- within Government, Public Sector and Wealth Management topic(s)

The current cost-of-living crisis means many workers struggling to cope with inflationary pressures, with food, transport and energy becoming significantly more expensive. If employers want to offer employees a payment or allowance to help out, what are the implications, and what is and is not allowed? Ius Laboris lawyers in a range of countries explain.

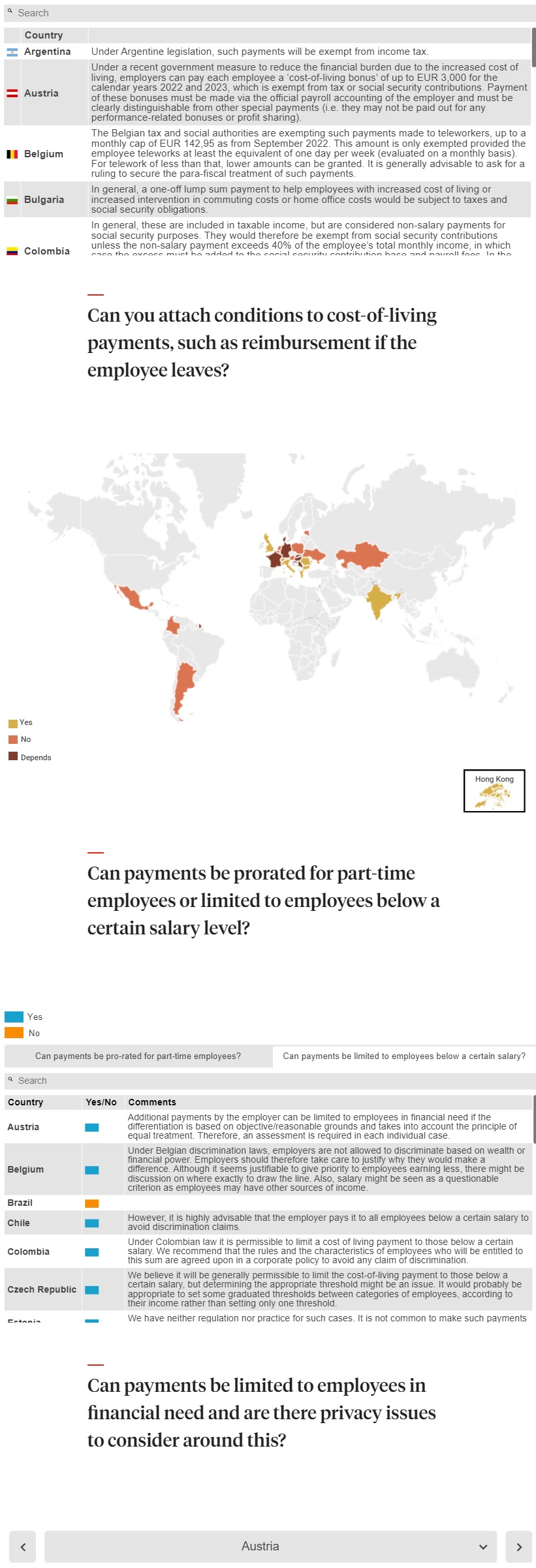

What are the tax and social security consequences of making payments to help employees with the cost of living?

Additional payments by the employer can be limited to employees in financial need so long as the differentiation is based on reasonable grounds and considers the principle of equal treatment.

The challenge in practice will be whether the employer has enough information on the employee's concrete financial situation to make an informed decision. If the employer already has such information, it may still be questionable whether the employer may make use of this information and if it may disclose it to justify its decision (e.g. to the board or the works council). The employer could explicitly ask employees to disclose their financial situation in order to participate in such additional payment, but it will still be obliged to secure this data and to later delete any sensitive personal data.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]