- within Employment and HR topic(s)

- in Africa

- within Real Estate and Construction, Criminal Law and Corporate/Commercial Law topic(s)

- in Africa

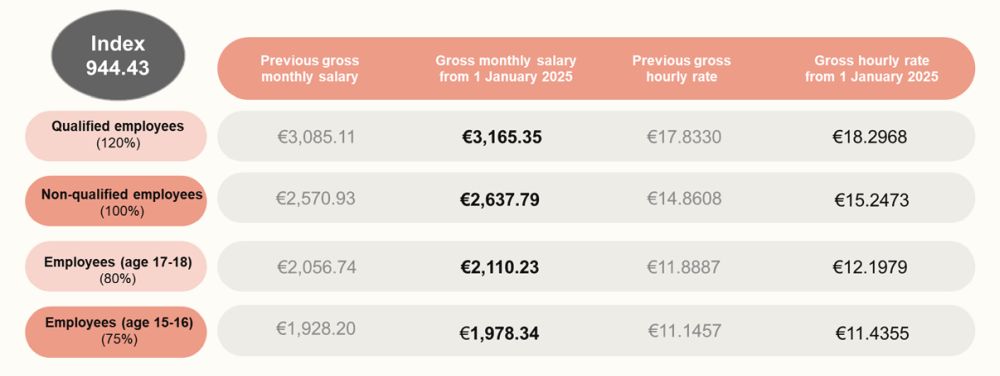

A 2.6% increase in the minimum social wage will be effective from 1 January 2025.

Bill of law 8459 1 on adapting minimum social wage rates to fluctuations in the average wage during 2022 and 2023 (the "Bill") was introduced into Parliament on 15 November 2024. It aims to reassess the minimum social wage by increasing it by 2.6% as follows:

It is worth noting that a European directive, Directive (EU) 2022/2041 on adequate minimum wages in the European Union 2 (Directive), establishes several criteria for revising the minimum social wage (see our Newsflash of 1 December 2022 for more detail). Included in these criteria, for example, is the long-term evolution of national productivity levels, which Luxembourg employers have been eager to see taken into account for some time.

The Directive should have been implemented into Luxembourg law by 15 November 2024. However, bill of law 8437 3 implementing the Directive was only introduced into Parliament on 30 August 2024 (see our Newsflash of 13 September 2024). However, the new criteria introduced by the Directive and used in bill of law 8437 do not appear to have been used yet to calculate the 1 January 2025 revision of the minimum social wage.

Footnotes

1. Bill of law 8459 modifying Article L.222-9 of the Labour Code.

2. Directive (EU) 2022/2041 of the European Parliament and of the Council of 19 October 2022 on adequate minimum wages in the European Union.

3. Bill of law 8437 amending the Labour Code in view of the implementation of Directive (EU) 2022/2041 of the European Parliament and of the Council of 19 October 2022 on adequate minimum wages in the European Union.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.