- within Intellectual Property, Insurance, Government and Public Sector topic(s)

- in European Union

- with readers working within the Basic Industries and Law Firm industries

1. INTRODUCTION

The Indian insolvency law framework before the year 2016 was highly fragmented and scattered across several legislations that referred matters to different judicial fora. These enactments include the Presidency Towns Insolvency Act, 1909, the Provincial Insolvency Act, 1920, the Sick Industrial Companies Act, 1985, the Recovery of Debts Due to Banks and Financial Institutions Act, 1993, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, and the Companies Act, 2013. The multiplicity of adjudicating bodies that handled insolvency cases gave rise to a cobweb of jurisdictional issues and delayed the insolvency resolution process, often leading to the debtor losing its economic value over time. The Indian economy faced a crisis when the non-performing assets were piling up due to the failure of debt recovery laws, leading to more companies shutting their business. In such circumstances, a need was felt for redesigning the entire insolvency resolution landscape instead of making repairs in a bits and pieces fashion. The primary goal of the new insolvency law was to ensure that commercially ailing companies were brought back to their feet to serve the Indian economy.

India's insolvency regime took firm ground only after the enactment of the Insolvency and Bankruptcy Code, 2016 (IBC). The IBC was envisaged as a code to consolidate and amend the laws relating to reorganisation and resolution of insolvency. The legislature faced the herculean task of creating a modern and robust environment conducive to the effective implementation of the IBC. Therefore, the IBC in its infancy had a standard linear process that creditors and debtors were required to follow to resolve corporate insolvencies. However, it was expected that with the passing of time and creation of an insolvency resolution ecosystem, sophisticated models of insolvency resolution would also follow.

In over five years, the IBC has witnessed six legislative interventions to eliminate the systemic loopholes. By such amendments, the legislature reflected its clear intent to bring need-based amendments in the IBC to ensure that the system becomes more efficient in resolving insolvencies. This report is a primer on the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021 (Ordinance) promulgated by the President of India on 4 April 2021. The Ordinance highlights the vital role of micro, small and medium enterprises (MSMEs) in the growth of the Indian economy and employment landscape.

The Ordinance recognises that the COVID-19 global pandemic has exposed many of the MSMEs to financial distress. In this background, the Ordinance states that it is expedient to introduce a pre-packaged insolvency resolution process (PPIRP) for corporate persons classified as MSMEs. The Ordinance introduces PPIRP under Chapter III-A within the IBC. Chapter III-A essentially puts forth what the Ordinance calls an "efficient alternative insolvency resolution process" for MSMEs to bring a quicker, cost-effective and value-maximising outcome for all stakeholders in the least disruptive manner. The Ordinance is pegged to be the lawmakers' answer to bringing a tailor-made insolvency resolution model that caters to MSMEs' unique nature and their simpler corporate structures.

2. THE NEED FOR INTRODUCING PPIRP TO THE INDIAN INSOLVENCY LAW FRAMEWORK

The Indian insolvency regime at this juncture has a largely reliable and mature ecosystem for corporate insolvency resolution. The roles of the creditors, the corporate debtor, and the insolvency professionals in the insolvency resolution process are well defined. While it was certain that further experimentation in the IBC would happen as things progressed, the unprecedented impact of the pandemic made it utmost important to bring in the PPIRP model for MSMEs. The COVID-19 pandemic shook the entire world. India was no exception to the sudden halt that was witnessed in the economic activities. The MSMEs were most severely impacted by the financial distress caused by the pandemic. The MSMEs are the backbone of the Indian economy1 inasmuch as they contributed around 30 per cent towards the gross domestic product (GDP) until the year 2019.2 The Central Government was planning to push MSMEs' contribution to 50 per cent of the Indian GDP.3 With the pandemic in place, the very existence of several MSMEs was under serious threat. The government came up with several swift-response actions and policy changes to mitigate the impact of the pandemic. The minimum threshold for a default under the IBC for initiation of the Corporate Insolvency Resolution Process (CIRP) was increased up to INR 1,00,00,000 (one crore) in respect of all defaults arising during the period of one year from 25 March 2020.4 However, such interim measures were required to be backed by long term changes that addressed the need of the hour, i.e., to protect the MSME sector from the brunt of the COVID-19 pandemic. Therefore, it was felt that the time had come to push the boundaries further in the IBC by incorporating a specialised model, namely the PPIRP catered to the MSMEs.

