Cyprus Tax Residency

The CyprusIncome Tax Law provides a number of tax reliefsthat either existed under Cyprus Tax Law or came into effect from 1 January 2012.

An individual is considered tax resident of Cyprusif he stays in the Republic for a period or periods exceeding in aggregate 183 days in any calendar year. If the 183 days are met the individual is considered tax resident for the whole year.

In the case of tax resident individual, tax is levied on worldwide income accruing or arising from sources both within and outside Cyprus.

Cyprus offers a second tax residency test, the "60 Day rule", which is effective since 2017.

The introduction of the 60 Day rule

In order to become a Cyprus tax resident on the basis of the "60 day rule" one must meet the following conditions:

- remain in Cyprusfor at least 60 days during a tax year, and

- do not reside in any other single state for a period exceeding 183 days, and is not tax resident in any other state; and

- carry out business activities and/or work in Cyprus and/or be a director in a Cyprus tax resident company and;

- maintain a permanent residence in Cyprus either owned or rented.

Tax Residency & Domicile

The key to understanding personal taxation in Cypruslies with the important concepts of 'tax residency' and 'domicile'.

Domicile: According to the domicile concept underthe tax legislation, every person has at any given time either:

- the domicile received by him/her at birth ('domicile of origin'), or

- the domicile (not being the same as the domicile of origin) acquired or retained by him/her by his/her own act ('domicile of choice').

Under (i) above, the domicile of origin of a legitimate child is that of the father's, or in the case of an illegitimate child, that of the mother's.

Under (ii), a person may acquire a domicile of choice by establishing his/her home at any place in Cyprus with the intention of permanent or indefinite residence.

For tax purposes however, a non-domiciled individual will be deemed as domiciled in Cyprus if he/she has been a Cypriot tax resident for at least 17 out of the last 20 years prior to the relevant tax year (deemed domicile rule).

An individual who has a domicile of origin in Cyprus, may still qualify as non-domiciled subject to certain conditions, namely to have not been a Cyprus tax resident for a consecutive period of 20 years.

Taxable Income

A tax resident individual, irrespective of his/her domicile status, is subject to income tax on his/her worldwide income, although there are a number of favourable deductions and exemptions in the legislation as explained below.

A non-tax resident individual is subject to income tax on income accruing or arising only from sources within Cyprus and is exempt from any Cyprustax on dividend and interest income.

However, where a person is non-domiciled in Cyprus, but is a Cyprustax resident, the following main benefits exist, for a period of at least 17 years, i.e. until the person is deemed domiciled in Cyprus:

- no Cyprus Special Defense tax is payable on receipt of dividend income from anywhere in the world (although on foreign dividends, the source country may withhold taxes);

- the provisions whereby a Cyprustax-resident company must declare at least 70% of its after-tax accounting profits within two years (known as the 'deemed dividend distribution rules'), do not apply to that proportion of shareholding beneficially owned by a non-Cyprus domiciled individual;

- no Cyprus Special Defense tax is payable on receipt of interest income and rental income from anywhere in the world (although on foreign interest, the source country may withhold taxes).

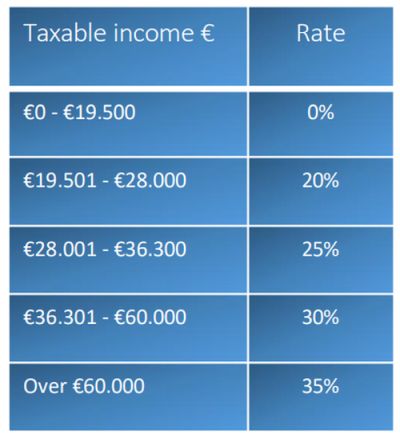

Income Tax Bands& Rates

Taxable income, i.e. gross income less exemptions less deductions, up to €19.500 is exempt from income tax. The taxable income exceeding this amount is subject to progressive tax ratesranging from 20% to 35% (the higher rate being for taxable income exceeding €60.000). Standard progressive personal tax rates will apply on the income in excess of the tax- free allowance as follows:

Relief for high salaried employeestaking up employment in Cyprus

The following exemption is available for individuals moving to Cyprusto commence employment effective from 1st January 2022:

50% exemption of employment income

The 50% exemption on income tax is granted to individuals who were not residents of Cyprus for 15 consecutive years prior to any employment in Cyprus. Under these circumstances, an individual is considered to have commenced first employment in Cyprus when for the first time (after a period of 15 consecutive years during which he was outside of the republic and was not performing salaried services in Cyprus) commences his employment in Cyprus to an employer resident in Cyprus to an employer resident in Cyprus or to a non-Cyprus resident employer.

The 50% exemption on income tax is granted to individuals, who meet the conditions for the exemption, even if they change employer.

The 50% exemption on income tax is granted for 17 consecutive years starting from the tax year of employment in the Republic.

Income tax exemption for overseas employment

Where an employee is Cyprus tax resident, then salaries from rendering services outside Cyprus to a non-Cyprus employer or to a foreign permanent establishment of a Cyprus resident employer for more than 90 days in a tax year are exempt from income tax. In order for the 90 day rule to apply there must be an employee/employer relationship.

Exemptions on gains arising from the disposal of securities

Any gains arising from the disposal of shares, bonds and other similar equity financial instruments are exempt from income tax. Any income from a buy-back or redemption of units in funds is also exempt from income tax.

Exemption from capital gains tax on sale of real estate

Profit arising from the disposal of immovable property situated outside Cyprus is exempt from any taxation (including capital gains tax) in Cyprus, although the foreign property may be subject to tax in the jurisdiction where it is located.

Advantages available to Pensioner Expatriates

A Cyprustax resident receiving a pension from abroad can choose one of the following two optionsto be taxed on the pension income, the choice being available every year:

- the pension can be taxed under the progressive income tax rates with the first €19.500 of net taxable income being tax-free; or

- the first €3.420 of the foreign pension tax free, with the remaining balance being taxed at a flat rate of 5%.

Any lump sum received as a retirement gratuity is exempt from tax.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.