbook of Procedures to allow General Authorization for Export after Repair (GAER). The revised provisions streamline the procedures for multiple re-exports of SCOMET items to related entities and authorized vendors/OEMs after repair in India under a one-time authorization with quarterly post-reporting instead of requiring fresh approvals for each shipment. For further details kindly refer to the link herein.

Amendment in import policy condition of Urea (18 Mar)

The Directorate General of Foreign Trade has extended the State Trading Enterprise (STE) status of Indian Potash Limited (IPL) for imports of Urea imports from 31st March 2025 to 31st March 2026.

Extension of the last date for filing Annual RoDTEP Return for Financial Year 2023-24 (19 Mar)

The Directorate General of Foreign Trade has extended the last date for filing Annual RoDTEP Return (ARR) for the financial year 2023-24 from 31st March 2025 to 30th June 2025. Accordingly, the applicable grace period is also extended from 30th June 2025 to 30th September 2025.

Extension of RoDTEP for Advance Authorizations (AAs) holders, Special Economic Zones (SEZs), and Export-Oriented Units (EOUs) (20 Mar)

The Directorate General of Foreign Trade notified that Remission of Duties and Taxes on Exported Products (RoDTEP) scheme was available for export of products manufactured by Advance Authorizations (AAs) holders, Special Economic Zones (SEZs), and Export-Oriented Units (EOUs) only up to 5th February 2025.

SIONs pertaining to Automobile Tyres under review (20 Mar)

The Directorate General of Foreign Trade has initiated the process to review the existing SIONs of Automobile Tyres. Accordingly, all the concerned EPCs, Exporters, Trade bodies and other stakeholders, who are availing the SIONs, have been invited to examine the existing SIONs and provide necessary comments / suggestions on why and how such SIONs require modification, if any, latest by 04th May 2025. The suggestions for such modification should be accompanied by detailed justification, along with production and consumption data, wastage norms duly certified by Chartered engineer and other relevant documents.

Proposal to make GST E-Invoices received through GSTN to DGFT BO portal mandatory for claiming Deemed Export Benefits (25 Mar)

In light of the ongoing integration process between the Directorate General of Foreign Trade and the Goods and Services Tax Network, the Directorate invited comments from all stakeholders on a proposal to make GST e-invoices received from GSTN on DGFT Back Office portal mandatory for claiming deemed export benefits under the Foreign Trade Policy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]