- in United States

- with readers working within the Insurance and Technology industries

- within Litigation, Mediation & Arbitration, Family and Matrimonial and Energy and Natural Resources topic(s)

- with Inhouse Counsel

1. |

BACKGROUND |

| 1.1. |

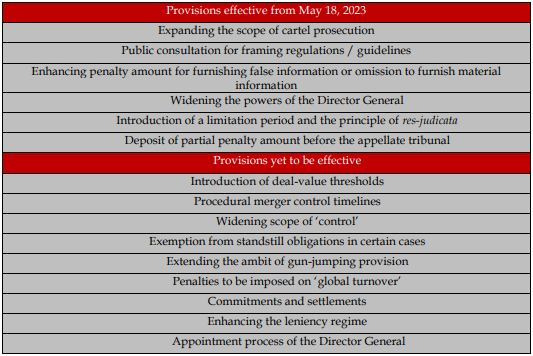

On April 11, 2023, the Competition (Amendment) Act, 20231 ("Amendment") received the assent of the Hon'ble President of India and certain provisions (mentioned below) have come into effect on May 18, 2023, after being notified by the Ministry of Corporate Affairs ("MCA Notification").2 Given that certain provisions are dependent on the regulations / guidelines to be issued by the Competition Commission of India ("CCI"), such provisions are likely to be implemented after the relevant regulations / guidelines are published by the CCI. The details of the effective date of the significant changes introduced by the Amendment are as set out below.

|

| 1.2. |

As such, the Amendment, intended to overhaul the provisions of the Competition Act, 2002 ("Act"), is a culmination of the: (i) changes recommended by the Competition Law Review Committee in 2019;3 (ii) feedback of various stakeholders on the draft Competition Amendment Bill, 2020;4 (iii) recommendations made by the Standing Committee on Finance on the Competition (Amendment Bill), 2022 ("2022 Bill");5 and (iv) further amendments made to the 2022 Bill by the Competition (Amendment) Bill, 2023.6 The Amendment is a welcome development and will enhance the effectiveness and adaptability of the Act to the evolving economic and business environment, thereby making the competition landscape in India more robust. Some of the key changes introduced by the Amendment are set out in detail below. |

2. |

KEY CHANGES INTRODUCED BY THE AMENDMENT |

| I. |

Merger control provisions: |

| A. |

Introduction of deal-value based thresholds |

| 2.1. | In addition to the existing asset value and turnover based criteria prescribed under the Act, for assessing notification requirement to the CCI, the Amendment has introduced a new criterion to determine whether any combination will require mandatory notification to the CCI, namely, a 'deal value' threshold ("DVT"). As such, the CCI will now be able to review transactions where: (i) the global deal value is in excess of INR 2,000 crore (approximately USD 250 million7); and (ii) the party acquired, taken control of, merged or amalgamated, has 'substantial business operations in India'; provided no exemption is available. |

| 2.2. | Thus, India has joined several other countries8 in introducing the DVT under their merger control regime, which will bring a number of such transactions involving 'asset lite' and 'low revenue' companies under the CCI's scrutiny. The Amendment has specified that the 'value of transaction' will include every valuable consideration, whether direct / indirect or deferred. The tests to determine whether a party has 'substantial business operations in India' will be laid down in the regulations / guidelines to be issued under the Act. |

| 2.3. | IndusLaw Recommendation: Given that the: (i) parties are increasingly adopting innovative and sophisticated transaction structures9; and (ii) proposed monetary threshold is fairly low by global standards; it is important that the regulations / guidelines, in addition to laying down test to determine 'substantial business operations in India', also specify the methodology for computation of 'deal value'. |

| B. | Procedural merger control timelines |

| 2.4. | The Amendment has expedited the timelines for merger review by the CCI by reducing the timeline for: (i) formation of a prima facie view, i.e., whether a transaction raises competition law concerns or not (timelines reduced from 30 (thirty) working days to 30 (thirty) calendar days); and (ii) formation of final view, i.e., approving / modifying / disapproving a transaction (timelines reduced from 210 (two hundred and ten) calendar days to 150 (one hundred and fifty) calendar days). Given that the timeline for a prima facie view has been reduced from the current 30 (thirty) working days to 30 (thirty) calendar days, the parties can expect faster approvals in non-problematic transactions. Further, it is expected that the parties will now necessarily have to undertake pre-filing consultation with the CCI in order to lessen the risk of invalidation of the notification owing to any defect, irregularity, or uncertainty. |

