- within Corporate/Commercial Law topic(s)

- with readers working within the Oil & Gas industries

- within Law Department Performance and Employment and HR topic(s)

A delay in compliance with the reporting requirements with the Ministry of Corporate Affairs ("MCA") under the Companies Act, 2013 ("Companies Act"), may turn expensive for Indian companies with effect from July 1, 2022.

Currently, the MCA charges an additional fee for filing of forms with them beyond the timelines prescribed under the Companies Act (either as a multiple of the normal fees up to a maximum of 12x of the normal filing fee OR as a per day additional filing fee for certain forms viz., annual returns and financial statements. Now, the MCA has introduced a concept of 'Higher additional fee in certain cases' with an increased additional fee up to 18x of the normal filing fees ("Higher Additional Fees") for companies that regularly default in meeting the prescribed timelines for such reporting requirements.

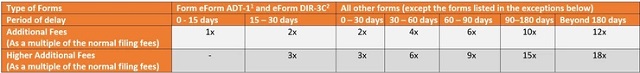

The quantum of the additional fees and the higher additional fees shall be as follows:

Note: Wherever higher additional fee is payable, additional fee shall not be charged.

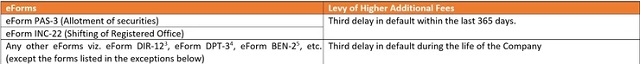

The trigger for levy of Higher Additional Fee is applicable while delayed filing of the below mentioned eForms in the below mentioned scenarios:

Exceptions: The provisions of the Higher Additional Fees is not applicable to the following filings:

- eForms for filing of annual financial statements viz. eForm AOC-4, AOC-4 CFS, AOC-4 XBRL;

- eForms for filing of annual return viz. eForm MGT-7, MGT-7A;

- eForm for increase in authorized share capital viz. eForm SH-7; and

- eForms in relation to registration/modification/satisfaction of charges viz. eForm CHG-1, CHG-4, etc.

Notifications: These provisions were notified by the MCA on January 11, 2022, via the following notifications:

- Notification of Section 56 of the Companies (Amendment) Act, 20201

- Notification of Section 80 of the Companies (Amendment) Act, 20172

- Notification of Companies (Registration Offices and Fees) Amendment Rules, 2022

Conclusion: By introducing the Higher Additional Fees, MCA is trying to encourage companies who have a tendency of delaying form filings to focus on complying with the timelines for reporting regulatory compliances under the Companies Act.

Footnotes

1 eForm ADT-1 – Filing for appointment of statutory auditors.

2 eForm DIR-3C – Filing for Intimation of Director Identification Number by the company to the registrar.

3 eForm DIR-12 – Filing for aappointment/ resignation of directors and key managerial personnel.

4 eForm DPT-3 – Filing for rreturn of deposits and money not considered as deposits.

5 eForm BEN-2 – Filing for receipt of declaration from significant beneficial owner.

6 Refer Section 56 on page 33 of the Companies (Amendment) Act, 2020.

7 Refer 2nd and 3rd proviso to Section 80(i) on pages 24 and 25 of the Companies (Amendment Act, 2017.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.