- within Tax topic(s)

- within Tax topic(s)

- with readers working within the Banking & Credit and Law Firm industries

- within Litigation, Mediation & Arbitration, Family and Matrimonial and Environment topic(s)

- with Inhouse Counsel

1. FOREWORD

In 1991, India opened its economy to the world which led to an influx of Foreign Direct Investment. This globalization of the Indian economy resulted in expansion of business cross border which in turn, led to erosion of India's tax base as profits were being shifted to tax haven countries. The law at the time, as envisaged under section 92 of the Income Tax Act, 1961 ("Act"), enabled the Revenue to attribute reasonable profits to a resident transacting with a non-resident, owing to their close connection. However, the erstwhile law proved inadequate in dealing with the growing concerns regarding manipulation of prices paid or charged in these intra group cross border transactions. This necessitated introduction of a statutory framework for computation of reasonable, fair and equitable profits and tax in India with respect to these intra group transactions.

Resultantly, Transfer Pricing ("TP") Regulations were introduced in India in 2001 to prevent erosion of India's tax base by ensuring that associated enterprises which are part of the same multinational group transact at arm's length. To put it simply, these regulations ensure that the price at which related parties of a multinational group transact (controlled transaction) is comparable to the price at which unrelated parties under similar situations would transact (uncontrolled transaction).

The Finance Act, 2001 introduced Chapter X to the Act, with a view to provide statutory framework to compute arm's length price in respect of income arising from 'international transactions' with 'Associated Enterprises' ("AEs"). These provisions are contained in sections 92 to 92F of the Act. Rules 10A to 10E have been inserted in the Income Tax Rules, 1962 ("Rules"), prescribing various documentation requirements and forms for filings.

2. THE NEED FOR SAFE HARBOUR RULES

With the operationalisation of TP regulations, India saw a steep escalation in TP disputes. In order to address this incessant increase in TP audits and prolonged litigation, various measures were adopted by the Indian Government which inter alia, included introduction of the Safe Harbour Rule ("SHR") in 2009. It has been one of the key developments in India's TP landscape as it provides certainty to the taxpayers that their transaction value with respect to a certain class of related party transactions, will be accepted by the Indian income tax authorities with limited scope for verification.

SHR are defined as circumstances in which the income tax authorities will accept the transfer prices declared by a taxpayer. These rules specify certain related-party transactions to which they shall apply, and provide for the corresponding pre-defined profit margins along with the monetary thresholds for such related party transactions which make a taxpayer eligible to opt for SHR.

Under the Act, section 92CB was introduced, which empowered the Central Board of Direct Taxes ("CBDT") to formulate SHR in India. Subsequently, a committee called the Rangachary Committee ("Committee") was constituted which was, inter alia, tasked with engaging in sector-wide consultations and providing the safe harbour provisions for each sector.

Accordingly, the Committee submitted its recommendations on SHR for the following sectors, namely, IT Sector; ITES Sector; Contract R&D in the IT and Pharmaceutical Sector; Financial transactions- Outbound loans; Financial Transactions-Corporate Guarantees and Auto Ancillaries-Original Equipment Manufacturers. These recommendations were on various parameters such as:

i) Definition of activities to be covered under the aforementioned sectors.

ii) Definition of eligible enterprise and eligible international transaction.

iii) Procedural and administrative issues.

iv) Monetary thresholds for safe harbour.

v) Profit margins/interest rates to be applied for safe harbour.

Basis these recommendations, CBDT notified the SHR as well as the necessary forms for the same in September 2013. These SHR have been provided under Rule 10TA to 10TG of the Rules for international transactions.

3. CURRENT FRAMEWORK OF SHR:

Over the years, the SHR have been amended and their scope have been expanded to make them more appealing to the taxpayer and accessible to a wider base of taxpayers. The law, as it stands today, is discussed in the ensuing paragraphs.

Applicability: The SHR are only applicable to certain specified taxpayers (hereinafter called the eligible assessee) in relation to certain specified international transactions (hereinafter called the eligible international transaction). The statute defines eligible assessee as a person who has validly exercised the option of safe harbour and inter alia, falls into any of the following categories:

i) provision of software development services or information technology enable services ("ITeS") or knowledge process outsourcing ("KPO") services, with insignificant risk, to a non-resident AE;

ii) advanced any intra-group loan;

iii) provision of corporate guarantee;

iv) provision of contract research and development ("R&D") services wholly or partly relating to software development and generic pharmaceutical drugs, with insignificant risk, to a non-resident AE;

v) manufactures and exports auto components (core or non-core) and where atleast 90% (ninety percent) of total turnover during the relevant previous year is in the nature of original equipment manufacturer sales;

vi) receipt of low value-adding intra-group services from one or more group entities.

The statute further provides an acceptable list of eligible international transactions to which the SHR shall apply.