The then finance minister Sh. Arun Jaitley in 2018 highlighted the importance of linking the informal out of court settlements with formal insolvency proceedings.5 The PPIRP is one such flexible mode of insolvency resolution with both an informal and a formal channel to bring the corporate debtor to its feet. A PPIRP begins with mutual discussions between the corporate debtor and creditors who come up with an informal understanding (a form of a resolution plan) which is later put through a competitive selection process. If the resolution plan of the corporate debtor stands out, it is allowed by the Adjudicating Authority (AA) in brief formal proceedings. What distinguishes a PPIRP from other modes of insolvency resolution is the fact that a significant chunk of the restructuring and corporate revival happens before the corporate debtor or its creditors proceed with statutory proceedings. The formal proceedings under PPIRP follow a strict timeline since the terms of the resolution are already agreed upon by the corporate debtor and its creditors.

2.1. Key differences between PPIRP and CIRP

The insolvency resolution framework for CIRP is an example of the "creditor in control model". The creditor in control model is where the control of the corporate debtor is taken away from the erstwhile management, which led to the entity's economic downfall or defaults on its financial obligations. It is deemed that the control should not rest with those who were the cause of the financial challenges that the corporate debtor faces while heading towards insolvency resolution. The creditor in possession model relies heavily on the commercial wisdom of the creditors. Therefore, the law expects the creditors to use their skillsets would resuscitate the corporate debtor.

On the other hand, the Ordinance inclines towards the "debtor in possession" for the MSMEs undergoing insolvency resolution under Chapter III-A of the IBC. The debtor in possession model allows the management of the corporate debtor to remain with the Board of Directors or the partners, as the case may be, of the corporate debtor.

The PPIRP is a swift process that is expected to be completed in a maximum of 120 days from one end to the other. This is much shorter than the duration for the CIRP, which ranges from 180 days to a maximum of 330 days.

The corporate debtor undergoing a PPIRP has the option to enter into a mutual settlement whereby it proposes a base resolution plan which competes with other resolution plans submitted by eligible resolution applicants. If the base resolution plan emerges as the most attractive one, it is implemented with the assent of the AA.

3. PPIRP UNDER THE IBC

3.1. Eligibility of a corporate debtor for undergoing PPIRP

Section 54A discusses the conditions for the eligibility of a corporate debtor to undergo a PPIRP. Sub-section (1) of Section 54A states that an application for initiating PPIRP may be made in respect of only such corporate debtors who are classified as an MSME under Section 7(1) of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act).

The Insolvency and Bankruptcy Board of India (Pre-Packaged Insolvency Resolution Process) Regulations, 2021 (Regulations) further restrict the applicability of the PPIRP only to companies and Limited Liability Partnerships (LLP), thereby excluding the proprietorship concerns, Hindu undivided family, an association of persons, co-operative societies and partnerships. The Regulations, in several instances, employ language which reflects a binary definition of MSMEs restricted to either LLPs or companies. The use of words such as "corporate applicant", "corporate persons", and "directors or partners" are few such indicators. Further, the definition of identification number under Regulation 2(i) is stated as the "limited liability partnership identification number or the corporate identity number" supplemented by the phrase "as the case may be". Therefore, the PPIRP can be undertaken by only companies or LLPs classified as MSMEs under the MSMED Act.

In a notification dated 26 June 20206, the Ministry of Micro, Small and Medium Enterprises has set forth the following new parameters for the MSMEs:

| MSME Type | Investment in Plant, Machinery or Equipment | Turnover |

| Micro | Does not exceed INR 1 (one) crores | Does not exceed INR 5 (five) crores |

| Small | Does not exceed INR 10 (ten) crores | Does not exceed INR 50 (fifty) crores |

| Medium | Does not exceed INR 50 (fifty) crores | Does not exceed INR 250 (two hundred and fifty) crores |

In addition to the conditions mentioned above, an MSME must

register itself on the Udyam Registration Portal. On successful

registration, the MSME shall have assigned to it a permanent

identification number, namely the Udyam Registration Number

(URN) and an e-certificate called the Udyam

Registration Certificate, which shall be used to identify the MSME

in the records of the concerned government departments and

ministries.

