- within Finance and Banking topic(s)

- within Litigation, Mediation & Arbitration, Government, Public Sector and Employment and HR topic(s)

- in United States

- with readers working within the Technology, Media & Information and Law Firm industries

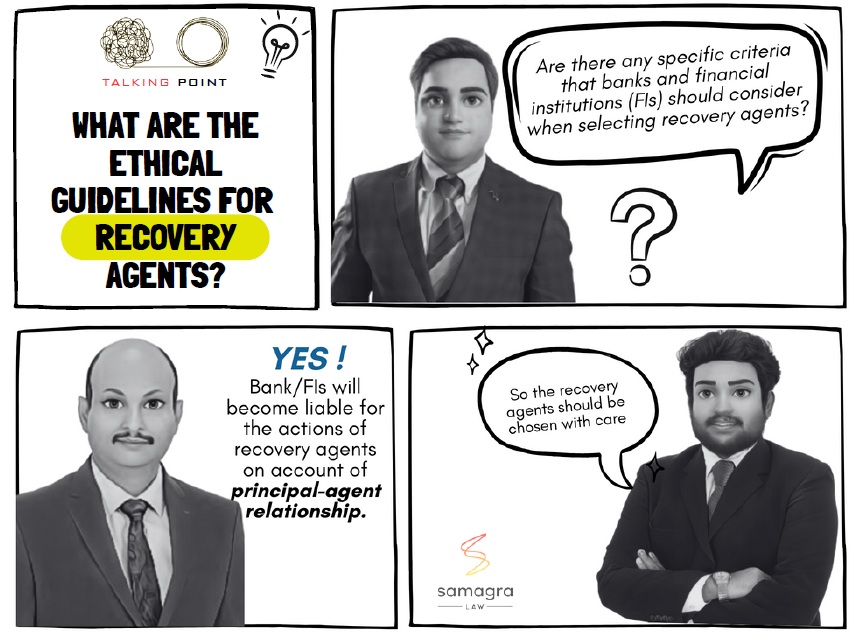

Recovery Agents and their engagement :

As per the RBI guidelines, Banks and Financial Institutions ('FI') can appoint external recovery agents to recover loans from defaulting customers. The recovery agents should be selected with utmost care, and their track record should be carefully scrutinized. They should be given proper training and guidance to ensure that they do not violate any law or misbehave with the customers. Since there exists a principal-agent relationship between the Banks/FIs and the recovery agents, the former can be held liable for the actions of recovery agents. If the recovery agents harass the customer resulting in any unfortunate incident, then the Banks/FIs may be held liable for criminal proceedings as well.

RBI guidelines for Recovery Agents :

The RBI has issued guidelines to regulate the activities of recovery agents employed by Banks and FIs. These guidelines are aimed at ensuring fair and ethical practices in the recovery process, and protecting the rights of borrowers.

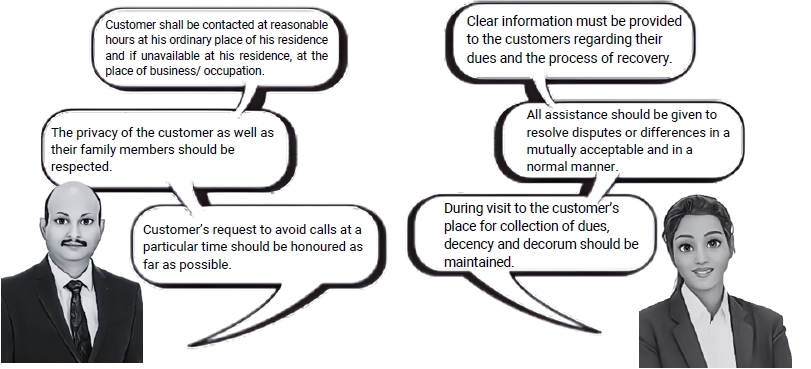

Some key highlights of the RBI guidelines for recovery agents include :

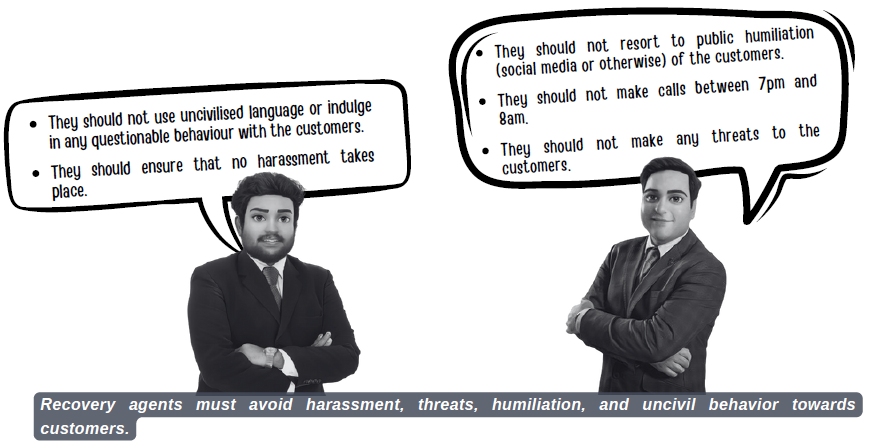

- Code of Conduct: Recovery agents are required to adhere to a code of conduct that includes treating borrowers with respect and dignity, maintaining confidentiality of borrower information, and refraining from using abusive language or harassment tactics.

- Training: Recovery agents should undergo training programs to ensure that they are aware of the legal and ethical guidelines governing their activities.

- Fair Practices: Recovery agents are prohibited from resorting to intimidation, harassment, or threats of violence in their efforts to recover dues from borrowers. They must also provide accurate information to borrowers about their rights and obligations.

Some Do's for Recovery Agents :

Some Don'ts for Recovery Agents :

Grievance Redressal mechanism :

A senior officer should be appointed as the Grievance Redressal Officer by the Bank/FI to address the complaints of the customers against the actions of the Recovery Agents. In case the complaints are not properly addressed and resolved, RBI could initiate action against such organisations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.