- within Finance and Banking topic(s)

- in United States

- with readers working within the Banking & Credit industries

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Accounting & Consultancy and Law Firm industries

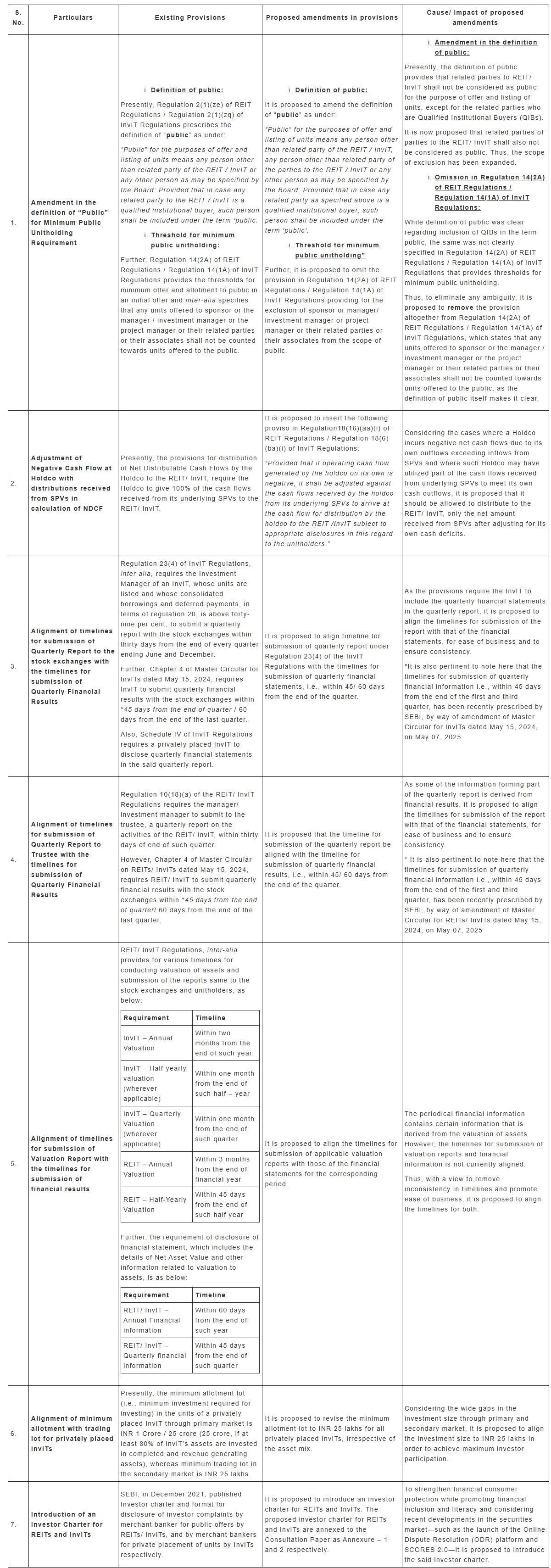

On May 02, 2025, Securities and Exchange Board of India ("SEBI") issued a consultation paper proposing several amendments to the SEBI (Real Estate Investment Trusts) Regulations, 2014 ("REIT Regulations") and SEBI (Infrastructure Investment Trusts) Regulations, 2014 ("InvIT Regulations"). These proposed changes primarily aim to align regulatory provisions, streamline disclosure requirements, and standardize associated timelines.

The following is a comparative analysis of the existing provisions, the proposed amendments, and their potential impact:\

The primary objective of this consultation paper is to align the timelines associated with various disclosure requirements, thereby addressing existing inconsistencies and promoting a more coherent regulatory framework. By standardizing these timelines, the proposed changes aim to reduce ambiguity and make the reporting process more intuitive and structured for businesses. Moreover, the simplification of disclosure sequences will not only ease the compliance burden but also contribute to greater clarity and transparency in regulatory filings.

The comments/ suggestions on the aforesaid consultation paper may be submitted with SEBI by May 22, 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.