The new definition of MSMEs has brought 99 (ninety-nine) per cent of Indian businesses under the ambit of the MSMED Act.7 While there is no recent data on the total number of MSMEs in India, as per the 73rd Round of the National Sample Survey (NSS) 2015-2016, conducted by the Ministry of Statistics & Programme Implementation, there are about 633.88 lakh MSMEs that exist in India.8 Out of the 633.88 lakh MSMEs, 608.41 lakh (95.98%) MSMEs were proprietary concerns.9 According to the recent data on Udyam Registration, only 26.42 lakh MSMEs have registered themselves so far.10

Given that the Regulations restrict the PPIRP to only MSMEs that are LLPs and companies registered on Udyam, only a fraction of all the MSMEs in India would be able to seek the benefit of the PPIRP as envisaged under the Ordinance. This is in direct conflict to urgently address the specific requirements of MSMEs concerning the resolution of their insolvency due to the unique nature of their businesses and simpler corporate structures.

Apart from the fundamental requirement that the corporate debtor should be an MSME, the corporate debtor has to comply with the conditions prescribed under sub-section 2 and 3 of Section 54A to be eligible for PPIRP. Sub-section 2 of Section 54A under the Ordinance requires a corporate debtor wishing to undergo the PPIRP to ensure that:

- Firstly, the corporate debtor has not undergone PPIRP before or completed the CIRP in three years preceding the PPIRP initiation date. Similarly, the corporate debtor is not currently undergoing CIRP.

- Secondly, no order requiring the corporate debtor to be liquidated is passed under Section 33 of the IBC, and the corporate debtor is eligible to submit a resolution plan under Section 29A of the IBC.

- Thirdly, the financial creditors of the corporate debtor not being related parties have proposed the name of the insolvency professional (IP) who is sought to be appointed as a resolution professional (RP) for conducting the PPIRP of the corporate debtor. Further, the financial creditors representing not less than 66 (sixty-six) per cent of the financial debt have approved such proposal. If the corporate debtor has no financial debt or where all financial creditors are related parties, the applicant shall seek the approval of operational creditors who are not related parties as per Regulation 14(8) of the Regulations.

- Fourthly, a majority of the directors or partners of the corporate debtor have made a declaration under clause (f) of Section 54A(2), which, amongst other things, requires the corporate debtor to affirm that the PPIRP is not being initiated to defraud anyone.

3.2. Threshold of default for initiating a PPIRP

The newly introduced second proviso to Section 4 of the IBC provides that the upper limit of a default shall be INR 1 (one) crore for matters relating to PPIRP under Chapter III-A of the IBC. On 9 April 2021, vide a notification, the Central Government exercising the powers under the second proviso to Section 4 of the IBC prescribed a minimum amount of default of INR 10 (ten) lakhs for a PPIRP.11

3.3. Steps before the filing of the application for the initiation of the PPIRP

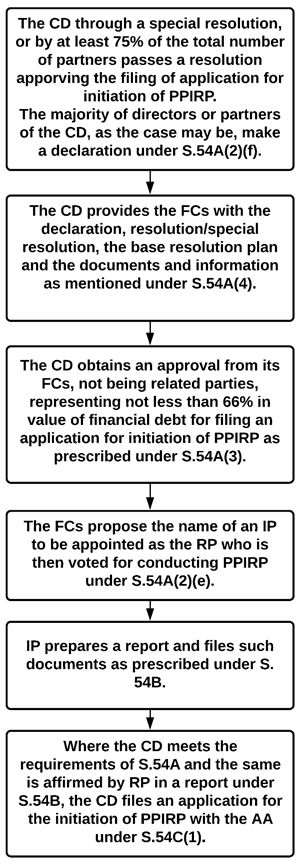

A corporate debtor post committing a default under Section 4 of the IBC can initiate a PPIRP if eligible under Section 54A. A corporate debtor shall, through a special resolution (in case of companies) or by a resolution with the support of at least 75 (seventy-five) per cent of partners (in case of LLPs), approve the filing of an application for initiating PPIRP under Section 54A(2)(g). Thereafter, the majority of directors or partners of the corporate debtor, as the case may be, shall make a declaration under Section 54A(2)(f) stating the following:

- Firstly, affirming that the corporate debtor shall file an application for initiating PPIRP within a definite time period not exceeding ninety days;

- Secondly, that the PPIRP is not being initiated to defraud any person; and

- Thirdly, informing the name of the insolvency professional (IP) proposed to be appointed as the resolution professional (RP).

