- within Wealth Management topic(s)

- in Australia

- with readers working within the Construction & Engineering industries

- within Wealth Management, Food, Drugs, Healthcare, Life Sciences and Strategy topic(s)

In-depth view of the current industry landscape, growth opportunities and vision for 2030

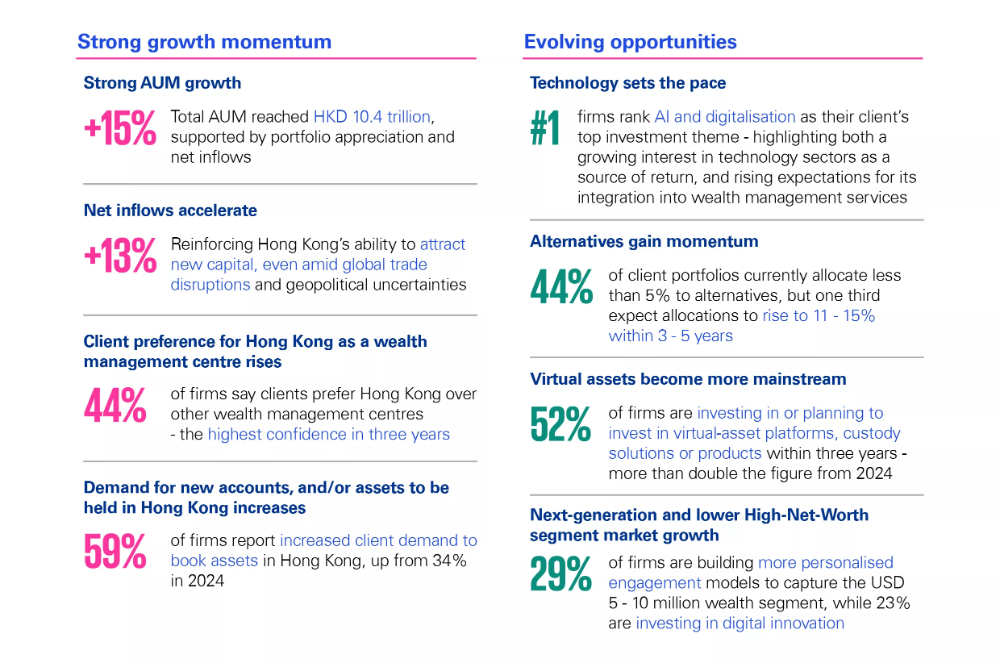

Welcome to the tenth annual Hong Kong Private Wealth Management report, jointly authored by the Private Wealth Management Association (PWMA) and KPMG China. The report provides an in-depth view of the industry landscape, key challenges and emerging growth opportunities. This year we also look ahead to 2030 and consider the key opportunities for Hong Kong to further consolidate its position as a leading hub for international clients.

The findings are based on a survey of PWMA member institutions, supplemented by interviews with senior industry executives in Hong Kong. The surveys and interviews were conducted between June and August 2025, with around 80% of the Association's Private Wealth Management (PWM) Institution members responding. This year we also sought feedback from 9 of the Association's PWM ecosystem members in the business of asset management, as well as 5 nonmember firms involved in digital assets or exchanges.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.