- within Employment and HR topic(s)

- in United States

- with readers working within the Metals & Mining and Pharmaceuticals & BioTech industries

For the German version, please read here >>

A key aspect of international employee assignments is the assessment of the employee's social security status.

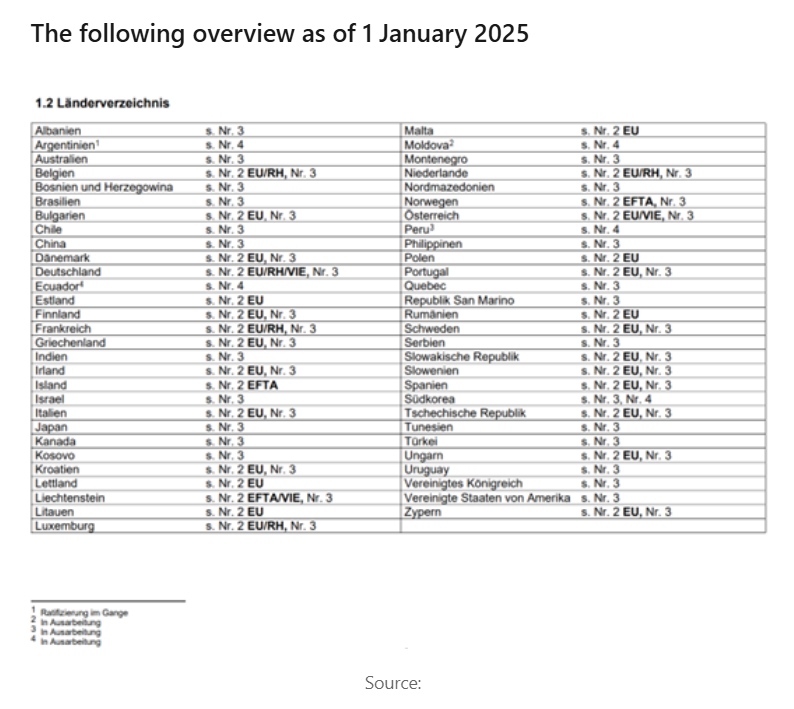

To this end, bilateral agreements have been concluded between the various countries or agreements have been concluded with several countries, such as the Agreement on the Free Movement of Persons or the EFTA Convention. The number of countries with which Switzerland has concluded an agreement is still quite manageable and is relatively small compared to the number of double taxation agreements concluded by Switzerland.

The following overview as of 1 January 2025

What does this mean for international employee assignments?

In principle, the agreements allow an employee on assignment in another country not to be subject to compulsory social security in the country of assignment, but to remain insured in their country of origin. This is intended to avoid gaps in contributions and possible negative effects on pension benefits as far as possible.

Of course, certain rules must also be observed when using an agreement. These include, for example, the fact that the employee must have been insured in the country of origin prior to the assignment abroad. However, the law does not specify how long the prior insurance coverage must be, but it should generally be at least 4 weeks.

Bilateral agreements

For example, there is a bilateral agreement between Switzerland and the USA. If an employee of a Swiss company is posted to the USA for two years, they can remain subject to social insurance in Switzerland on the basis of the existing social insurance agreement. This means that the assignment in the USA has no negative impact on their Swiss "social security career".

However, as the bilateral agreements do not generally cover all classes of insurance, this also means that in the country of assignment, in this case the USA, the employee cannot be exempt from all classes of insurance in the USA. This then leads to additional social security contributions. As a rule, these contributions are also paid by the employer. Accordingly, these contributions must also be taken into account for the calculation of tax and social security contributions as a monetary salary component.

It should also be mentioned that the nationality of the employee is irrelevant for the application of the social security agreement. The agreements generally allow for posting periods of up to a maximum of 5 or 6 years. However, this is regulated differently depending on the agreement.

Multilateral agreements

The two most frequently used multilateral agreements in Switzerland are the Agreement on the Free Movement of, which governs postings between Switzerland and an EU member state, and the EFTA Convention, which regulates postings between Switzerland and an EFTA state.

In contrast to the bilateral agreements, however, nationality plays a role here. This means that the Agreement on the Free Movement of Persons can only be used for Swiss or EU nationals. The EFTA Agreement only applies to Swiss or EFTA nationals.

The period of utilization is also fundamentally limited. Both the Agreement on the Free Movement of Persons and the EFTA Agreement only allow for a period of up to 2 years. However, it is possible to extend this to a maximum of 5 or 6 years (in accordance with the bilateral agreements), provided that an exceptional agreement can be reached. As is an exceptional agreement, both countries involved in a posting must agree to this and there is no legal entitlement.

The scope of insurance in both agreements (Agreement on the Free Movement of Persons and EFTA Agreement) covers all branches of insurance. Accordingly, the employee can remain fully insured in the country of origin and be fully exempted from the social security obligation in the country of assignment.

No agreement

If an employee is posted to a country with no social security agreement, they must always be subject to compulsory social security in the country of assignment.

Switzerland has created a possibility that, in some situations, an employee can continue to be insured in Switzerland voluntarily. Here, too, the aim is to minimize the negative effects on the "insurance career" in the case of foreign assignments. For this to be possible, however, the employee must have been subject to social insurance in Switzerland for at least 5 years beforehand.

If there is no voluntary continued insurance option, it is advisable to look for international solutions, as the scope of insurance in these countries, with which Switzerland has not yet concluded an agreement, is generally much lower than in Switzerland. As an employer, however, you want the employee to suffer as few disadvantages as possible regarding the scope of insurance.

Some other countries also offer such voluntary continued insurance options.

Conclusion

The risk of an employee being incorrectly insured during an assignment abroad is relatively high, which is why it is advisable to check all constellations carefully on a case-by-case basis before each assignment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]