The corporate debtor then provides its financial creditors with the declaration, resolution/ special resolution, the base resolution plan and the documents and information mentioned under Section 54A(4). The corporate debtor, based on the information submitted under Section 54A(4), obtains an approval from the financial creditors not being related parties and representing not less than 66 (sixty-six) per cent in value of the financial debt for filing an application for the initiation of the PPIRP as prescribed under Section 54A(3).

If the corporate debtor has no financial debt or where all financial creditors are related parties, the applicant shall seek the approval of operational creditors who are not related parties as per Regulation 14(8) of the Regulations.

Post giving their approval for filing an application for the initiation of the PPIRP, the financial creditors propose the name of the IP to be appointed as the RP, which proposal is then approved under Section 54A(2)(e). The IP then prepares a report and files such documents as prescribed under Section 54B. Where the corporate debtor meets the requirements of Section 54A and the same is affirmed by the IP in a report under Section 54B, the corporate debtor files an application for the initiation of the PPIRP before the AA under Section 54C(1).

3.4. Duties of the IP proposed to be the RP before the initiation of the PPIRP

According to Section 54B, the IP shall have the duty to prepare a report confirming whether the corporate debtor meets the requirements prescribed under Section 54A, and whether the base resolution plan conforms to the requirements stated in clause (c) of Section 54A(4). Further, the IP shall file such reports and documents with the Board and perform such other duties as may be specified. The fee payable to the IP in relation to the duties performed under Section 54B(1) would be determined and borne in such manner as may be specified, and such fees shall form the part of the PPIRP process costs if the application for initiation of the PPIRP is admitted.

Under Section 54B(2), the duties of the IP shall cease in two circumstances. Firstly, where the corporate debtor fails to file an application for initiating PPIRP within the time stated in the declaration under Section 54A(2)(f). Secondly, where the application for initiating the PPIRP is admitted or rejected by the AA.

3.5. Documents furnished along with the application for initiation of PPIRP

Sub-section (3) of Section 54C states that the corporate debtor shall, along with the application for initiation of PPIRP, furnish the following documents:

- The declaration, special resolution or resolution, as the case may be, and the approval of financial creditors for initiating PPIRP.

- The name and written consent, in such form as specified, of the IP proposed to be appointed as RP under Section 54A(2)(e) and his report under Section 54B(1)(b).

- A declaration regarding the existence of any transactions of the corporate debtor that may be within the scope of provisions regarding the avoidance of transactions under Chapter III or fraudulent or wrongful trading under Chapter VI, in such form as may be specified.

- Information relating to books of account of the corporate debtor and such other documents relating to such period as may be specified.

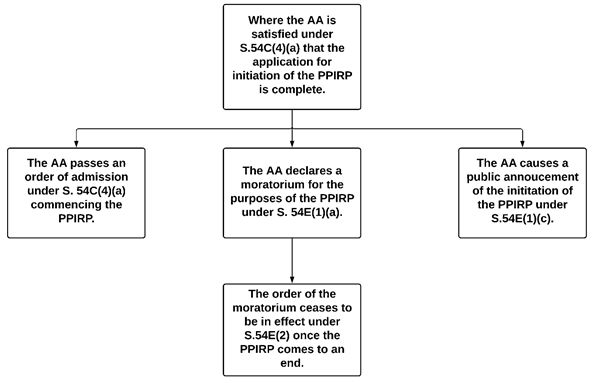

3.6. Decision of the AA to admit or reject the application for PPIRP and the timeline for completion of the PPIRP

If the application for initiation of the PPIRP is complete, then the AA shall admit it within a period of 14 (fourteen) days. However, if the application is incomplete, the same shall be rejected. A PPIRP commences from the date the application for its initiation is admitted.

As per Section 54D(1), a PPIRP shall be completed within a period of 120 (one hundred and twenty days) from the date of commencement. Section 54D(2) further states that the RP shall submit the resolution plan as approved by the CoC to the AA under sub-section (4) or sub-section (12), as the case may be, of Section 54K, within a period of 90 (ninety days) from the PPIRP commencement date.

Where the CoC approves no resolution plan within the prescribed time period the RP shall, on the date of expiry of the time period, file an application with the AA for the termination of the PPIRP. It is clear that the PPIRP process has a shorter and stricter policy for the timeframe in which the insolvency resolution is supposed to occur.