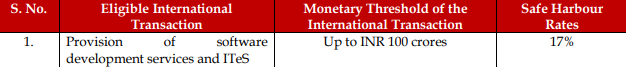

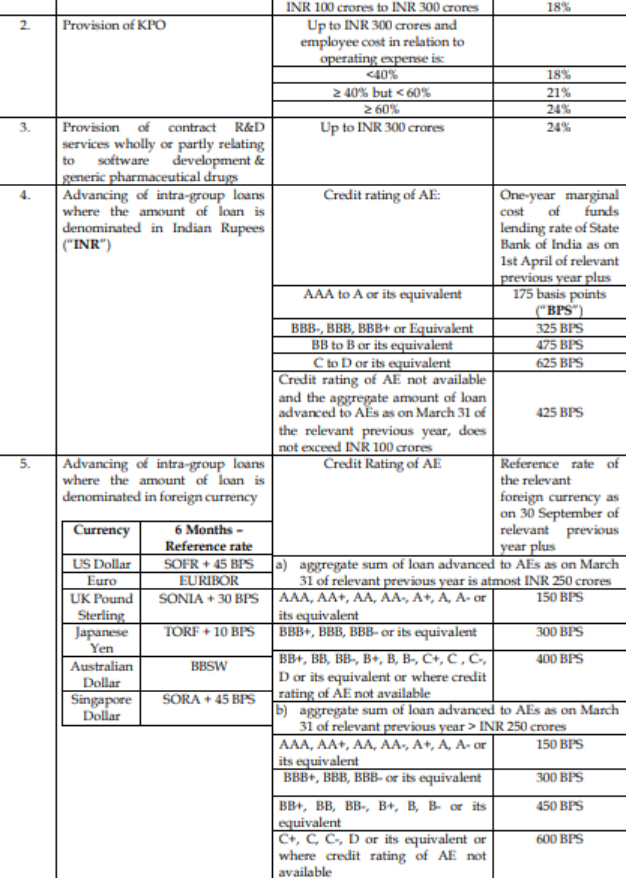

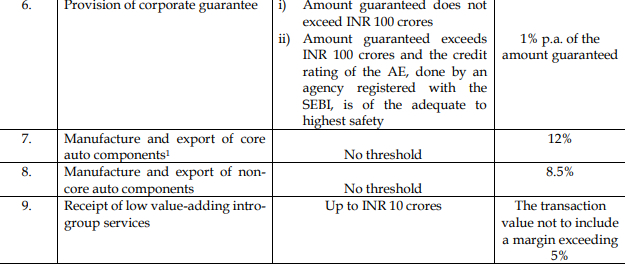

Current threshold: Under the current framework, the safe harbour is subject to certain ceilings in terms of threshold of the international transaction undertaken and the corresponding rate applicable thereto. The details of the same are tabulated below:

4. PROCEDURE FOR AVAILING SAFE HARBOUR

Filing of Form 3CEFA: Rule 10TE of the Rules lays down the procedure for availing Safe Harbour. In order to exercise the option of safe harbour, the taxpayer must furnish a Form 3CEFA to the Assessing Officer ("AO") on or before the due date prescribed under the Act for filing the return of income ("ROI") for:

- the relevant AY if the option is exercised only for that AY; or

- the first of the AYs, in case the option is exercised for more than one AY.

Further, such ROI should be furnished by the taxpayer on or before the date of furnishing of Form 3CEFA, to avoid a situation of ROI being filed after the prescribed due date. The safe harbour will be applicable to the taxpayer, for a period of 5 years or less. In case the safe harbour is availed for multiple AYs, then a statement for the AY subsequent to the initial AY is required to be furnished to the AO before filing the ROI for that year. Such statement shall provide details of the eligible transactions, their quantum and profit margins. However, the option exercised for subsequent AYs can be revoked under the following circumstances:

i) if the option is declared invalid by the TPO or by the Commissioner where an objection against the TPO order is filed by the taxpayer, or

ii) if the eligible assessee voluntarily opts out of it by furnishing an intimation to the income tax authority.

Verification by the AO/TPO: It is to be noted that the adoption of SHR by the taxpayer is not absolute and is subject to verification by the AO/TPO.

Once the option is exercised by the taxpayer, the AO would verify the eligibility of the taxpayer and the international transaction to check if the option has been validly exercised. Where the AO is not satisfied with the validity of the option exercised, a reference shall be made to the TPO for determining the validity of the option exercised by the taxpayer. Basis the procedure enumerated under Rule 10TE of the Rules, an order within the prescribed timelines is passed on the validity of the option after an opportunity of being heard is given to the taxpayer.

5. CONCLUSION

More than a decade since its introduction, India's SHR remain underutilized by taxpayers seeking certainty in determining arm's length pricing.

The tepid response to SHR is primarily due to the relatively high profit margins prescribed under the SHR, which often exceed those achieved through other dispute resolution mechanisms. Consequently, taxpayers have shown a greater preference for options such as Advance Pricing Agreements ("APAs") or though tribunal / court rulings, which offer a more realistic opportunity to achieve commercially viable transfer pricing outcomes.

In order to enhance the effectiveness and appeal of SHR, the Government should consider rationalizing the prescribed margins to better reflect industry realities and align them with margins commonly accepted in APAs and judicial precedents. Such a move would support the Government's broader objective of minimizing transfer pricing disputes and promoting certainty in tax administration.

Another deterrent to SHR adoption is the continued compliance burden it places on taxpayers. Despite opting for SHR, taxpayers are still required to comply with general transfer pricing documentation requirements, including maintaining detailed TP documentation and filing Form 3CEB. Streamlining these compliance obligations for SHR applicants would significantly reduce administrative overhead and improve uptake

In addition, the limited scope of eligible transactions under the current SHR framework restricts its broader application. For example, while the safe harbour provisions presently apply to the advancement of intra-group loans, they do not extend to the receipt of such loans. Expanding the scope to include both directions of financial transactions, as well as revising the monetary threshold for low-value-added intra-group services—currently capped at INR 10,00,00,000 (Indian Rupees Ten Crores)—would make SHR more inclusive and relevant to a wider range of taxpayers.

In conclusion, although there is growing interest among taxpayers in exploring SHR, addressing these structural and procedural challenges is essential to achieving its intended purpose. With thoughtful recalibration, SHR can evolve into a more practical and widely accepted mechanism for reducing transfer pricing litigation in India

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.