- in United States

- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Media & Information and Metals & Mining industries

I. Individuals

1.1 Personal Income Tax

Residents are subject to tax on their worldwide income. Non-residents are taxed on their Albanian-source income only. Income tax is assessed in the tax year on a current year basis. Individuals who have annual income greater than 1,200,000 ALL have the obligation to file a personal income return form. Individuals who have untaxed revenues from different sources other than employment, also, individuals who have a second job have the obligation to file personal income return form even though their total annual income might not exceed the amount ALL 1,200,000.

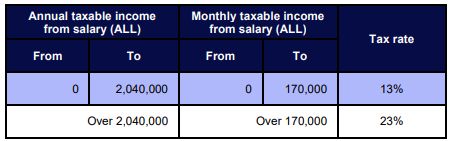

1.1.1 Tax Rates

The tax rates applicable from 01.01.2025 will be as follows:

The amount of contributions for private pensions up to the level of minimum salary 40,000 ALL, are deductible from the taxable salary income.

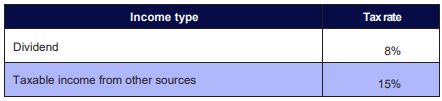

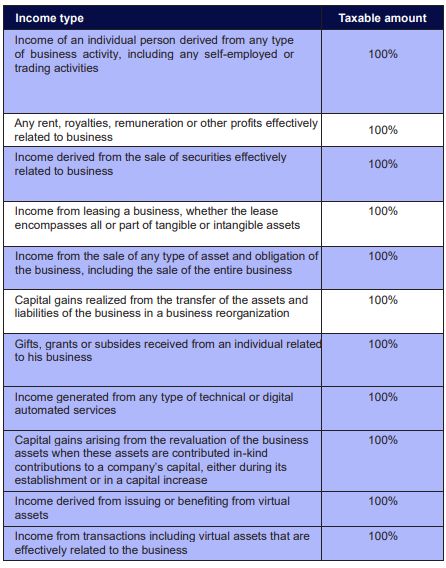

Other taxable personal income types with the tax rates are listed above:

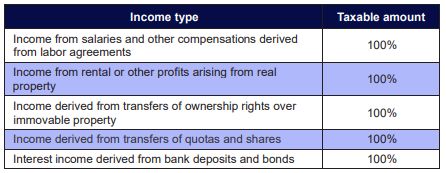

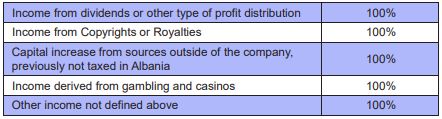

1.1.2 Taxable Income

1.1.3 Exempt Income from personal income tax

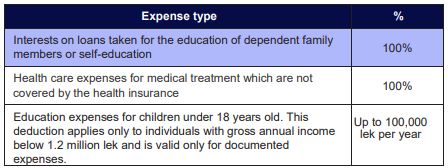

1.1.4 Deductible Expenses

The total of deductible expenses cannot exceed the amount of total taxable income. Deductible expenses are applicable only to resident taxpayers. Deductible Expenses related to are

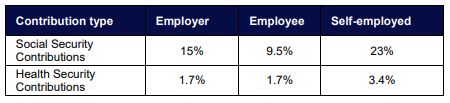

1.2 Social Security and Health Insurance Contributions

Mandatory social security and health insurance contributions are due on employment, civil and management income. The social security contribution is calculated on a monthly gross salary and ranges from a minimum amount of ALL 40,000 to a maximum amount of ALL 176,416. The health insurance contribution is calculated on a monthly gross salary. Self-employed people must pay social security contribution calculated on the minimum salary of ALL 40,000 and health insurance contribution on the minimum salary of ALL 80,000. Contribution rates are as follows:

II. Tax on Personal Income from Business

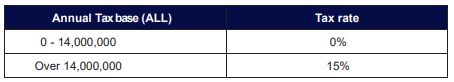

Taxable net income (taxable profit) from business for individual traders and self-employed individuals is taxed at the following progressive rates:

2.1 Rates

2.2 Taxable Income

The annual taxable income from business is determined as the total business income, subtracting the documented expenses related to earnings, maintaining, and securing income

2.3 Deductible Expenses for trade and self-employed individuals

Individuals, trade individuals or self-employed individuals with an annual turn-over of up to ALL 10,000,000 has the right to choose one of the following methods of deductible expenses, declaring to the tax administration the method they will choose, which can be changed no more often than once in three years:

- 60% of the income for production activities

- 90% of the income for wholesale trading activities

- 70% of the income for wholesale trade activities of goods and individual transport

- 60% of the income for activities such as bars, restaurants, discos etc.

- 50% of the income for service activities, artisanal activities, and craft activities

- 30% of the income for self-employed individuals

- Or to calculate the deductible expenses based on the respective documentation and invoices for each expenditure 2.4 Non-deductible Expenses

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.