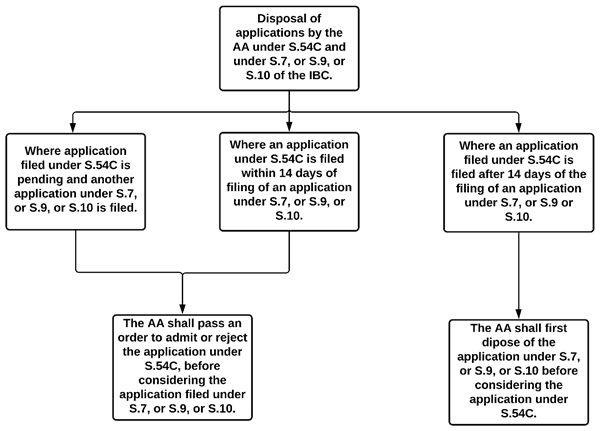

3.7. Disposal of applications under Section 54C and under Section 7, or 9, or 10

The Ordinance by way of amendment under Section 11 of the IBC throws light on the treatment to be meted out to applications filed under both Section 54C and under Section 7, or 9, or 10 seeking initiation of PPIRP and CIRP respectively. Section 11A provides that where an application filed under Section 54C is pending the AA shall pass an order to admit or reject the application under Section 54C, before considering the application under Section 7, or Section 9, or Section 10 filed afterwards in respect of the same corporate debtor. Similarly, where an application under section 54 is filed within fourteen days of filing of any application under Section 7, or Section 9, or Section 10 in respect of the same corporate debtor, then the AA shall first dispose of the application under section 54C.

However, where an application under section 54 is filed after fourteen days of filing of any application under Section 7, or Section 9, or Section 10 in respect of the same corporate debtor, then the AA shall first dispose of the application under Section 7, or Section 9 or Section 10.

The provisions of Section 11A shall not apply where an application under Section 7 or Section 9 or Section 10 is filed and pending as on the date of the commencement of the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021.

3.8. Declaration of the moratorium and public announcement of PPIRP

Once the AA admits an application for the initiation of the PPIRP, it shall along with the order of admission, declare a moratorium which shall be mutatis mutandis guided by Section 14 of the IBC. The AA would also appoint an RP as proposed in the application, provided the RP meets the requirements posed under Section 54E(2) read with Regulation 7 of the Regulations. Upon the appointment, the RP shall make a public announcement of the initiation of the PPIRP through the RP in the manner prescribed under Regulation 19 of the Regulations.

The order of a moratorium has effect from the PPIRP commencement date until the PPIRP comes to an end. The object of the declaration of a moratorium under a PPIRP is to ensure that there is no depletion of corporate debtor's assets during the insolvency resolution process so that it can continue as a going concern while maximising its value.12

3.9. Duties of the RP during the PPIRP

The RP during the PPIRP has the following duties as described under Section 54F:

- Firstly, confirm and maintain an updated list of claims submitted by the corporate debtor under Section 54G and inform about the same to the creditors.

- Secondly, monitor the management of the affairs of the corporate debtor.

- Thirdly, constitute the CoC and convene and attend all its meetings. Further, inform the CoC in the event of breach of any of the obligations of the Board of Directors or partners, as the case may be, of the corporate debtor under the provisions of Chapter III-A.

- Fifthly, prepare the information memorandum on the basis of the preliminary information memorandum submitted under Section 54G and any other relevant information.

- Sixthly, file applications for the avoidance of transactions under Chapter III, or fraudulent or wrongful trading under Chapter VI, if any.

- Lastly, such other duties as may be specified.

3.10. Powers of the RP during the PPIRP

Section 54F(3) states that the RP shall exercise the following powers during the PPIRP:

- Firstly, access all books of accounts, records and information available with the corporate debtor, or an information utility, or any government authorities, or statutory auditors, or the accountants and such other persons as may be specified.

- Secondly, attend meetings of members, Board of Directors and committee of directors, or partners, as the case may be, of the corporate debtor.

- Thirdly, appoint accountants, legal or other professionals in such manner as may be specified.

- Fourthly, collect all information relating to the assets, finances and operations of the corporate debtor for determining the financial position of the corporate debtor and the existence of any transactions that may be within the scope of provisions relating to avoidance of transactions under Chapter III or fraudulent or wrongful trading under Chapter VI as provided under Section 54F(3)(f).