| C. | Widening the scope of 'control' |

| 2.5. | In line with the shift in the CCI's decisional practice regarding interpretation of 'control', the Amendment has lowered the scope of control to the lowest standard of 'control', i.e., the ability to exercise 'material influence'. Thus, now, even combinations involving acquisition of minority investments along with certain investor protection rights may require prior notification to the CCI if the acquirer will gain the ability to exercise 'material influence'. |

| 2.6. | IndusLaw Recommendation: While the Amendment seeks to codify the prevailing practice, it does not explicitly set out any factors for assessing what rights would constitute 'material influence'. Thus, in the absence of any guidance from the CCI, parties may notify even non-controlling minority investments to the CCI by way of abundant caution, which will ultimately increase the burden on the CCI. Thus, identifying a list of associated rights (or at the very least a non-exhaustive list of examples) would amount to 'material influence' will provide much-needed clarity and certainty to the business community |

| D. | Exemption from standstill obligations in certain cases |

| 2.7. | The merger control regime in India is suspensory in nature and prescribes a standstill obligation, whereby the parties to a transaction are not permitted to consummate any part of a transaction till receipt of the CCI's approval. Recognising that such a blanket prohibition is onerous, the Amendment exempts transactions involving open market purchases and other transactions on a regulated stock exchange from the standstill obligations of the merger control regime provided: (i) the transaction has been timely notified to the CCI; and (ii) the acquirer does not exercise any ownership / beneficial rights / interest in such shares or securities, until the approval of the CCI. Thus, the Amendment seeks to dilute standstill obligations for transactions involving listed companies which will enable consummation of time-sensitive market-related purchases without going through the rigours of stringent regulatory requirements. |

| E. | Extending the ambit of gun-jumping provisions |

| 2.8. | Given that the existing framework prescribes only asset value and turnover based thresholds for notification of a transaction, the CCI has the power to penalize the parties up to 1% (one per cent) of the total assets or turnover, whichever is higher, for gun-jumping.10 In line with the proposed introduction of the DVT, the Amendment empowers the CCI to penalize parties up to 1% of the 'deal value' of the transaction. |

| II. | Antitrust provisions: |

| A. | Penalties to be imposed on 'global turnover' |

| 2.9. | The Act empowers the CCI to impose penalties upon the contravening parties based on their 'turnover'.11 Previously, the Supreme Court in Excel Crop Care Limited v. Competition Commission of India & Anr.12 ("Excel Crop Case"), in line with the doctrine of proportionality, had clarified that the CCI should impose the penalty only on the 'relevant turnover', i.e., an enterprise's turnover pertaining to products and services that have been affected by such a contravention and not on the total turnover. |

| 2.10. | In antithesis to the Excel Crop Case, the Amendment has expanded the scope of computation of penalty from 'relevant turnover' to 'global turnover derived from all the products and services' by contravening parties. Thus, multi- product / service conglomerates with global operations, such as big-tech companies, might now be saddled with higher penalties compared to their Indian counterparts for engaging in similar anti-competitive conduct. Not only will this provision run afoul of the principle of proportionality, but also lead to discriminatory treatment by the CCI between the contravening companies while imposing penalties. Hence, global conglomerates might view this as an unfair regulatory risk. |

| 2.11. | IndusLaw Recommendation: It is hoped that the penalty regulations / guidelines to be issued by the CCI will restore the principle of proportionality which would allay fears of global conglomerates proposing to enter or expand their operations in India. |

| B. | Expanding the scope of cartel prosecution |

| 2.12. | Under the Act, only horizontal anti-competitive agreements are presumed to have an appreciable adverse effect on competition ("AAEC"). Recognising that all anti-competitive agreements may not fall within the current pigeon-hole provisions of the Act, the Amendment has expanded the scope of cartel prosecution to include within the ambit of cartel: (i) hybrid anti-competitive agreements (such as hub and spoke cartels); and (ii) facilitators / non-participants who had 'intended to participate' in the cartel. |

| 2.13. | Thus, the Amendment will enable the CCI to treat cartel facilitators at par with cartel participants and anti-competitive agreements between parties operating at different levels of the value chain will also be presumed to cause an AAEC. |

| 2.14. | IndusLaw Recommendation: Given that the Amendment also seeks to introduce an element of mens rea in cartel prosecution, which is ordinarily a concept of criminal law in India, it is imperative that a proper standard of proof is adhered to in such cases so that these provisions are only applicable to genuine cartel facilitators. |

