- within Tax topic(s)

- in United States

- within Tax topic(s)

- within Tax topic(s)

- with readers working within the Banking & Credit and Law Firm industries

Globeview updates

The Finance Act 2024 has introduced several impactful changes, particularly in transaction taxes. Our team has extensively analyzed the revised capital gains and buyback taxation rules. If you haven't already read our analysis, we encourage you to review our emails and LinkedIn posts for a detailed breakdown.

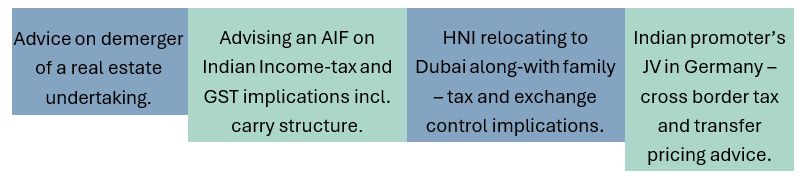

In addition to our academic efforts, we have been working on various projects over the past month, including:

Tax updates regarding Employee Stock Options Plans (ESOP)

The landscape of ESOPs is evolving, with new forms such as cross-border ESOPs and buyback options introducing complex tax and regulatory challenges.

Taxability of compensation on account of stock options devaluation

Tech companies are finding innovative ways to compensate employees. For instance, Flipkart spun off its PhonePe business, which impacted the value of previously granted ESOPs. To address this, Flipkart issued a one-time payment to employees with vested but unexercised ESOPs, treating it as salary and deducting tax accordingly.

A recent Delhi High Court ruling suggested this payment is a capital receipt, thus not taxable as income. On the other hand, the Madras High Court ruled that the amount for one time compensation would be treated as a taxable perquisite.

ESOPs have been a very effective way for employee incentive and wealth creation option for a talented team. The tax basis significantly alters the decision on the ESOPs.

Buyback of ESOPs

The practice of buying back ESOPs from employees presents another tax consideration. The tax treatment can vary, with the potential for the compensation to be classified as capital gains rather than salary. Given that capital gains are taxed at a lower rate (15%) compared to salary (up to 39%), this distinction is significant. The Budget 2024 has amended the tax outcome on buyback of shares. Note that the buyback of ESOPs differs from the buyback of shares.

Impact of Budget 2024 amendments on ESOPs

ESOPs are taxed as salary at slab rates based on the fair market value minus the exercise price in the year of exercise. After exercise, any appreciation is taxed as capital gains. With the Finance Act 2024 reducing the long-term capital gains tax rate to 15%, employees could benefit from exercising ESOPs well before a liquidity event and take the benefit of the lower tax rate. However, this strategy presents conundrum to the employees to pay tax upfront without immediate cash flows.

GST applicability on cross border ESOPs

Indian subsidiaries of foreign companies often grant stock options issued by their parent companies to their employees. The current practice generally involves foreign parent issuing shares to Indian employees and Indian companies reimbursing the foreign parent on a cost basis. Doubts regarding the applicability of GST on an Indian company's reimbursement to its foreign parent on a cost-only basis prevailed until recently.

Traditional practice has been that such reimbursements are not subject to GST. This is now confirmed by a circular from the Central Board of Indirect Taxes and Customs. However, if there's any markup on the cost, the Indian company will need to pay GST under reverse charge mechanism.

Originally published August 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.