- Lastly, take other actions in such manner as specified.

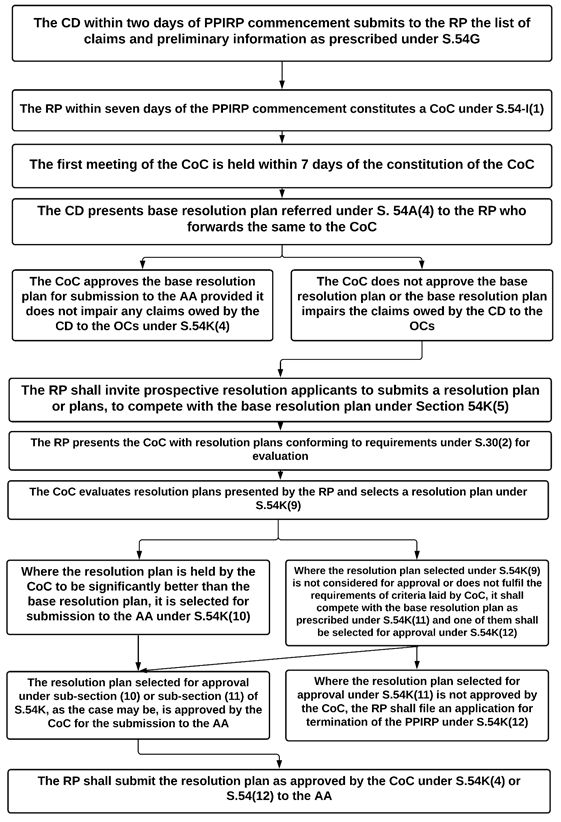

3.11. List of claims and preliminary information memorandum

As per Section 54G(1), the corporate debtor shall, within 2 (two) days of the PPIRP commencement date, submit to the RP a list of claims in Form P2 of the Regulations with details of the creditors, their security interests and guarantees, if any. Along with the list of claims, the corporate debtor shall also give the RP a preliminary information memorandum containing information relevant for formulating a resolution plan.

Section 54G(2) states that every promoter or director or partner or persons authorising the submission of the corporate debtor shall be, without prejudice to section 77A, liable to pay compensation to every person who has sustained any loss or damage as a consequence of the omission or inclusion of any misleading information in the list of claims of the preliminary information memorandum submitted by the corporate debtor. However, no person mentioned under Section 54G(2) would be liable if the list of claims or the preliminary information memorandum was submitted without their knowledge or consent.

3.12. Committee of creditors

The RP shall, within 7 (seven) days of the PPIRP commencement date, constitute a CoC based on the list of the claims confirmed under clause (a) of sub-section 2 of Section 54F. The composition of the CoC can be altered based on an updated list of the claims. However, such an alteration would not affect the validity of the prior decisions of the CoC.

3.13. Management of affairs of the corporate debtor

Section 54H provides for the management of the corporate debtor during the PPIRP. It states that the management of the affairs of the corporate debtor shall continue to vest in the Board of Directors of the Corporate Debtor. The Board of Directors or the partners are required to make every endeavour to protect and preserve the value of the value of the assets of the corporate debtor and manage its operations as a going concern.

Further, the promoters, members, personnel and partners of the corporate debtor would continue to exercise and discharge their respective contractual and statutory rights and duties in relation to the operations of the corporate debtor.

3.14. Vesting of the Management of the Corporate Debtor with the RP

As per Section 54J, the CoC is entitled, by a vote of not less than 66 (sixty-six) per cent of the voting shares, to vest the management of the corporate debtor with the resolution professional at any time during the PPIRP. After receiving the CoC's approval, the RP shall make an application for the vesting of management of the corporate debtor with the RP.

On receiving an application, the AA shall pass an order vesting the management of the corporate debtor with the RP, if it opines that during the PPIRP:

- Firstly, the affairs of the corporate debtor were conducted fraudulently; and

- Secondly, there has been gross mismanagement of the affairs of the corporate debtor.

3.15. Consideration of the resolution plan

As per Section 54K, the corporate debtor shall submit the base resolution to the RP within 2 (two) days of the PPIRP commencement date, and the RP shall then present it to the CoC. The CoC may provide the corporate debtor with an opportunity to revise the base resolution plan before its approval or invitation of prospective resolution applicants.