| C. | Commitments and settlements |

| 2.15. | The Amendment has introduced a mechanism for commitments and settlements, enabling the parties to apply to the CCI to propose commitments or settlements in antitrust cases (except in cartel cases). As such, the parties can propose commitments at any time after an investigation has been initiated but before the Director General's13 ("DG") investigation report is issued, whereas settlements can be offered after the DG's investigation report is issued but before the CCI issues its final decision ("Settlement"). Additionally, the Amendment has enabled the aggrieved parties to file compensation claims even after the orders of the Supreme Court (in addition to filing them post the orders of the CCI and National Company Law Appellate Tribunal ("NCLAT")14) and in cases where Settlement has been offered. |

| 2.16. | The Amendment provides that the CCI ought to give the informant, the DG, the settlement applicant as well as third parties an opportunity to submit their objections / suggestions on the commitment or settlement proposal before passing a final order adopting such proposal, which will not be appealable before the appellate tribunal. Further, the order accepting commitments or settlements can be revoked if the applicant does not make full and true disclosures, or if there has been a material change in the facts. Thus, the introduction of a commitment and settlement mechanisms will: (i) ensure swift correction of anti-competitive practices; (ii) spare willing and legally compliant companies to face the rigours of an extensive CCI investigation; and (iii) ease the pressure on the CCI's resources. |

| 2.17. | IndusLaw Recommendation: With the introduction of compensation claims even in Settlement cases, it appears that availing the Settlement mechanism will entail an admission of guilt by the settlement applicant. Given that a settlement applicant may be liable not only to pay a penalty to the CCI but also compensation to aggrieved parties, the Settlement mechanism is likely to have a limited success as it will disincentivise the parties from availing it. |

| D. | Enhancing the leniency regime |

| 2.18. | The Amendment introduces a 'leniency plus' policy, by allowing a leniency applicant in one cartel to disclose a cartel in a separate market and avail reduction of additional lesser penalty for the cartel already being investigated. Further, in order to ensure that a leniency applicant continues to co-operate with the CCI, the Amendment empowers the CCI to impose the full amount of penalty in case a leniency applicant: (i) fails to comply with the conditions of lesser penalty; or (ii) provides false evidence; or (iii) fails to disclose vital information |

| 2.19. | The Amendment also seeks to cure a prevailing lacuna in the Act by allowing parties to withdraw leniency applications. However, even though the CCI would not be able to use the admission of any wrongdoing by the withdrawing leniency applicant, it could use the information provided by such applicant as part of its investigation. Thus, the introduction of 'leniency plus' policy will further bolster the already successful leniency regime in India. Moreover, it will: (i) allow the CCI to unearth multiple cartels and save time and resources expended on cartel investigations; and (ii) act as an added incentive for the companies to make vital disclosures. |

| III. | Miscellaneous provisions: |

| A. | Public consultation for framing regulations / guidelines |

| 2.20. | The Amendment has introduced a mandatory obligation on the CCI to ensure transparency while making regulations / guidelines. The CCI will now be required to publish draft guidelines, invite public comments and publish a general statement of response to public comments. However, in certain situations of public interest or if the regulations / guidelines relate to CCI's internal functioning, then such public consultation is not mandatory. |

| B. | Enhancing penalty amount for furnishing false information or omission to furnish material information |

| 2.21. | The Amendment enhances the penalty for furnishing false information or failing to furnish material information in relation to transactions requiring the CCI's approval from INR 1 crore (approximately USD 125,00015) to INR 5 crore (approximately USD 625,00016). Further, the Amendment mandates the CCI to publish guidelines in relation to the appropriate amount of penalty to be levied for contravention of provisions of the Act. As such, the publication of penalty guidelines will ensure that the penalties levied by the CCI are proportionate to the gravity of the infringement and will further increase certainty for the stakeholders on the computation of penalties. |

| C. | Appointment process of the Director General |

| 2.22. | Under the Act, the power of appointment of the DG is with the Central Government. The Amendment empowers the CCI to appoint the DG with the prior approval of the Central Government. Thus, the CCI will not have an unfettered right to appoint the DG owing to a checks and balances mechanism in place. |

| D. | Widening the powers of the Director General |

| 2.23. | The Amendment expands the DG's powers of investigation by empowering it to: (i) examine the agents of the company (such as bankers and auditors and legal advisors employed by the company (i.e., in-house legal counsel)) in addition to officers, employers, etc. under investigation on oath; (ii) seek information from third parties about the affairs of company under investigation; and (iii) retain all information and documents requisitioned by it during an investigation, for up to 360 (three hundred and sixty) days. |

| E. | Introduction of a limitation period and the principle of res-judicata |

| 2.24. | While the Act does not prescribe any limitation period for filing of an information or reference, the Amendment has introduced a limitation period of three years from the date of cause of action for filing of information or reference with the CCI, in relation to antitrust violations. Further, in line with the principle of res-judicata followed by various civil courts in the country, the Amendment empowers the CCI to reject an information if it is based on the same or similar facts and issues addressed in a previous order issued by the CCI. As such, the introduction of a limitation period will motivate the informants to take prompt action against anti-competitive conduct. It will also provide some respite to companies who cease/ correct their anti-competitive conduct by providing some safeguards for their past conduct. |

| F. | Deposit of partial penalty amount before the appellate tribunal |

| 2.25. | The Amendment mandates the NCLAT to only entertain an appeal by an erring company upon deposit of 25% (twenty-five per cent) of the penalty amount. Currently, the NCLAT, as a matter of practice, requires the appellant to deposit 10% (ten per cent) of the penalty amount with the NCLAT registry. While the Amendment aims to dissuade the parties from seeking frivolous adjournments before the NCLAT, the requirement for partial deposit of the penalty amount may lead to an unintended consequence, especially for smaller companies as they may indulge in dilatory tactics by approaching various high courts in administrative proceedings instead of approaching the NCLAT on merits of the case. |

3. |

INDUSLAW VIEW |

| 3.1. | Given that the Act has been in force for over 10 (ten) years and the proposal to amend the Act has been in the pipeline for a few years now, the Amendment is a welcome development and a step in the right direction towards ensuring a robust competition regulatory framework. Since the major changes to be brought about by way of the Amendment17 require corresponding regulations /guidelines to be issued, it is expected that the Amendment will come into effect in a staggered manner. |

| 3.2. | Accordingly, the MCA Notification only brings into effect certain provisions of the Amendment (as mentioned above). However, this is an important first step and can significantly alter the status quo in terms of the antitrust landscape in the country. Recognition of hub and spoke cartels (which includes hybrid anti-competitive agreements and facilitators/ non-participants such as intermediaries / dealers / suppliers, who had 'intended to participate' in the cartel) may lead to a slew of information being filed with the CCI against such entities for their role in facilitating a cartel. |

| 3.3. | Additionally, it is heartening to see that the provision regarding mandatory public consultation for framing of regulations / guidelines has come into effect. This will allow the CCI to understand the feedback and the concerns of the stakeholders and finetune the provisions to ensure a smooth transition once the remaining provisions of the Amendment come into force. Lastly, the recent appointment of Ms. Ravneet Kaur as the new Chairperson of the CCI (after a wait of 7 (seven) months) has come at an opportune time as the industry navigates the complexities and practicalities of the new competition law regime and will greatly benefit from her guidance. |

Footnotes

1. Available here: https://egazette.nic.in/WriteReadData/2023/245101.pdf.

2. Available here: https://egazette.nic.in/WriteReadData/2023/245953.pdf.

3. Available here: https://www.ies.gov.in/pdfs/Report-Competition-CLRC.pdf.

4. Available here: https://www.taxmanagementindia.com/file_folder/folder_5/Draft_Competition_Amendment_Bill_2020.pdf.

5. Available here: https://loksabhadocs.nic.in/lsscommittee/Finance/17_Finance_52.pdf.

6. Available here: http://164.100.47.4/BillsTexts/LSBillTexts/PassedLoksabha/185C_2023_LS_E3312023105854AM.pdf.

7. Converted at the rate of 1 USD = INR 80. Converted figures have been rounded off.

8. For instance, Austria, Germany, South Korea and the United States of America.

9. For instance, deals involving: (i) share swap; (ii) contingent or conditional consideration (such as performance-based payments or earn-out payments); (iii) post-closing adjustment mechanism; (iv) payment for non-competition, etc.

10. Gun-jumping refers to the consummation of a notifiable transaction (in full/ part) without prior approval of the CCI or until the lapse of 210 days from the date of notification.

11. Section 27 of the Act.

12. Civil Appeal No. 2480 of 2014, Excel Crop Care Limited v. Competition Commission of India & Anr., order dated May 08, 2017.

13. CCI's investigative arm.

14. The appellate tribunal for competition law matters

15. Converted at the rate of 1 USD = INR 80. Converted figures have been rounded off.

16. Converted at the rate of 1 USD = INR 80. Converted figures have been rounded off.

17. Such as, DVT, settlement and commitment mechanism, leniency plus regime, etc.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.