The CoC may approve the base resolution plan for submission to the AA under Section 54K(4) if it does not impair any claims owed by the corporate debtor to the operational creditors. However, where the CoC does not approve the base resolution plan under Section 54K(4) or the base resolution plan impairs any claims owed by the corporate debtor to the operational creditors, the RP invites prospective resolution applicants to submit a resolution plan or plans, to compete with the base resolution plan.

The resolution applicants submitting resolution plans pursuant to an invitation under sub-section (5) must fulfil the criteria as may be laid down by the resolution professional with the approval of the committee of creditors, having regard to the complexity and scale of operations of the business of the corporate debtor and such other conditions as may be specified.

The RP is required to provide to the resolution applicants — (a) the basis for evaluating resolution plans as approved by the CoC and (b) the relevant information referred to in Section 29, which shall mutatis mutandis apply, to the proceedings under this Chapter.

Thereafter, the RP shall present to the CoC, for its evaluation, the resolution plans which conform to the requirements referred to in Section 30(2). The CoC shall evaluate the resolution plans presented by the RP and select a resolution plan from amongst them. If, based on such criteria as laid by the CoC, the CoC decides that any resolution plan is significantly better than the base resolution plan, the same may be selected for approval.

If no such plan is considered for approval or the resolution plans are not significantly better than the base resolution plan, it shall compete with the base resolution plan, as per the scheme of scoring provided in Regulation 42 of the Regulations and one of the plans is selected for the final approval. Therefore, either the base resolution plan or the resolution plan received from an applicant other than the corporate debtor may be approved by the CoC under Section 54K. However, where no resolution plan is approved, the RP shall apply for the termination of the PPIRP.

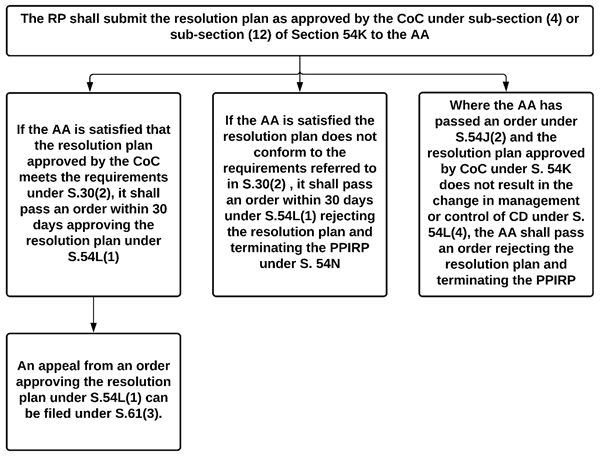

3.16. Approval of the resolution plan

Section 54L discusses upon the approval of the resolution plan by the AA. The AA must satisfy itself that the resolution plan approved by the CoC meets the requirements of Section 30(2) and has provisions for its effective implementation. If the AA is satisfied that the conditions mentioned above are met, it shall, within 30 (thirty) days of the receipt of the resolution plan, by order approve the resolution plan.

Where the AA decides that the plan does not meet the conditions prescribed, it may within thirty days of the receipt of the resolution plan, by order reject the resolution plan and pass an order terminating the PPIRP.

Moreover, where the AA has passed an order for vesting of the management of the corporate debtor with the RP and the plan approved by the CoC does not result in the change in the management or control of the corporate debtor to a person not in management or control of the corporate debtor, the AA shall pass an order whereby it would:

- Firstly, reject the resolution plan;

- Secondly, terminate the PPIRP; and

- Thirdly, declare the PPIRP costs, if any, to be included as part of liquidation costs for the purposes of liquidation of the corporate debtor.

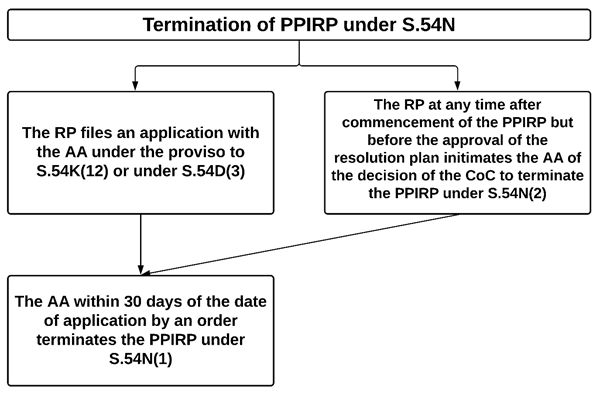

3.17. Termination of the PPIRP

As per Section 54N, where the RP files an application to the AA for the termination of the PPIRP either on account of non-approval of the resolution plan or the elapse of 90 (ninety) day timeline for the PPIRP, the AA shall within 30 (thirty) days pass an order whereby it:

- Firstly, terminates the PPIRP; and

- Secondly, provides for the manner of continuation of proceedings initiated for the avoidance of the transactions under Chapter III or proceedings initiated under Section 66 and Section 67A, if any.

Where the RP, at any time after the PPIRP commencement date, but before the approval of the resolution plan, intimates the AA of the decision of the CoC approved by not less than 66 (sixty-six) per cent voting share, to terminate the PPIRP, the AA shall pass an order to that effect.

Notwithstanding anything to the contrary, where the AA has passed an order for vesting of the management of the corporate debtor with the RP, and the PPIRP is required to be terminated, the AA shall pass an order whereby it would:

- Firstly, allow for the liquidation in respect of the corporate debtor as referred in Section 33(b); and

- Secondly, declare that the PPIRP costs, if any, shall be included as a part of the liquidation costs for the purposes of liquidation of the corporate debtor.

3.18. Conclusion

The move to introduce PPIRP in the IBC has the right intentions; however, the design of the Ordinance restricts its application to a small group of MSMEs that fulfil the criterion set forth through the new definition of MSMEs promulgated recently. A law introducing PPIRP should have been made applicable to as many beneficiaries as possible to truly align itself with the aim of addressing the plight of distressed MSMEs truly.

The MSMEs that fall within the scope of the Ordinance are expected to benefit from the option of undergoing PPIRP given its informal and time-bound nature. The Ordinance can be seen as yet another economic experiment awaiting the test of time. Therefore, it would be important to witness how the legal framework of PPIRP would develop further through the judicial pronouncements in India.

4. STEPWISE FLOW-CHARTS OF THE PPIRP UNDER THE IBC

4.1. Disposal of applications under Section 54C and under Section 7, or Section 9, or Section 10 of the IBC by the AA

The provisions of Section 11A shall not apply where an application under Section 7 or Section 9 or Section 10 is filed and pending as on the date of the commencement of the Insolvency and Bankruptcy Code (Amendment) Ordinance, 2021.

4.2. Steps before the filing of the application for the initiation of the PPIRP before the AA

4.3. Declaration of the moratorium and public announcement of the PPIRP

4.4. Steps from the listing of the claims to the approval of a resolution plan by the CoC

4.5. Approval of the resolution plan by the AA

4.6. Termination of the PPIRP under Section 54N

Acknowledgement: The author would like to acknowledge the research and assistance rendered by Harshvardhan Korada, a student of the Amity Law School, Delhi.

Footnotes

1. Ministry of Micro, Small and Medium Enterprises Annual Report 2020-2021. Read more here.

2. The Economic Times, "MSME sector contributes 30% to GDP, 48% to exports: Nitin Gadkari". Read more here.

3. Financial Express, "Centre aims to increase MSME sector contribution to GDP up to 50%: Gadkari". Read more here.

4. Ministry of Corporate Affairs, Notification dated 24 March 2020. Read more here; Economic Times, Government raises default threshold to Rs. 1 crore for invoking IBC proceedings. Read more here.

5. Speech by Sh. Arun Jaitley at the conference on 'Insolvency and Bankruptcy Code, 2016: A Roadmap for the Next Two Years'. Read more here.

6. Ministry of Micro, Small and Medium Enterprises, Notification dated 26 June 2020. Read more here.

7. Times of India, 99% businesses in India now in MSME category. Read more here.

8. Ministry of Micro, Small and Medium Enterprises Annual Report 2020-2021. Read more here.

9. Ministry of Micro, Small and Medium Enterprises Annual Report 2020-2021. Read more here.

10. Financial Express, 26 lakh MSME registrations so far on Modi govt's new portal not exciting, say experts. Read more here.

11. Ministry of Corporate Affairs, Notification dated 9 April 2021. Read more here.

12. P. Mohanraj & Ors. v. M/s Shah Brothers Ispat Pvt. Ltd., 2021 SCC OnLine SC 152; Swiss Ribbons (P) Ltd. v. Union of India, 2019 4 SCC 17.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.